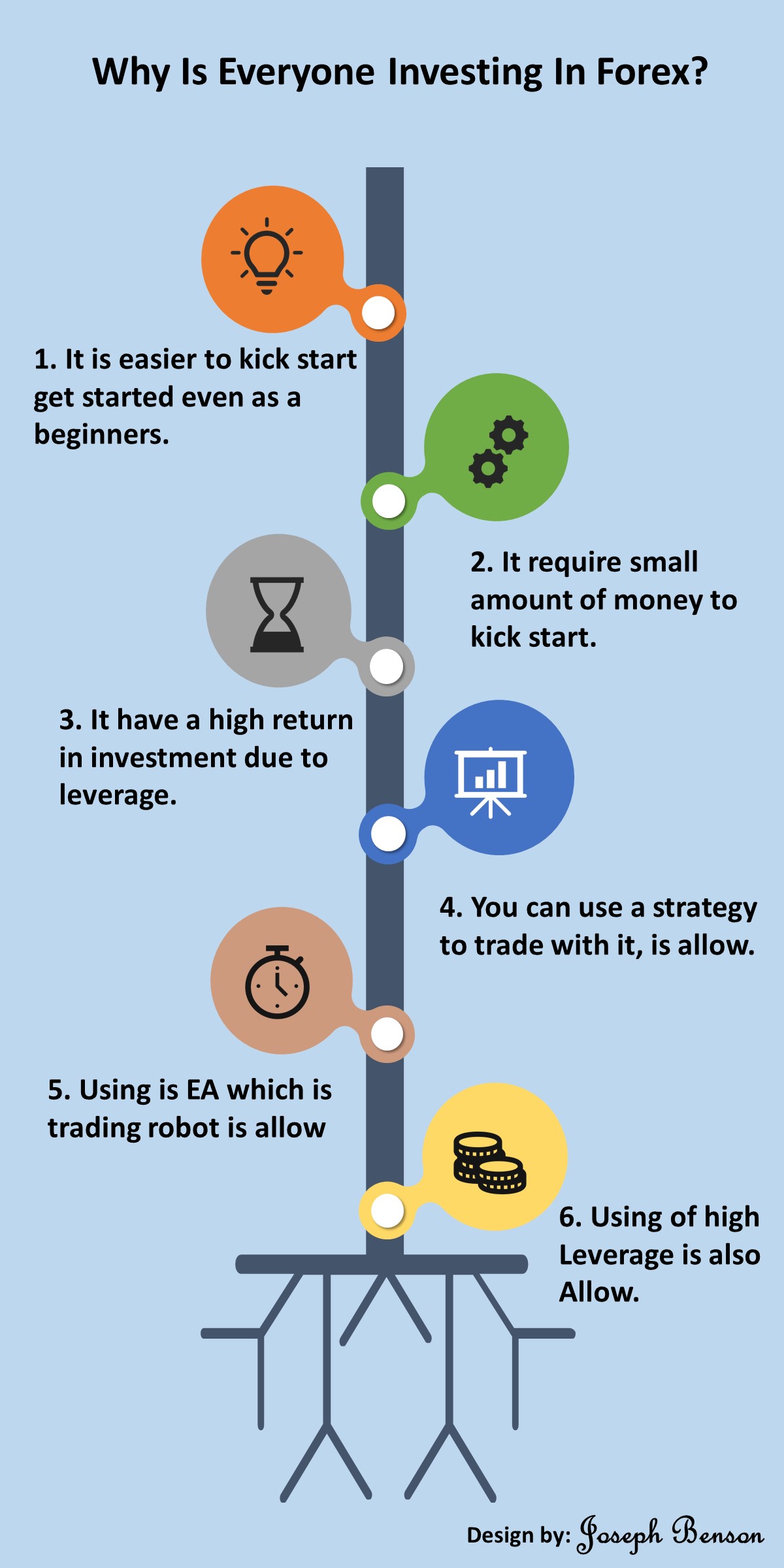

Why is everyone investing in forex? The reason is forex trading is profitable and simple to start compare to other form of trading or investment which most of them require large sum of capital to get started, but with forex trading you can start with as little as $5, some brokers even accept $1 for a start.

Why everyone is investing in forex have a lot of answers some see forex as get rich quick investment but the right knowledge or education, yes you can make quick money trading forex if you have the basic education.

Why are they investing in the forex market? Does everyone just want to earn money so quickly? Well, I think that this is a reasonable question for most people who weren’t trading on the FOREX market.

