In forex trading, the pursuit of a Forex Indicator 100 Percent Accurate solution captivates the imagination of traders both new and experienced.

This comprehensive guide is designed to shed light on the intricacies of forex indicators, exploring whether achieving 100% accuracy is feasible.

And providing practical insights on how to leverage these tools effectively. Getting 100% is nearly imposible, but we are getting closer with AI.

Contents

Introduction to Forex Indicators

Forex trading is a battleground where traders constantly seek to outmaneuver market movements.

Forex indicators serve as the weapons of choice, providing statistical means to interpret and predict currency price actions.

These tools are indispensable for traders aiming to minimize risks and maximize profits.

What is a Forex Indicator?

A forex indicator is a statistical method used by currency traders to analyze and predict market trends by interpreting price data.

Indicators typically fall into two categories: technical and fundamental.

Technical indicators scrutinize past market data, while fundamental indicators focus on economic and financial factors affecting currency values.

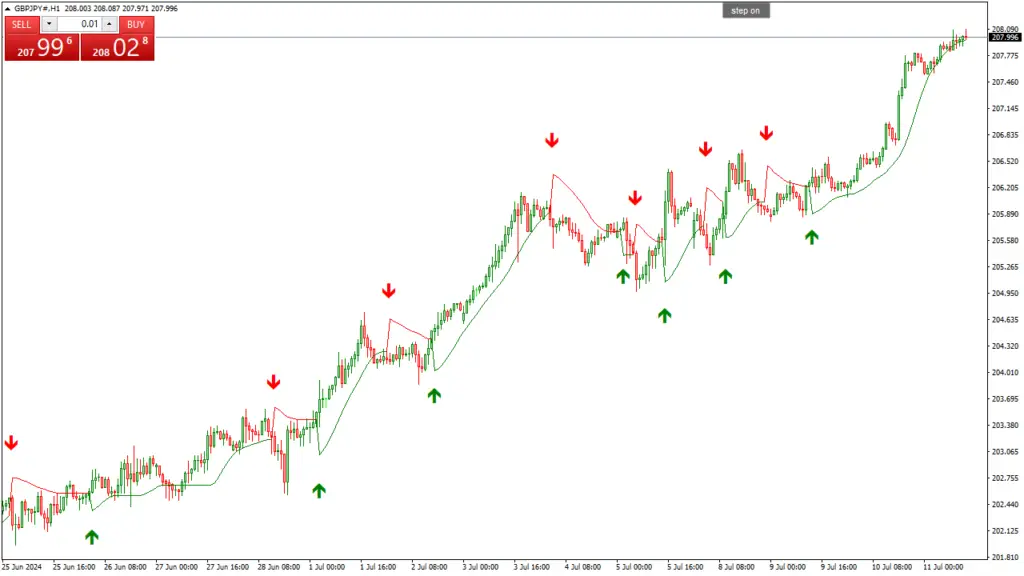

Watch my video!

Why Traders Seek a Forex Indicator 100 Percent Accurate

The search for a Forex Indicator 100 Percent Accurate is driven by the desire to eliminate risk and guarantee profitability in trades.

In a market where significant sums of money can be gained or lost in minutes, the allure of a perfectly accurate indicator is understandable.

However, the practical application and reliability of such an indicator are subjects of much debate.

Types of Forex Indicators

Understanding different types of forex indicators can illuminate their unique functionalities and limitations.

Technical Indicators

Technical indicators analyze historical price and volume data to forecast future market trends. These are mathematical calculations based on asset prices or trading volumes.

