Do you Pay Taxes on Forex? Learn all the details in this article, for traders in foreign exchange, or forex, markets, the main objective is simply to make successful trades as well as see the forex account grow.

In a market where profits and also losses can be understood in the blink of an eye, several just want to earn money in the short-term without truly considering the longer-term ramifications.

Nevertheless, it typically makes some sense to consider the tax obligation ramifications of buying and also marketing forex before making that first trade.

Do you Pay Taxes on Forex?

Forex options and futures traders

For tax obligation objectives, forex alternatives and also futures agreements are taken into consideration IRC Section 1256 contracts, which are subject to a 60/40 tax obligation consideration.

To put it simply, 60% of gains or losses are counted as long-lasting funding gains or losses, as well as the continuing to be 40% is counted as short term.

What you need to know

1. Aspiring forex traders could wish to consider tax obligation ramifications prior to beginning.

2. Forex futures as well as choices are 1256 contracts and also taxed using the 60/40 policy, with 60% of gains or losses dealt with as long-lasting funding gains as well as 40% as temporary.

3. Spot forex traders are taken into consideration “988 traders” and also can deduct every one of their losses for the year.

4. Currency traders in the spot forex market can choose to be exhausted under the very same tax obligation guidelines as routine products 1256 contracts or under the unique policies of IRC Area 988 for currencies

A 60/40 tax treatment is often beneficial for people in high revenue tax obligation brackets. For instance, the earnings of supplies sold within one year of their purchase are considered temporary capital gains.

And also are always tired at the very same price as the investor’s common revenue, which can be as high as 37%.

When trading futures or choices, investors are efficiently exhausted at the optimum long-term funding gains price, or 20% (on 60% of the gains or losses) and the optimum short-term capital gains rate of 37% (on the various other 40%).

Read more article: Foreign Exchange Market Today

Want to Make Money Trading? Try This!

