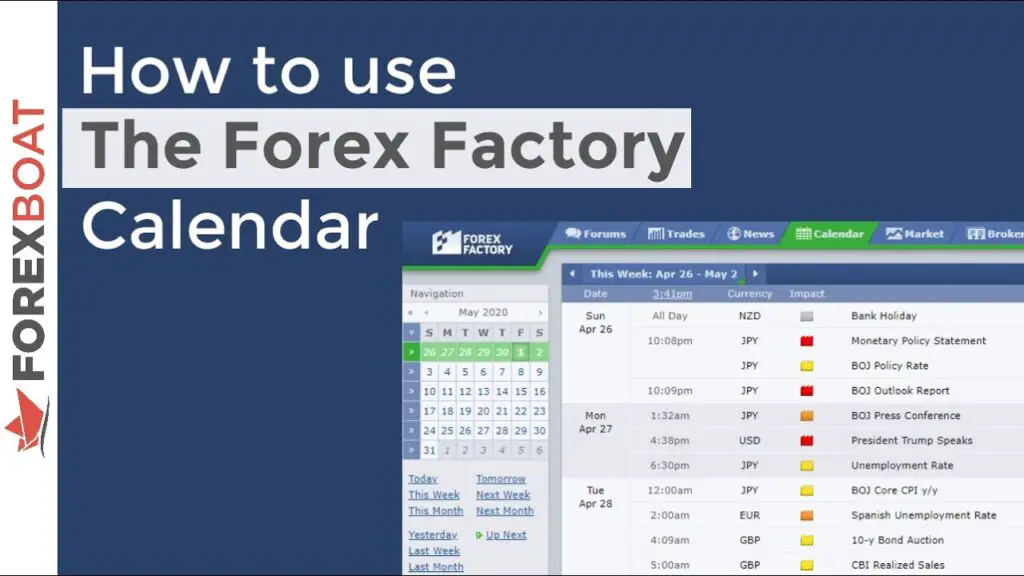

The Forex Factory Calendar is a valuable tool for traders, providing a comprehensive overview of economic events and announcements that can impact the financial markets.

It is an essential resource for both beginner and experienced traders, offering a centralized platform to track and analyze market-moving events.

Contents

The calendar includes a wide range of economic indicators, such as interest rate decisions, GDP releases, employment reports, and other key economic data from around the world.

Understanding the significance of these events and their potential impact on currency pairs and other financial instruments is crucial for successful trading.

- Bull and Bear Statue Wall Street Decor: Bronze-finish figurine symbolizes the eternal duel of markets; perfect Wall Stre…

- Durable Resin Bull Figurine and Bear Sculpture: Detailed bull statue and bear statue crafted from sturdy resin with meta…

- Compact Desktop Decor for Office or Home: Measuring 9×9.5×4.5 inches, this bull figurine fits desks, shelves, or trading…

The Forex Factory Calendar also provides valuable insights into market sentiment and expectations, as it includes forecasts and previous data for each economic event.

This allows traders to gauge the potential market reaction to upcoming announcements and make informed trading decisions.

By understanding the Forex Factory Calendar and the implications of different economic indicators, traders can better anticipate market movements and adjust their trading strategies accordingly.

Navigating the Forex Factory Calendar for Beginners

Filtering and Customization Options

The calendar can be filtered based on various criteria, such as currency pairs, impact level, and specific time frames, allowing traders to focus on the events that are most relevant to their trading activities.

Understanding Impact Ratings and Time Zone Settings

The color-coded impact ratings provide a quick visual reference for the potential market significance of each event. Traders can also customize their view of the calendar by adjusting the time zone settings to align with their local time, ensuring that they are aware of upcoming events in their trading hours.

Conducting Thorough Research and Analysis

The Forex Factory Calendar offers a detailed description of each economic event, including historical data and consensus forecasts, enabling traders to conduct thorough research and analysis before making trading decisions.

By familiarizing themselves with the navigation tools and customization options available on the platform, beginners can effectively utilize the Forex Factory Calendar to enhance their trading strategies.

How to Use the Forex Factory Calendar for Trading

Utilizing the Forex Factory Calendar for trading involves a strategic approach that integrates fundamental analysis with technical analysis. Traders can use the calendar to identify potential trading opportunities based on upcoming economic events and their expected impact on the market.

For example, a trader may anticipate a bullish trend in a currency pair following a positive employment report or a hawkish interest rate decision.

Conversely, negative economic data or dovish policy statements can lead to bearish market sentiment.

