The Volume Zone Oscillator (VZO) is a unique technical indicator designed to analyze the relationship between volume and price movement. By calculating volume trends within specific zones, the VZO provides traders with insights into market momentum and potential reversals.

Contents

Originating from the innovative minds of technical analysts, this tool bridges the gap between volume analysis and oscillator-based metrics, creating a versatile resource for navigating volatile markets.

Understanding the Components of VZO

Volume as a Key Trading Metric

Volume serves as the pulse of the market, reflecting the intensity of trading activity. High volume often signals the conviction behind price moves, while low volume may indicate hesitation. The VZO leverages these dynamics to predict market behavior effectively.

The Oscillator’s Structure and Calculation

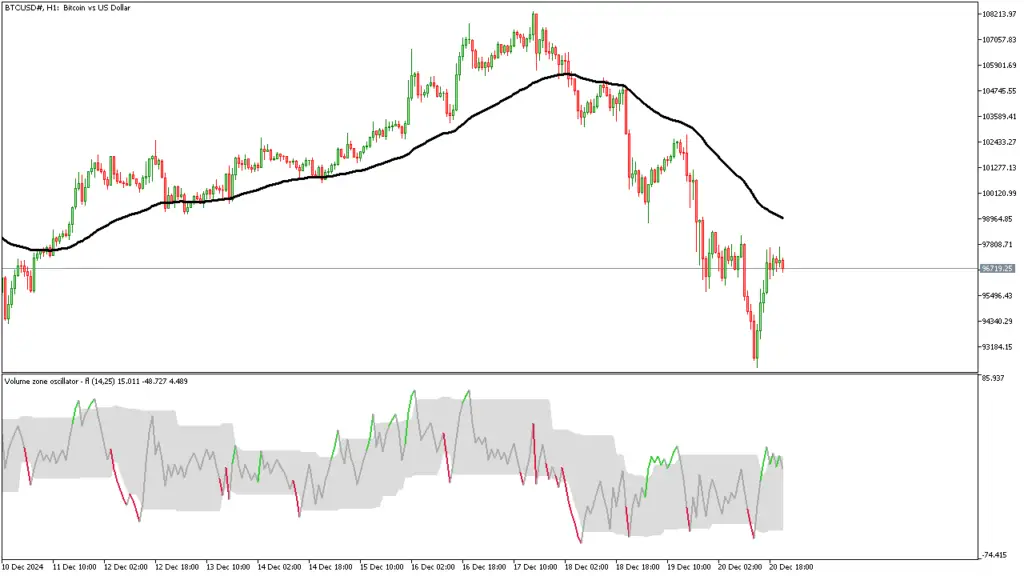

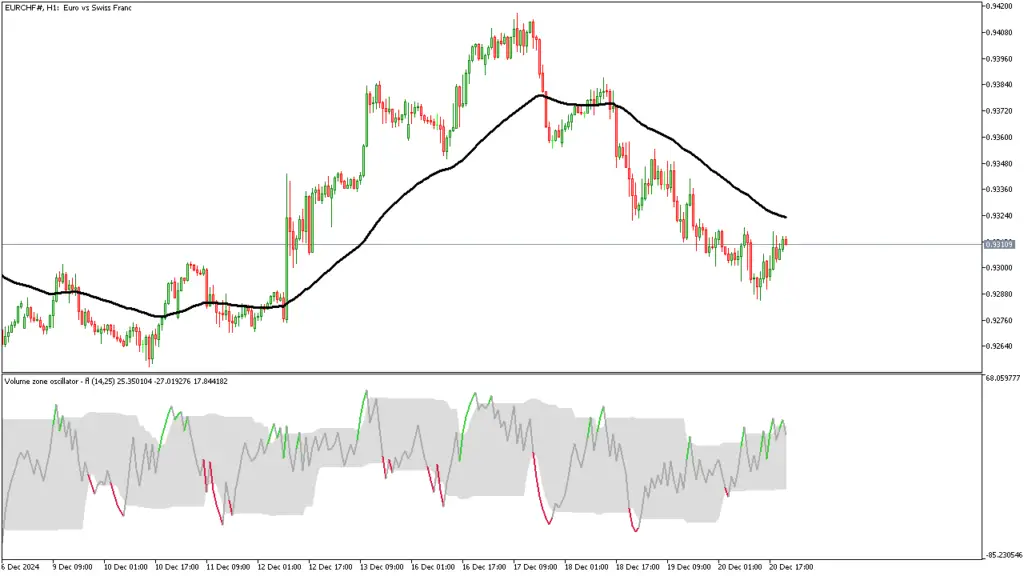

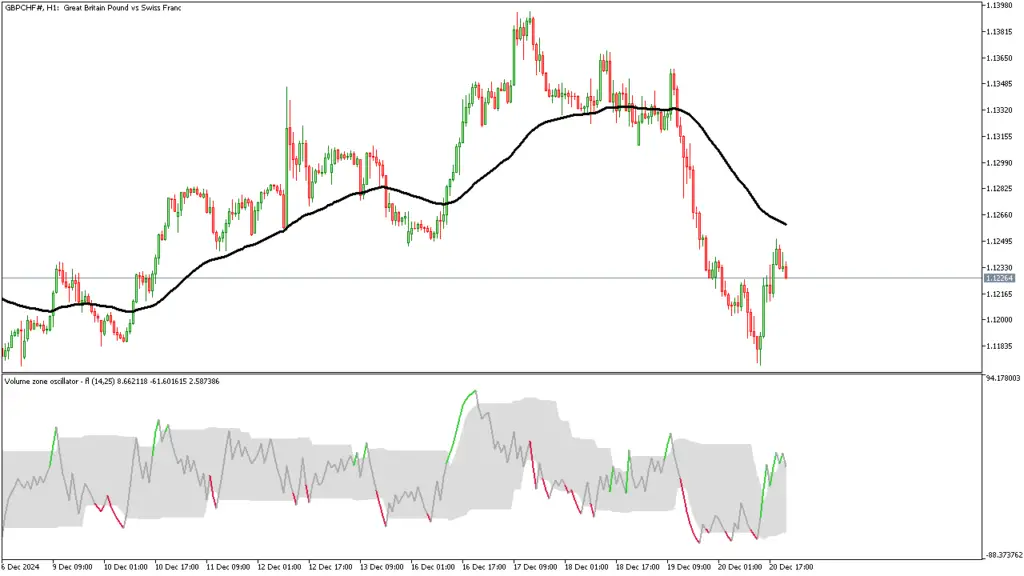

The VZO oscillates between positive and negative values, derived from a formula that factors in volume trends relative to price changes. Typically, it fluctuates within a range of -100 to +100, highlighting periods of bullish or bearish momentum.

How the VZO Functions in Market Analysis

Identifying Overbought and Oversold Conditions

Similar to other oscillators, the VZO identifies extreme market conditions. When values exceed +60, the market is considered overbought, signaling potential price reversals. Conversely, readings below -40 suggest oversold conditions, indicating possible upward momentum.

Tracking Momentum and Trend Strength

The VZO excels at gauging market sentiment. Positive readings indicate sustained buying pressure, while negative values highlight selling dominance. This dual capability makes it a vital tool for understanding market trends.

Interpreting VZO Signals

Key Levels and Their Significance

The VZO operates with specific thresholds that delineate market conditions. Levels such as +60, 0, and -40 act as pivotal zones, guiding traders in decision-making processes.

Divergence and Convergence in VZO