So why do so many people invest on the forex market. There is a tax of course, but if you look at that honestly and in an objective way, you’ll realize that it’s very small. The real reason why this grows so fast is because anyone can invest in FOREX.

But not everyone can find solid information about it and start using it. That’s why many traders who want to be successful traders must start reading all available information before investing their money in order to keep their money safe.

Why is everyone trading or investing in forex?

The forex market is the largest, most liquid financial market in the world. It stands for foreign exchange market and is used to trade currencies. The main reasons people are investing in forex are:

1. It allows you to profit from price fluctuations in stocks, commodities, and bonds.

2. You can diversify your portfolio by adding exposure to a new asset class with low correlation to your existing holdings

3. There are no limits on how much you can invest or trade, unlike with other markets (e.g., stocks or real estate).

Let’s see more different reasons why people invest in the forex market:

Income generation – Forex traders can generate income by charging a spread on customers’ trades.

Capital preservation – The forex market has no central counter party that would be responsible for losses incurred by speculators.

Diversification – Forex traders can choose from more than 100 currency pairs to trade, which allows them to diversify their portfolio without having to purchase individual stocks or bonds.

Volatility – The volatility of currencies makes it possible for traders to profit from price movements either up or down.

Liquidity – In contrast with other markets, where there may be only one buyer or seller, there are always buyers and sellers in the forex market.

This means that even if you want to buy or sell large amounts of currency at once (which would normally move the price), there will always be someone ready to take your order at a fair price.

Read more articles: Can Forex Trading be a Business?

Forex have greater flexibility

Forex trading is a widely-used method of trading in the world of finance it is also easy to start trading. The reason why forex trading has become so popular is because it gives investors the ability to trade any time they want and from anywhere they want.

Forex traders can trade as much or as little as they like, whether it be at night, on weekends, or during holidays. The great thing about forex trading is that it allows you to take advantage of the global economy and move your money around whenever you want.

If there’s a currency that’s performing poorly, then you can sell it and move your money into another currency that’s doing well.

This type of flexibility is something that investors love about forex trading as it gives them far more control over their portfolios than any other type of investment strategy would allow them to have. The Forex market is the largest financial market in the world, and it is open 24 hours a day, five days a week.

This means that you can trade at any time of day or night, which is great for traders who are busy with other things during normal business hours. Forex also has greater flexibility than stocks and options because they’re traded on margin, so you don’t need to pay 100% of your investment upfront.

Instead, you can use leverage to make larger trades than you would without leverage. Because of this leverage, any fluctuations in price will be amplified by your initial investment amount.

For example, if you invested $100 in USD/CHF (Swiss francs) at 1:1 leverage, then any movement of one pip (.000100) will result in a profit or loss of $1 per pip.

So if USD/CHF moves from 1.0130 to 1.0120 (10 pips), then your profit or loss will be $10 x 10 pips = $100 per contract regardless of whether it’s a long or short position.

Read more articles: Fx Swap and Currency Swap Difference

Top pick

Editor’s choice

Best value

Forex have superior risk management when trading

Forex you have superior risk management. This is an important point for those who are beginning to trade Forex. The first thing that you need to understand is that Forex trading is not like traditional trading.

Many traders will think that they can just open a position, wait until they make a profit and then close it. However, this is not how Forex works. You can get into a position and lose money on the first day or even within minutes!

For example, if you go long on EUR/USD and the USD strengthens against the Euro, then you will lose money instantly because your currency pair has gone down in value relative to your base currency (i.e., US dollars).

In order for you to make money in Forex, you have to understand how the market works and how it behaves over time. To do this, you need to have superior risk management skills so that if something goes wrong in one trade then it doesn’t ruin all of your other positions at once

Forex trading can be a risky business. But with proper risk management, you can avoid many of the pitfalls that are common to trading.

The first step in managing your risks is to understand what they are. You will have different types of risk depending on the strategy you use, your time frame and the markets you trade in.

The second step is to determine how much risk you can take on and how much capital you need in order to do so. This is called position sizing, and it’s critical to any successful trading strategy.

Once you know how much risk you can take on and how much capital it requires, then you need to decide when to exit trades that aren’t working out for you.

Read more articles: How do I Start a Forex Brokerage

Forex trading have extremely higher returns

Forex has extremely higher returns than any other field. The average return on an investment in forex is 600%. It’s the highest return on investment in the world.

Forex trading is a good way to earn money. You do not need to invest a lot of money, you can start with a small amount and grow your capital over time.

Forex trading is a safe way to make money because it is regulated by governments. In addition, there are many online resources that can help you learn how to trade Forex professionally. The forex market is one of the largest markets in the world and it is also one of the most volatile.