- Bull and Bear Statue Wall Street Decor: Bronze-finish figurine symbolizes the eternal duel of markets; perfect Wall Stre…

- Durable Resin Bull Figurine and Bear Sculpture: Detailed bull statue and bear statue crafted from sturdy resin with meta…

- Compact Desktop Decor for Office or Home: Measuring 9×9.5×4.5 inches, this bull figurine fits desks, shelves, or trading…

By aligning their trading decisions with the scheduled economic events on the Forex Factory Calendar, traders can capitalize on market volatility and price movements triggered by these announcements.

It is essential to combine the information from the calendar with technical analysis tools to confirm entry and exit points for trades.

Additionally, risk management strategies should be employed to mitigate potential losses in case of unexpected market reactions to economic events.

Key Features of the Forex Factory Calendar

The Forex Factory Calendar offers several key features that make it an indispensable tool for traders. One of its primary features is the comprehensive coverage of global economic events, including indicators from major economies such as the United States, Eurozone, Japan, and China.

This allows traders to stay informed about developments across different regions and their potential impact on currency pairs and other financial instruments.

Another important feature is the customization options available on the platform, which enable traders to filter and prioritize economic events based on their relevance and potential market impact.

The color-coded impact ratings provide a quick assessment of the significance of each event, helping traders to focus on high-impact announcements that are likely to drive market volatility.

Furthermore, the detailed event descriptions and historical data provided on the Forex Factory Calendar allow traders to conduct thorough research and analysis before making trading decisions.

This wealth of information empowers traders to make well-informed choices based on a comprehensive understanding of upcoming economic events and their potential implications for the financial markets.

Tips for Using the Forex Factory Calendar Effectively

To effectively utilize the Forex Factory Calendar, traders should consider several tips to enhance their trading strategies. Firstly, it is essential to stay updated with the latest economic events and announcements by regularly checking the calendar for upcoming releases.

By staying informed about potential market-moving events, traders can proactively plan their trading activities and adjust their positions as needed.

Additionally, traders should pay attention to consensus forecasts and historical data provided on the calendar to gauge market expectations and potential deviations from these expectations.

Understanding market sentiment and expectations can help traders anticipate potential price movements following economic announcements.

Moreover, it is important for traders to remain flexible in their trading approach and adapt to changing market conditions based on the information provided by the calendar.

By being open to adjusting their strategies in response to new economic data and developments, traders can effectively navigate market volatility and capitalize on trading opportunities.

Making the Most of the Forex Factory Calendar as a Beginner

As a beginner, making the most of the Forex Factory Calendar involves familiarizing oneself with its features and functionalities while gradually integrating its insights into trading decisions.

It is important for beginners to start by understanding the significance of different economic indicators and their potential impact on currency pairs and other financial instruments.

By gaining a foundational understanding of fundamental analysis and economic events, beginners can begin to leverage the information provided by the calendar in their trading activities.

Furthermore, beginners should take advantage of the educational resources available on the Forex Factory platform, including forums, tutorials, and articles that provide insights into using the calendar effectively.

Engaging with the trading community on Forex Factory can also offer valuable perspectives and tips from experienced traders, helping beginners gain practical knowledge and insights into utilizing the calendar for trading.

Additionally, beginners should focus on developing a disciplined approach to using the calendar by incorporating it into their trading routine and decision-making process.

By consistently monitoring upcoming economic events and analyzing their potential impact on the market, beginners can gradually build confidence in utilizing the calendar as a valuable tool for informed trading decisions.

Integrating the Forex Factory Calendar into Your Trading Strategy

Integrating the Forex Factory Calendar into a trading strategy involves aligning fundamental analysis with technical analysis to make well-informed trading decisions.

Traders can use the calendar to identify key economic events that are likely to influence market sentiment and price movements in specific currency pairs or other financial instruments.

By incorporating these anticipated market drivers into their overall trading strategy, traders can proactively position themselves to capitalize on potential opportunities or mitigate risks associated with market volatility.

Moreover, integrating the calendar into a trading strategy requires a systematic approach to evaluating upcoming economic events and their potential impact on different aspects of the financial markets.

- Bull and Bear Statue Wall Street Decor: Bronze-finish figurine symbolizes the eternal duel of markets; perfect Wall Stre…

- Durable Resin Bull Figurine and Bear Sculpture: Detailed bull statue and bear statue crafted from sturdy resin with meta…

- Compact Desktop Decor for Office or Home: Measuring 9×9.5×4.5 inches, this bull figurine fits desks, shelves, or trading…

This may involve conducting thorough research and analysis based on historical data, consensus forecasts, and market expectations provided by the calendar.

