Understanding lot size in forex, on average, the foreign exchange market trades 30 billion dollars’ worth of contracts each day, according to Bloomberg News. There are a total of 60 currencies with USD-denominated trading. Additionally, forex markets are more complex in the sense that forex trade is a lot more systematic than a lot of other trades.

In the financial world, lots come in two sizes: small and large. The size depends on the exchange rates that are relevant at the time the trade is executed. For example, the dollar-British pound rate is determined after the trade has taken place.

There is no fixed rate for the size of the contract, but it’s not uncommon to trade with multiple lot sizes. This makes it possible to enter a trade quickly and just as easily as changing the size.

Small lots in forex trades usually amount to $100,000 or so. It’s usually impossible to follow the whole way through, however. Small lots can easily move within a week’s time, sometimes within minutes, given the liquidity in the forex market.

In contrast, when you are doing larger trades, like lot sizes of $500,000 or $1 million, the amount of time will vary considerably. There will be a lot of high-volume transactions, like trading ten million dollars’ worth of contracts in a day.

Read more article: How to use VPS for Forex Trading

Small and large volumes in forex trades

As is the case for other trades, to understand how forex trades work, it’s necessary to understand the components that will be combined to settle a trade.

These components include the bid and offer prices, the trading size, the liquidity of the trade, and the amount of currency needed to cover the entire trade, plus reserve requirements.

During forex trading, the price of one currency can change and that’s why it’s important to understand a few of the factors that are relevant to the overall trading process.

If the price of one currency moves by 20 percent in a single day, that’s quite a lot, even though there may be other currencies that also move.

The price movement will, however, not necessarily translate into significant changes for trading, as the volume of transactions still remain. What can be observed is the effect of the trade on the exchange rate of the market.

The higher the volatility in the market, the more price changes there will be, which is one of the reasons why trading a lot of small amounts of currency is usually quite risky, despite the benefits of getting in and out quickly.

Regardless of what kind of volume you are trading in forex, it’s usually possible to do the entire process within a period of several days or weeks. This means that a lot of small trades can be tracked and traded in a relatively short period of time.

Given the fact that there are two size contracts for every unit of currency, it is usually possible to split the trading of one currency into two parts.

The smallest part can be split into three smaller parts. With this method, it will always be possible to follow what’s happening and then take the next step.

The method of splitting a lot of small contracts also means that there will always be lots of liquidity in the forex market. This is the case with all exchanges, but it’s particularly true for forex.

The reason for this is the huge size of the forex market, which is what makes it so popular. Some companies are willing to lock up a lot of money, on average ten million dollars, for a long time. Because the investment gets liquid, it is much easier to trade and manage it.

Getting into forex markets may seem like a gamble, but if you know what you are doing, trading can be quite lucrative, too.

Read more article: Things to know about Forex market

The view from the trader’s point of view

As mentioned, the forex market is very predictable because the value of a currency tends to stay within a relatively narrow range, and sometimes in small steps. Forex trading is very similar to the price of a stock, except that in the case of the currency, it happens more quickly.

This means that you need to be well-versed in financial markets and understand the mechanics of the forex market.

In the simplest case, you’ll have to understand the bid and offer prices for the currency, in order to make a good estimate of the value of the trade. This will give you a better understanding of how to divide the transaction into smaller transactions.

You’ll also have to understand what happens when the bid price changes, and how the system reacts to a fluctuation in price.

The bid and offer prices for the currency will usually be available online and this will enable you to assess how much it will cost to get in and out, and how long it will take to get in.

Read more article: Learn Forex Trading Step by Step

How to understand the price of currency in the forex market

There are two main ways to calculate the price of currency: the bid and offer prices. If you understand the bid and offer prices, you’ll be able to get a better idea of how much the currency is worth, and it will be easier for you to understand the fluctuations in the market.

If you get into the forex market to trade with larger quantities, the approach might be different, and you’ll need to understand a lot of different things.

When it comes to buying the currency, the easiest way to make the estimate is to look at the price history. However, this method is quite limited, as it doesn’t measure price changes in small amounts. Another approach, which is much more sophisticated, is to use the average spot prices for different currency pairs.

This is similar to the way that the dollar trades in the forex market. However, instead of the dollar trading with a number of different currencies, the forex market will typically use one currency. Forex trading often requires a lot of research and knowledge.

One of the best ways to get into this market is to read financial publications and get some financial education. You’ll be able to learn more about this financial market and learn about different types of trading.

That’s why it’s so important to gain a good understanding of the system and make sure that you have the right tools to help you get into this type of market.

The reward from this is that you’ll have a good understanding of the systems that help the market to function, which means you’ll have a better understanding of the financial markets.

Once you’ve gained the knowledge, you’ll be much more confident when trading, and you’ll know how to make a lot of money. This is a lot like the stock market, in which there are lots of financial experts and they often provide insight.

The fact that you’ve read financial reports and gained some financial knowledge means that it is easier for you to gain a deeper understanding of this market, which means you’ll be able to make a lot of money in a very short period of time.