- Moving Averages:

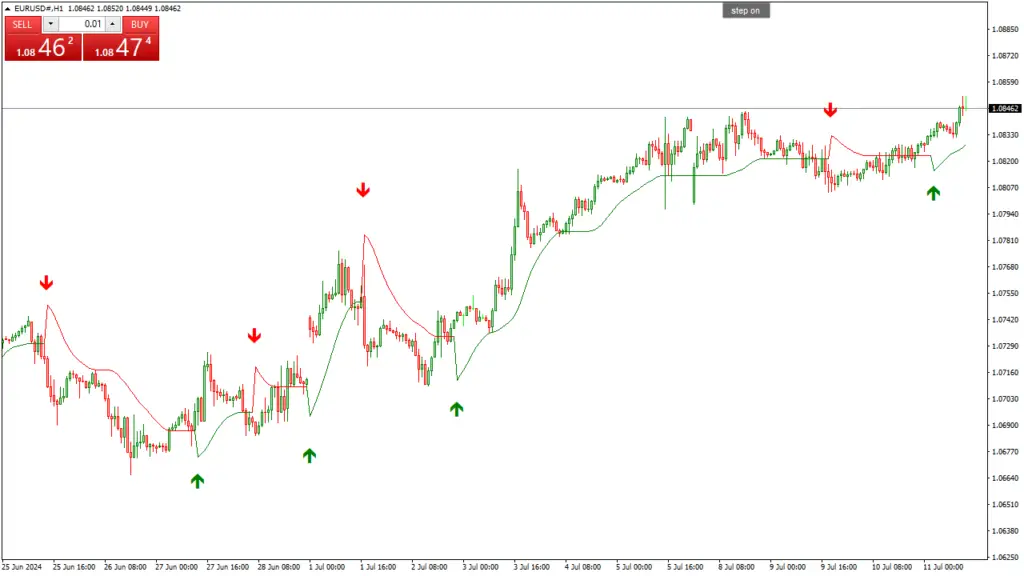

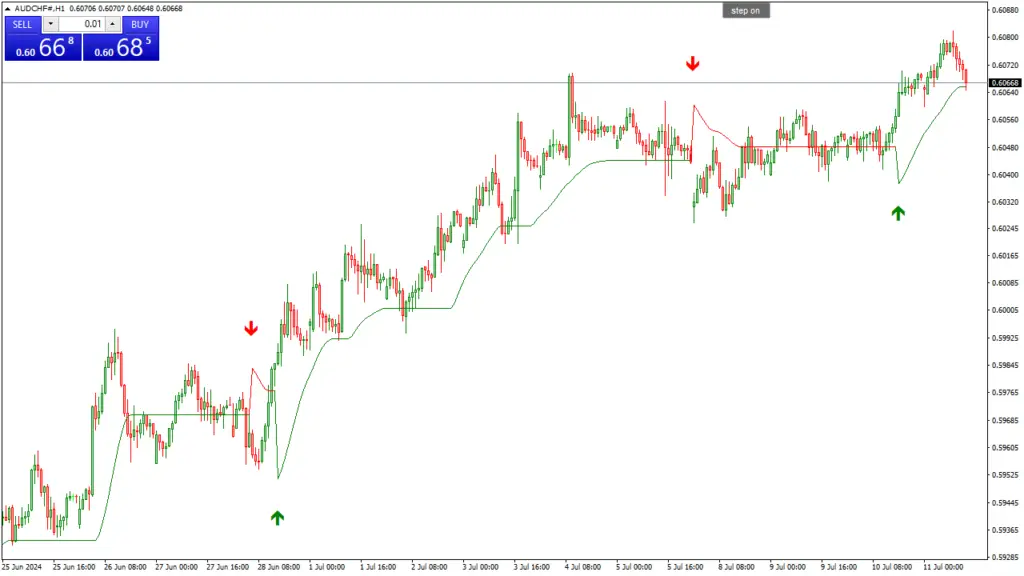

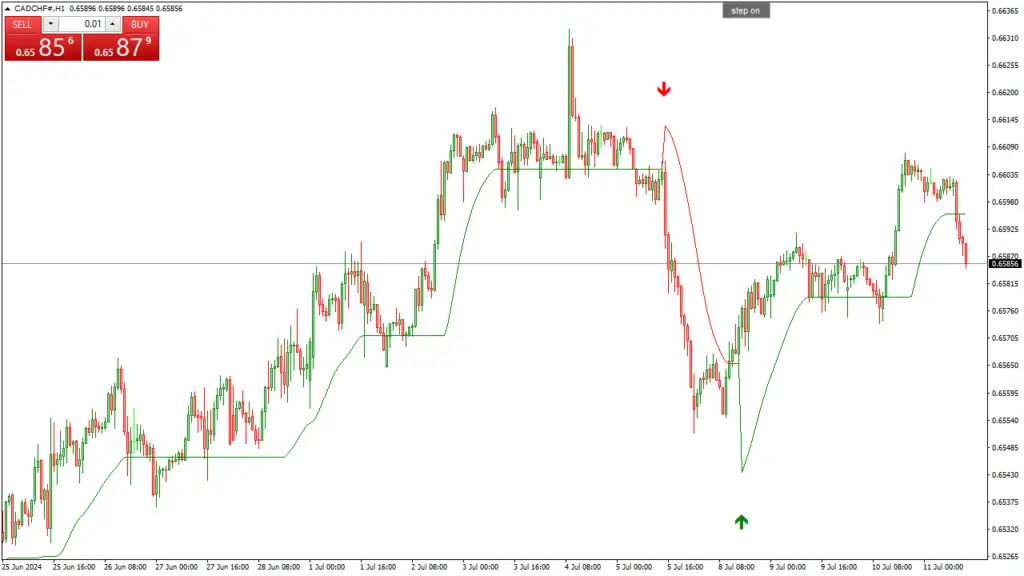

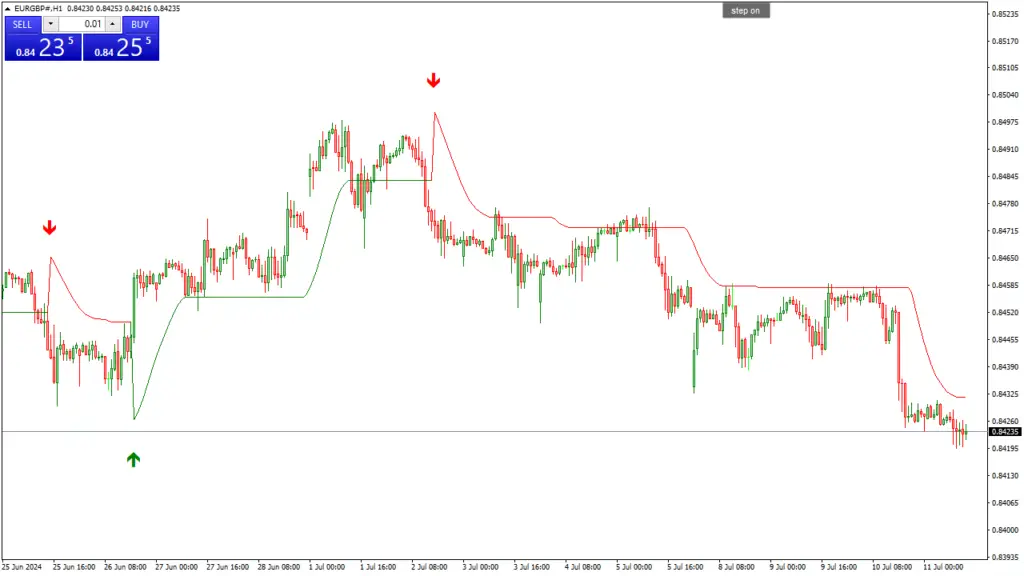

- Moving averages smooth out price data by creating a single flowing line representing the average price over a specific period. This helps in identifying the direction of the trend.

- Types:

- Simple Moving Average (SMA)

- Exponential Moving Average (EMA)

- Relative Strength Index (RSI):

- RSI measures the speed and change of price movements, indicating whether an asset is overbought or oversold. RSI values range from 0 to 100, with levels above 70 indicating overbought conditions and below 30 indicating oversold.

- Bollinger Bands:

- Bollinger Bands consist of a middle band (moving average) and two outer bands representing standard deviations from the middle band. These bands adjust dynamically based on market volatility.

Fundamental Indicators

Fundamental indicators assess economic, financial, and other qualitative and quantitative factors to determine the intrinsic value of a currency.