In this article, we will analyze why the forex market has such high returns, what some of the key factors that make it so volatile, and how to use them to your advantage.

The fact that there are so many people involved in this market makes it very easy for traders to profit from price movements, even if they do not have any special knowledge or skills.

As a retail trader, you will not be able to take advantage of all these opportunities because of your limited capital. However, there are several strategies that you can use to try and maximize your profits while minimizing risk at the same time. I will explain these strategies below:

1) Buy low and sell high: This seems like a no-brainer, but many traders fail to follow this simple rule because they panic at times when prices start falling fast or shoot up too quickly in a very short period of time.

You should always keep an eye on price action and make sure that you buy low and sell high in order to maximize your profits over time.

2) Use leverage wisely: Leverage allows you to trade on margin with a relatively small amount of capital. This is great for increasing profits, but it also increases the amount at risk so don’t use too much!

3) Don’t chase your losses: If you’re wrong about a trade, don’t try to “make it back.” Just accept that it was a mistake and move on.

Making bad trades is part of being a trader; it’s how we learn what not to do. The sooner you learn that lesson and stop trying to recover your losses, the better off you’ll be.

4) Use limit orders: Limit orders allow you to set price levels at which you’d like to buy or sell an asset but they only get filled if those prices are reached during market hours (or when trading resumes after a holiday).

This is great because it lets us avoid getting caught up in volatile markets where our orders might get filled at bad prices if we were using market orders instead.

Read more articles: Setting Up Your Own Forex Brokerage

FX offer leverage and margin easy to invest

Forex offers leverage and margin. Leverage is the number of times your account size can be multiplied to trade in the market. The margin is a percentage of the funds you use to open positions.

The difference between the two is that when you place a leveraged trade, the broker has already taken care of the margin requirement and added it to your trading balance.

Margin requirement is calculated based on your debit balance and not on your actual free margin amount. For example, if you have $100,000 in your account, then you will have 100:1 leverage, but if you only have $5,000 in your account, then you will have 5:1 leverage.

If you want to open a position worth $5,000 with 5:1 leverage then it will cost you $5 per pip movement in the market. If EUR/USD moves by 0.0001 then this means that you will lose or gain $5 per pip movement in EUR/USD (0.0001).

Leverage is a measure of how much money you can borrow from your broker to trade with. If you want to trade $100,000 but only have $10,000 in your account, then you might be able to use 100:1 leverage.

Margin is a loan that you take out from your broker and pay interest on each month until the full amount is repaid you can also think of it as a kind of ‘borrowing’ that allows you to buy more currency units than your actual cash balance would allow.

The good news is that forex offers both leverage and margin so investors who have smaller accounts can still participate fully in this exciting market!

Read more articles: Forex Trading Basics Rules

Top pick

Editor’s choice

Best value

You don’t need much capital to trade FX or start investment

You don’t need much capital to trade forex. You can start with as little as $100. The minimum deposit required for most online forex brokers is usually around $200 or less. Although it’s always a good idea to check with the individual broker before opening an account.

Trading forex with a small amount of capital can be risky. Even if you are able to make small profits, they won’t amount to much if you’re trading with only a few hundred dollars.

If you’re just starting out and don’t have much money to invest, it’s better to use a demo account until you’re confident enough in your abilities.

The most reputable brokers offer free demo accounts where you can practice without risking any real money. If you want to trade on your own and learn how to trade, it is best to start off with a demo account where you can practice without risking any real money.

Once you have learned how to trade, and have built up some confidence in your ability, you can start using a live account.

The minimum deposit required for opening a live account is usually around $100 – $200 depending on the broker. This is a small amount of money that anyone could afford to invest in this market.

The question then becomes: How much money should I keep in my trading account? There is no simple answer to this question because everyone’s situation is different.

For example, if you are trading with leverage (borrowing money from your broker). Then the amount of money you need in order to maintain a certain position will be higher than if you were not using leverage at all.

Read more articles: Download Forex Profit Supreme

The forex market runs 24 hours a day for all investors

The forex market runs 24 hours a day, 5 days a week. During the rest of the time, it’s closed for maintenance. There are two main sessions of trading in the foreign exchange market:

The London session, which is open from 2:00 p.m. to 8:00 p.m. in New York City (EST) and until 5:00 p.m. in London (GMT).

This is often referred to as “the Asian session” because most traders in Asia use this time frame to trade currencies and commodities in their local markets.

The Asian session also includes Tokyo and Sydney, Australia, which are located several hours ahead of New York City time.