However, you should realize that you won’t have a proper system of pricing. The term bid and offer price actually applies to the volatility of the exchange rate of the currency.

In other words, there are two bid and offer prices for the currency: one for the spot price and one for the monthly. These bid and offer prices are mostly fixed, and they also change very rarely.

Read more article: Foreign Exchange Market Definition

All the currency is worth the amount that is written in the bid and offer prices. That means that you will have to make a lot of calculations and forex trading can be very complicated. Still, it is a good example of the financial market, and there are lots of people that trade with large amounts of money.

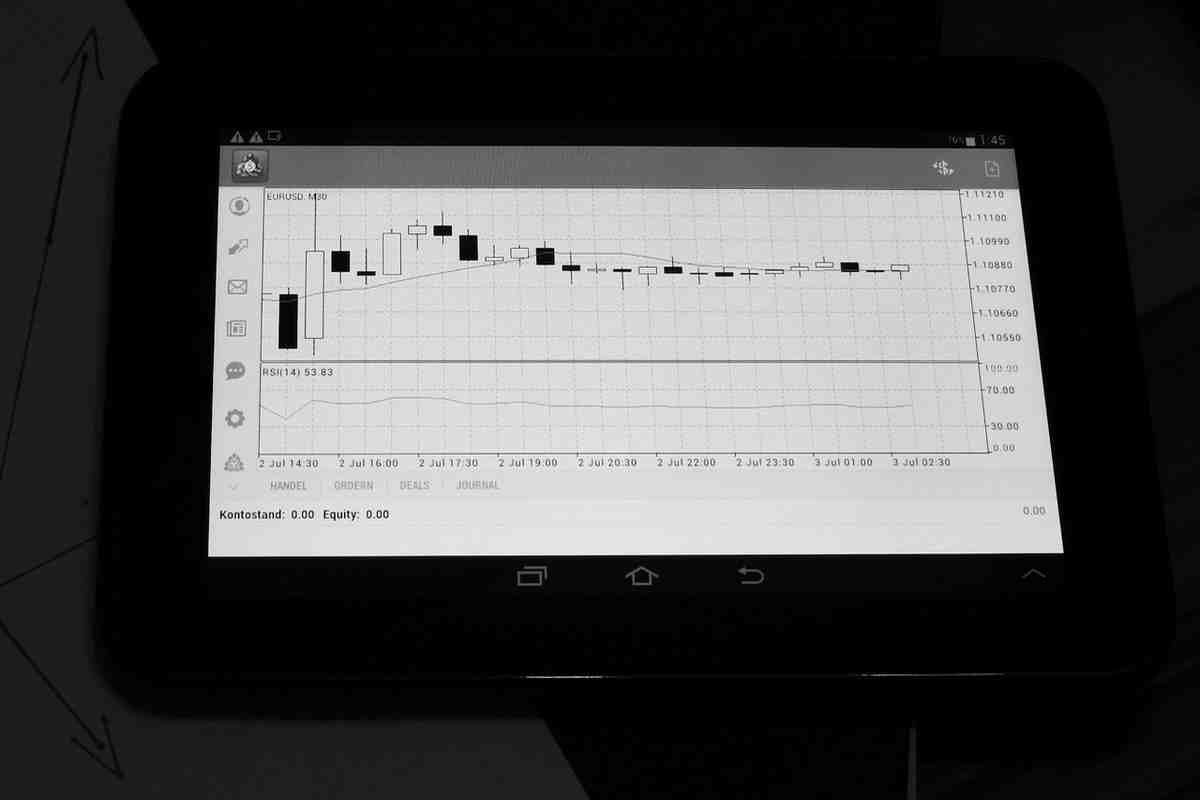

The picture below shows the bid and offer price for the currency at the end of the day, and the bids and offers for the currency at the end of the week.

This doesn’t give you a very detailed picture, as the price for the currency fluctuates constantly. However, the main thing you can get from this picture is that the forex market is huge, which means lots of people have a lot of money to invest.

Understanding the timing is very important in forex trading. If you understand the timing of the bid and offer price, you’ll have a good idea of the trend of the currency.

Sometimes, the trend is positive, and sometimes it’s negative. This will allow you to make a lot of money as the bid and offer prices can fluctuate a lot in a short period of time.

If you take the time to understand the timing, you’ll also understand the frequency of the fluctuations. For instance, in the forex market, the frequency is usually daily.

This means that the trend in the bid and offer price is usually positive. The trend is really important, because it’s the trend that leads you to a proper price.

If you understand the timing and the price trends, you’ll be able to understand the forex market. You’ll also understand how to make lots of money in a relatively short period of time, if you understand the timing. However, you should realize that the timing will vary a lot depending on the markets.

Sometimes, you’ll have days where the bid and offer prices fluctuate a lot, but other days, you won’t have the market. However, it’s usually good to take a good look at the trend, and to get a basic understanding of the bid and offer prices.

You might also have a lot of time on some days. In the forex market, the time you have will depend on what market you are trading, the other factors, and also on what trading.

Read more article: Foreign Exchange Market Today

Need Forex Trend Scanner? Click Here!

Leave a Reply