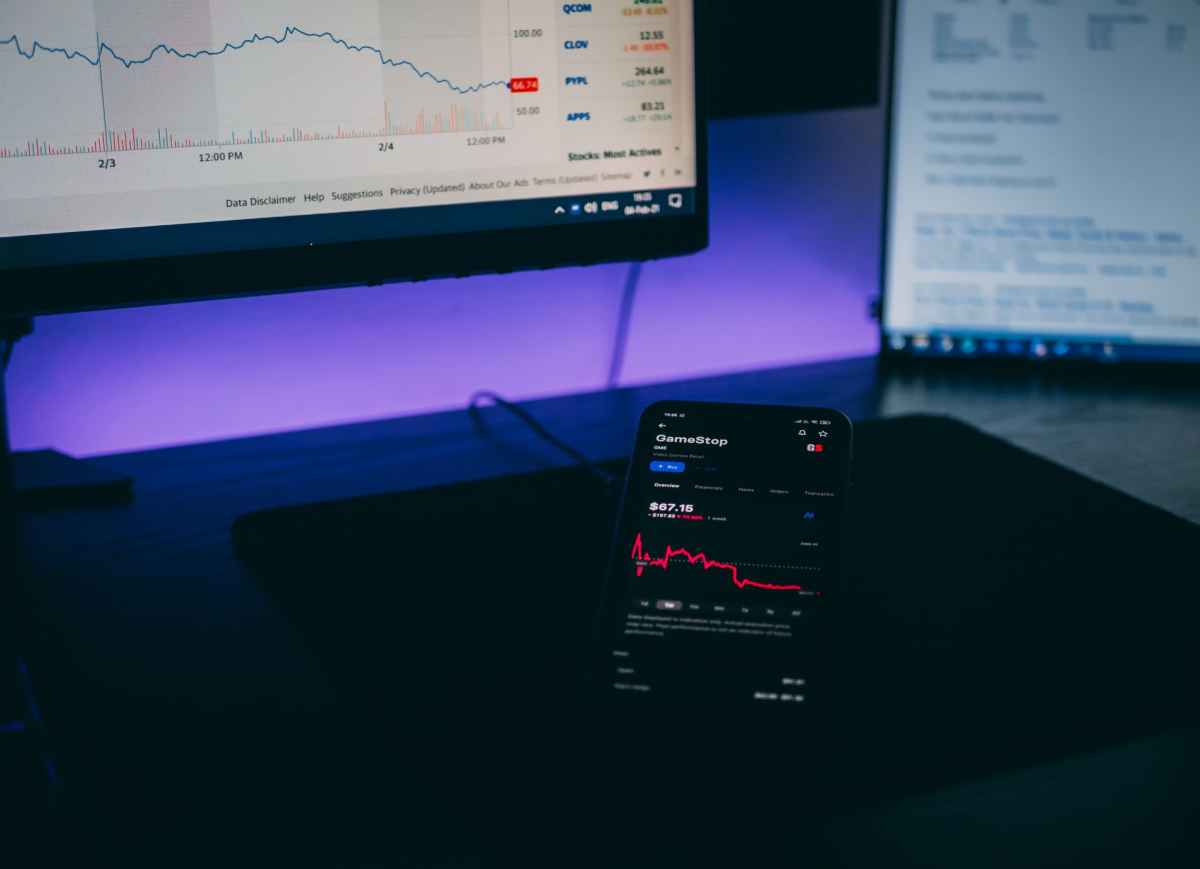

For over the counter (OTC) investors

The majority of place traders are exhausted according to IRC Section 988 contracts, which are for foreign exchange purchases settled within 2 days, making them available to treatment as ordinary losses as well as gains.

If you trade spot forex, you will likely be organized in this group as a “988 trader.” If you experience bottom lines with your year-end trading, being classified as a “988 trader” is a substantial advantage.

As in the 1,256 agreement category, you can count all of your losses as “normal losses,” not just the initial $3,000.

Which agreement to choose

Now comes the tricky part: Determining just how to file tax obligations for your scenario. While choices or futures and OTC are organized individually. The investor can choose to trade as either 1256 or 988. Individuals must choose which to utilize by the initial day of the calendar year.

IRC 988 contracts are less complex than IRC 1256 contracts. The tax obligation rate continues to be consistent for both gains as well as losses, which is much better when the trader is reporting losses. Notably, 1256 contracts, while more complicated, offer 12% more savings for a trader with internet gains.

Many audit firms utilize 988 contracts for area traders and also 1256 contracts for futures traders. That’s why it is necessary to speak with your accounting professional before spending. Once you start trading, you cannot change from one to the various other.

Many traders naturally prepare for web gains, and also often choose out of 988 status as well as into 1256 condition. To pull out of a 988 standing, you require to make an internal note in your books in addition to file the adjustment with your accountant.

Complications can magnify if you trade supplies as well as money due to the fact that equity transactions are tired in a different way, making it more difficult to pick 988 or 1256 agreements.

Read more article: Foreign Exchange Market Definition

Maintaining track

You can count on your brokerage statements, however a more precise and also tax-friendly way of keeping an eye on profit and also loss is via your performance document.

This is an IRS-approved formula for record-keeping:

- Subtract your beginning possessions from your end properties (net).

- Subtract cash down payments (to your accounts) and add withdrawals (from your accounts).

- Subtract earnings from interest as well as add passion paid.

- Add in various other trading expenditures.

The efficiency document formula will provide you an extra precise representation of your profit/loss ratio and also will make year-end declaring less complicated for you and your accounting professional.

Read more article: Learn Forex Trading Step by Step

Want to Make Money Trading? Try This!

Points to remember

When it concerns forex taxes, there are a couple of points to bear in mind: Mind the deadline. In most cases, you are required to pick a sort of tax situation by Jan. 1. If you are a new trader, you can make this choice any time before your first trade.

Keep excellent records: It will certainly conserve you time when tax period approaches. That will provide you more time to trade as well as much less time to prepare your taxes. Pay what you owe: Some traders try to beat the system and also don’t pay tax obligations on their forex trades.

Because non-prescription trading is not registered with the Commodities Futures Trading Commission (CFTC), some believe they can get away with it.

You ought to know that the internal revenue service will catch up eventually, and also the tax evasion costs will be higher than any kind of taxes you owed.

Read more article: Things to know about Forex market

Conclusion

Whether you are planning on making forex a job course or are simply thinking about meddling it, taking the time to submit correctly can save you hundreds if not thousands in taxes.

It belongs of the procedure that’s well worth the time. Download free indicator below and watch the video to learn how to install and trade with this amazing indicator for maximum profits.

Read more article: How to use VPS for Forex Trading

Download WPR Arrow Indicator Here

Want to Make Money Trading? Try This!

Leave a Reply