By integrating this fundamental analysis with technical indicators and chart patterns, traders can develop a comprehensive understanding of potential market movements driven by economic events.

Furthermore, risk management strategies should be integrated into trading plans when using the calendar to anticipate market volatility.

By setting clear risk parameters and implementing stop-loss orders based on potential market reactions to economic announcements, traders can effectively manage their exposure to unexpected price fluctuations.

Common Mistakes to Avoid When Using the Forex Factory Calendar

When using the Forex Factory Calendar, it is important for traders to avoid common mistakes that can impact their trading decisions and overall performance. One common mistake is solely relying on economic events without considering other factors that may influence market movements.

While economic indicators play a significant role in shaping market sentiment, it is essential for traders to consider broader geopolitical developments, central bank policies, and technical analysis signals when making trading decisions.

Another mistake to avoid is overlooking the potential impact of unexpected or outlier events that may not be explicitly listed on the calendar.

Market-moving developments such as geopolitical tensions, natural disasters, or sudden policy announcements can significantly influence market dynamics, even if they are not included in scheduled economic releases.

Traders should remain vigilant and adaptable in response to unforeseen events that may impact their trading positions.

Additionally, it is crucial for traders to avoid overtrading or making impulsive decisions solely based on immediate reactions to economic announcements listed on the calendar.

Developing a disciplined approach to utilizing the calendar involves conducting thorough research, analyzing potential market scenarios, and exercising patience in executing well-considered trading strategies.

Advanced Techniques for Utilizing the Forex Factory Calendar

Advanced traders can employ sophisticated techniques when utilizing the Forex Factory Calendar to enhance their trading strategies.

One advanced technique involves conducting correlation analysis between specific economic indicators and their potential impact on currency pairs or other financial instruments.

By identifying strong correlations between certain economic events and market movements, advanced traders can develop targeted trading strategies based on these relationships.

Furthermore, advanced traders may utilize sentiment analysis tools in conjunction with the calendar to gauge market expectations and positioning ahead of key economic releases.

Sentiment indicators derived from market positioning data or surveys can provide valuable insights into potential market reactions following economic announcements listed on the calendar.

- Bull and Bear Statue Wall Street Decor: Bronze-finish figurine symbolizes the eternal duel of markets; perfect Wall Stre…

- Durable Resin Bull Figurine and Bear Sculpture: Detailed bull statue and bear statue crafted from sturdy resin with meta…

- Compact Desktop Decor for Office or Home: Measuring 9×9.5×4.5 inches, this bull figurine fits desks, shelves, or trading…

Moreover, advanced traders may explore event-driven trading strategies that capitalize on short-term price movements triggered by scheduled economic events.

By closely monitoring market reactions to specific announcements listed on the calendar and executing well-timed trades based on these reactions, advanced traders can leverage short-term opportunities driven by heightened volatility.

My Conclusion

To maximize profits with the Forex Factory Calendar, traders should focus on developing a comprehensive understanding of how different economic events influence market dynamics and price movements.

By conducting thorough research and analysis based on historical data provided by the calendar, traders can identify recurring patterns or trends associated with specific economic indicators and their impact on various financial instruments.

Additionally, maximizing profits involves integrating fundamental analysis insights from the calendar with effective risk management strategies.

Traders should carefully assess potential market volatility surrounding scheduled economic events and implement risk mitigation measures such as setting appropriate stop-loss orders or position sizing based on anticipated price fluctuations.

- Bull and Bear Statue Wall Street Decor: Bronze-finish figurine symbolizes the eternal duel of markets; perfect Wall Stre…

- Durable Resin Bull Figurine and Bear Sculpture: Detailed bull statue and bear statue crafted from sturdy resin with meta…

- Compact Desktop Decor for Office or Home: Measuring 9×9.5×4.5 inches, this bull figurine fits desks, shelves, or trading…

Furthermore, maximizing profits with the calendar requires disciplined execution of well-researched trading strategies that align with anticipated market movements driven by economic announcements.

By remaining focused on high-impact events listed on the calendar and executing trades based on informed analysis, traders can position themselves to capitalize on profitable opportunities while managing risks effectively.

In conclusion, mastering the use of the Forex Factory Calendar is essential for both beginner and advanced traders seeking to make informed trading decisions based on fundamental analysis insights.

By understanding its features, navigating its functionalities effectively, integrating its insights into trading strategies, avoiding common mistakes, and employing advanced techniques when appropriate, traders can harness its power as a valuable tool for maximizing profits in the dynamic world of forex trading.

Leave a Reply