- Gross Domestic Product (GDP):

- GDP measures a country’s economic performance. A higher GDP indicates a stronger economy, which can bolster the value of its currency.

- Interest Rates:

- Central banks regulate interest rates to control inflation and stabilize the currency. Higher interest rates lead to higher returns on investments in that currency, attracting foreign investors and increasing demand.

- Employment Data:

- Employment statistics like unemployment rates and job creation figures impact economic stability and, consequently, currency value.

Is a Forex Indicator 100 Percent Accurate Possible?

The dream of a Forex Indicator 100 Percent Accurate remains tantalizing yet controversial. Market dynamics are influenced by a multitude of factors, many of which are unpredictable.

Psychological elements, geopolitical events, and sudden market shifts make achieving 100% accuracy highly improbable.

Forex market behavior is not strictly deterministic, making it impossible for any single indicator to provide infallible signals.

While some indicators boast high accuracy under specific conditions, claiming 100% reliability would be misleading.

Popular Forex Indicators and Their Accuracy

Despite the inherent limitations, there are indicators renowned for their reliability and effectiveness.

Moving Averages

Moving Averages are favored for their simplicity and ability to highlight trend direction. They smooth price data and filter out the ‘noise’ of market fluctuations.

- Simple Moving Average (SMA): Averages closing prices over a specified period, useful for identifying long-term trends.

- Exponential Moving Average (EMA): Gives more weight to recent prices, making it more responsive to new information.

Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. A higher RSI suggests an overbought condition, while a lower RSI indicates an oversold condition.

It is particularly useful for predicting price reversals and identifying strength or weakness in a trend.

Bollinger Bands

Bollinger Bands are praised for their ability to measure market volatility. The bands contract during low volatility and expand during high volatility. Traders use them to identify potential breakout and breakdown points.

Example Case Study: A trader using Bollinger Bands observed the bands narrowing (squeezing), indicating low volatility. They anticipated a significant price movement and set a strategy to trade the breakout.

When the price broke out above the upper band, the trader entered a long position and capitalized on the ensuing upward surge.

How to Use Forex Indicators Effectively

Using forex indicators effectively involves more than just understanding their mechanics. Here are key strategies:

- Combine Multiple Indicators: No single indicator can provide all the insights needed. Combining indicators can offer a more comprehensive view. For example, using RSI with Moving Averages can confirm trends and identify entry/exit points.

- Backtesting: Before using an indicator in live trading, backtest it against historical data to assess its reliability. This helps in understanding its performance under different market conditions.

- Stay Updated: Market conditions change, and so should your strategies. Regularly update your knowledge and tools to stay relevant.

- Use Risk Management Tools: Regardless of the indicator’s accuracy, use stop-loss and take-profit orders to manage risks effectively.

Limitations and Risks of Relying on Forex Indicators

Believing in a Forex Indicator 100 Percent Accurate approach can lead to complacency and significant losses. Understanding the limitations and risks of indicators is crucial:

- Over-fitting: Indicators that work perfectly on historical data may fail in real market conditions. Over-optimized strategies are prone to fail when market dynamics change.

- Market Noise: Indicators can give false signals during times of high market volatility or low liquidity.

- Lack of Context: Indicators alone don’t provide the full picture. Economic news, geopolitical events, and other external factors can drastically affect market movements.

- Human Error: Misinterpreting indicators or failing to follow a disciplined trading plan can lead to significant losses.

Conclusion

While the notion of a Forex Indicator 100 Percent Accurate is enticing, it remains a challenging and perhaps unrealistic goal. However, that does not undermine the value of forex indicators in trading.

By understanding their strengths, limitations, and appropriate usage, traders can significantly enhance their ability to make informed decisions.

Incorporate multiple indicators, stay informed about market trends, and practice diligent risk management to navigate the complex landscape of forex trading.

The key to success lies not in finding a perfect indicator but in developing a robust, flexible, and informed trading strategy.

Unlock and Download Discover Curiosity it’s Free!

Sorry trial period is over Click here to buy!

After downloading and installing, use the demo account to familiarize yourself with the system before starting live trading.

Leave a Reply