The New York session is open from 6:00 p.m. to 4:00 p.m., but it can be as early as 3:30 p.m., depending on how many people are trading at that time and whether there are economic reports being released shortly after 3:30 p.m..

Which would cause traders to want to trade before they hear about the news event or get caught up in some type of price move triggered by those reports.

Read more articles: Accounting for Foreign Exchange Swap

Top pick

Editor’s choice

Best value

The forex currency pairs is highly liquid

The forex market is highly liquid. This means that there are many buyers and sellers at all times, which allows you to easily enter and exit positions quickly.

The forex market is open 24 hours a day, five days per week (from Sunday 5:00 p.m. EST to Friday 4:00 p.m. EST). This allows investors to trade in the very early morning or late night hours when other markets are closed.

In fact, this is when some of the largest trades are made because other traders are asleep or away from their desks. What makes the forex market so liquid?

The answer lies in its size and accessibility. The forex market is the largest financial market in the world with more than $4 trillion traded every day by over 4 billion people worldwide!

The forex market is highly liquid, which means that there are many buyers and sellers trading in the same currency pair at any one time.

Having a high level of liquidity allows you to enter and exit positions quickly and easily without affecting the price of your trade significantly.

The forex market is not only liquid but also extremely diverse. There are over 200 currency pairs that make up the forex markets, each with its own unique characteristics and volatility.

The diversity of the market means that you can find an instrument that suits your trading style, whether it be day trading or long-term investing.

Read more articles: Create Your Own Forex Robot

The forex market is highly regulated due to money flow

The forex market, a hub for foreign exchange transactions, is the biggest financial market globally, with a daily average trading volume of over $5.3 trillion. Given its vastness and significance, the forex market is heavily regulated by various financial and governmental entities worldwide.

In this section, we’ll talk about why the forex market needs to be regulated, how important the regulatory bodies are, and what the benefits of regulation are for traders and the market as a whole.

The need for regulation comes from the need to keep the market’s integrity and make sure that traders get fair and clear prices.

With the high volume of trades that take place each day, it’s imperative to prevent traders from falling victim to unfair or manipulative practices that could harm their investments.

As such, governmental and financial organizations have established regulations to govern the forex market, including rules surrounding trade execution, margin requirements, and reporting obligations.

The US Commodity Futures Trading Commission (CFTC) is a major player in the regulation of the forex market. The CFTC oversees and regulates the forex market in the US, ensuring fair and transparent pricing and curbing fraudulent activities.

Furthermore, the CFTC collaborates with other financial organizations and governments globally to set international standards for forex regulation. The Financial Conduct Authority (FCA) in the UK is another important part of the forex market’s regulation.

The FCA regulates and supervises financial firms operating in the UK, including forex brokers, to ensure fair and transparent pricing and to protect against fraudulent activities.

Regulation of the forex market brings about numerous benefits to traders and the market as a whole. To begin with, it ensures fair and transparent pricing, reducing the risk of market manipulation and fraud.

This, in turn, increases confidence in the forex market, leading to a surge in trading activity and a more liquid market. Moreover, regulation guarantees that Forex brokers operate securely and safely, reducing the risk of fraud and financial losses for traders.

For example, rules may require Forex brokers to keep a certain amount of capital, which protects their finances and keeps them from losing money on the market.

The forex market’s regulation is a result of its massive money flow. Regulation is crucial in ensuring fair and transparent pricing for traders and protection against fraudulent activities.

The CFTC and the FCA are among the key players in the regulation of the forex market. The benefits of regulation include increased confidence in the market, a reduced risk of market manipulation and fraud, and a surge in trading activity.

Read more articles: Why is There Swap in Forex?

Conclusion

There are two primary reasons for a trend toward investing in the Forex market. First and foremost, the value of currencies is constantly fluctuating. This means that a trader can join in the action of short-term price fluctuations while keeping company with some of the wealthiest investors in the world.

Also, forex trading has very affordable minimum deposit requirements. The potential to earn a substantial profit on a forex investment is greater than at any other time in history. Sometimes it helps to have an insider’s look at a trend that many other people might not understand.

While this won’t be an answer for everyone, those who are interested in investing in Forex should look for the top trends in currency investments and analysis.

A forex investment is an excellent way to invest in the world economy if you have the time and the talent to intelligently analyze a global market. Regardless of your reasons for investing in forex, the information presented here should be useful in making a decision.

Read more articles: Will Forex Trading Ever Stop?

Start Your Forex Investment with $500 Free

Leave a Reply