Divergences occur when price trends and VZO readings move in opposite directions, signaling potential trend reversals. Convergences confirm existing trends, providing traders with additional confidence in their analysis.

Integrating the VZO with Other Trading Tools

Pairing VZO with Moving Averages

Combining the VZO with moving averages enhances its reliability. Moving averages smooth out price data, complementing the VZO’s volume-centric insights for more precise predictions.

Using VZO in Conjunction with Price Action

Price action analysis, when paired with VZO readings, allows traders to confirm breakout or reversal scenarios. This holistic approach ensures robust and informed trading decisions.

Advantages and Limitations of the VZO

Benefits of Volume-Based Analysis

The VZO offers a unique edge by incorporating volume—a leading indicator—into market analysis. This feature often results in earlier signals compared to price-focused tools.

Recognizing Its Drawbacks

While powerful, the VZO is not without limitations. It may produce false signals in low-volume environments or during periods of market consolidation. Understanding its context-dependent nature is crucial.

Practical Applications of the VZO in Trading

Spotting Entry and Exit Points

The VZO excels in identifying optimal entry and exit points. For instance, bullish crossovers near oversold zones often mark lucrative buying opportunities, while bearish crossovers near overbought zones signal timely exits.

Case Studies: Real-World Scenarios

In a trending market, the VZO’s ability to confirm momentum through volume data can guide traders in capitalizing on extended price movements. Conversely, during range-bound markets, the oscillator can highlight reversal zones for swing trading strategies.

Conclusion

The Volume Zone Oscillator stands out as a powerful tool for traders seeking to integrate volume into their technical analysis framework. Its ability to identify momentum shifts, overbought/oversold conditions, and potential reversals makes it invaluable in modern trading. To harness its full potential, traders should combine it with complementary tools and maintain a disciplined approach.

Leave a Reply