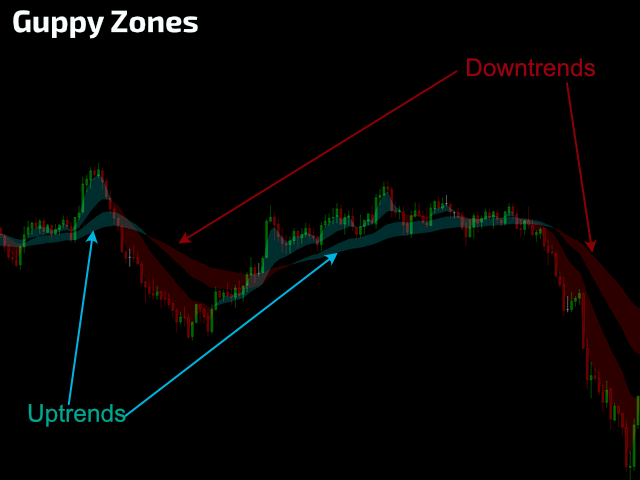

Guppy zones, if you have the chance to check out the book “Trend trading – A seven step approach to success” by Daryl Guppy, you will have a lot of info about how to “check out” the marketplace.

In his book Daryl program, to name a few things, how can we utilize a visual tool to determine the volatility and pattern in between short-term and long durations: The GMMA – Guppy Multiple Moving Averages.

Instead of utilizing his initial concept of having 12 Exponential Moving Averages in your chart – which could be really CPU-demanding if you have more than 1 chart open on your computer system.

We chose to reword this concept and change it into simply an easy Filled-area however maintaining all the computations of the initial concept. Welcome to Guppy Zones.

How to read this indicator

Daryl’s book was based upon daily charts, and the settings of his GMMA were likewise based upon day-to-day durations, so, for the short-term durations he utilized: 3,5,8,10,12, and 15-day.

Exponential Moving Averages, and for the Long-term durations he utilized: 30, 35, 40, 45, 50 and 60-day EMAs.

You can experiment with the worths on the settings of Guppy Zones, as it is extremely essential to adjust ANY sort of sign to your requirements (Symbol, Timeframe, and Strategy).

Guppy Zones will reveal you locations of Dynamic Support and Resistances.

Integrating the reading in between the long-lasting and brief zones will supply you with more self-confidence about where the marketplace is “going”.

Integrating likewise the vibrant Support & Resistance zones with the Chart/traditional Support & Resistance zones you will have the ability to determine and track trade targets and Stops.

Read more article: Learn Forex Trading Step by Step

Settings

Short-term Start duration. Utilizing the Classical setting = 3

Short-term End duration. Utilizing the Classical Setting = 15

Long-lasting Start duration. Utilizing the Classical setting = 30

Long-lasting End duration. Utilizing the Classical setting = 60

Smoothing Method. Classical = EMA (Exponential Moving Average).

Cost Type utilized for estimations. Classical = CLOSE rate.

Butterfly is a forex trading system that uses three moving averages to identify potential market turning points. It is based on the idea that when price reaches one of the moving averages, it tends to turn around and move in the opposite direction.

The butterfly indicator was developed by Larry Williams and can be used for scalping or swing trading.

The butterfly indicator consists of two outer bands, R1 and R2, which are set above and below the middle band, SMA(50). These bands can be set at any desired distance from each other.

The butterfly indicator differs from other indicators in that it provides traders with three different levels of support and resistance instead of just one level. The closer these levels are together, the stronger they will be as support or resistance lines.

Read more article: Foreign Exchange Market Definition

The butterfly is a neutral indicator that can be used on all timeframes. It gives you two signals, one trend-based and the other countertrend based.

The trend-based signal is placed at the beginning of the bar and represents the direction of the main trend. The countertrend signal is placed at the end of the bar and represents a possible change in direction.

The concept behind this indicator is very simple: If a bar closes above the opening price, then it will be considered as bullish (green circle); if it closes below, then it will be considered as bearish (red circle).

This is how we get our first signal – “Trend”. The second signal comes from looking at where each bar closes in relation to its opening price – high or low.

If it closes higher than its opening price, then this is considered as an indication that there may be some buying pressure happening (green circle); if it closes lower than its opening price, then this could mean some selling pressure exists (red circle).

Read more article: Foreign Exchange Market Today

Download Butterfly Forex Indicator Here

Need Forex Trend Scanner? Click Here!

Leave a Reply