Trend lines are a vital component in the toolkit of forex traders, as they facilitate the identification of market direction and pinpoint potential entry and exit points for trades.

How to trade trend line? A trend line is a linear representation that connects two or more price points, thereby illustrating the direction of the prevailing market trend.

Contents

There exist two primary categories of trend lines: uptrend lines, which link consecutive higher lows, and downtrend lines, which connect successive lower highs.

By mastering the skills of drawing and interpreting trend lines, traders can acquire valuable insights into market trends, ultimately enabling them to make more informed trading decisions.

Identifying and Drawing Trend Lines

Identifying Trends

To identify an uptrend, traders look for a series of higher lows, while for a downtrend, they look for a series of lower highs.

This helps traders to determine the direction of the market and make informed decisions.

Drawing Trend Lines

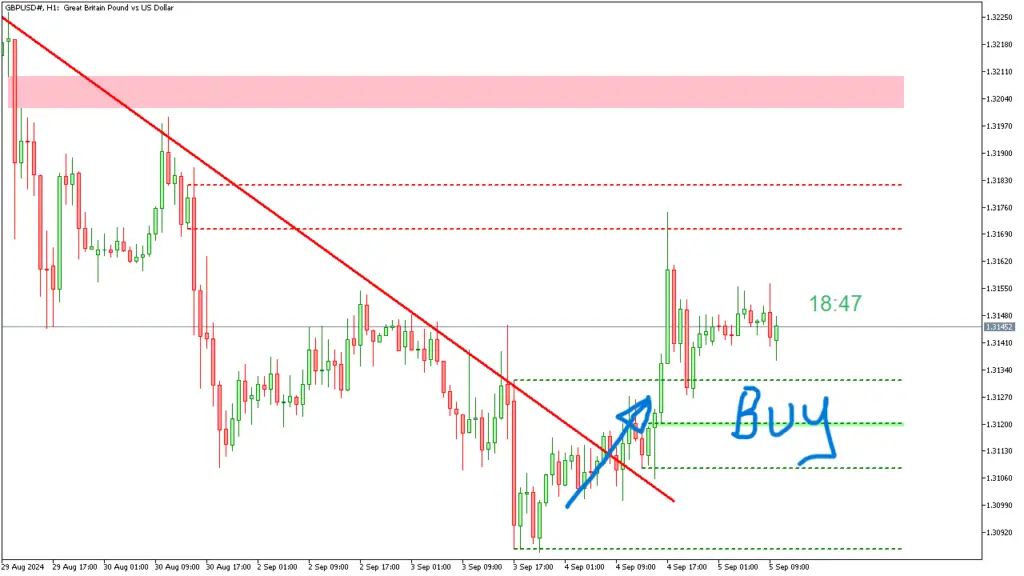

Once the trend has been identified, traders can then draw a trend line by connecting the lows or highs with a straight line.

It is essential to ensure that the trend line touches as many price points as possible to confirm its validity.

Importance of Accurate Trend Lines

Drawing trend lines accurately is crucial for successful trading, as it provides traders with a visual representation of the market trend and potential support and resistance levels.

This information can be used to develop effective trading strategies and minimize potential losses.

Using Trend Lines to Confirm Market Trends

Trend lines can be used to confirm market trends and provide valuable insights into potential entry and exit points for trades.

When a trend line is drawn on a price chart, it can act as a visual guide for traders to identify the direction of the market trend.

If the price consistently bounces off an uptrend line, it confirms the presence of an uptrend, while if the price consistently fails to break above a downtrend line, it confirms the presence of a downtrend.

By using trend lines to confirm market trends, traders can make more informed trading decisions and increase their chances of success in the forex market.

Trading Strategies with Trend Lines

| Topic | Details |

|---|---|

| Strategy Name | How to Trade Trend Line | Advance Forex Strategy |

| Key Concept | Using trend lines to identify and trade market trends |

| Timeframe | Works on multiple timeframes (e.g. 1-hour, 4-hour, daily) |

| Indicators | Trend lines, support and resistance levels |

| Entry Criteria | Price bouncing off trend line, confirmation from other indicators |

| Exit Criteria | Break of trend line, reaching profit target, stop loss hit |

| Risk Management | Using stop loss orders, position sizing, risk-reward ratio |

There are several trading strategies that traders can use with trend lines to capitalize on market trends.

One popular strategy is trend line breakouts, where traders look for a break above or below a trend line to signal a potential change in the market trend.

Another strategy is trend line bounces, where traders look for the price to bounce off a trend line to confirm the continuation of the current trend.

Additionally, traders can use trend lines in conjunction with other technical indicators, such as moving averages or oscillators, to further confirm market trends and potential trading opportunities.

Advanced Techniques for Trading Trend Lines

In addition to basic trading strategies, there are advanced techniques that traders can use to enhance their trading with trend lines.

One advanced technique is using multiple time frame analysis to confirm trend lines on different time frames, which can provide a more comprehensive view of the market trend.

Another advanced technique is using Fibonacci retracement levels in conjunction with trend lines to identify potential support and resistance levels.

By incorporating advanced techniques into their trading with trend lines, traders can gain a deeper understanding of market trends and improve their trading performance.

Managing Risk and Setting Targets with Trend Lines

Risk Management through Stop-Loss Orders

Traders can utilize trend lines to set stop-loss orders at key support or resistance levels, thereby managing their risk and protecting their capital.

This strategy enables traders to limit their potential losses by automatically closing a position when it reaches a certain price level.

Setting Profit Targets with Trend Lines

In addition to managing risk, traders can use trend lines to set profit targets by identifying potential areas where the price may reverse or encounter resistance.

By doing so, traders can capitalize on potential price movements and maximize their gains.

Improving Risk-Reward Ratio and Profitability

By effectively managing risk and setting targets with trend lines, traders can improve their risk-reward ratio and increase their profitability in the forex market.

This approach enables traders to make more informed trading decisions, leading to better outcomes and a more successful trading experience.

Tips for Successful Trend Line Trading in Forex

There are several tips that traders can follow to improve their success in trading with trend lines.

Firstly, it is important to practice drawing and interpreting trend lines on historical price charts to develop a keen eye for identifying market trends.

Secondly, traders should be patient and wait for confirmation of a trend before entering a trade based on a trend line.

Thirdly, it is important to use multiple time frame analysis to confirm trend lines on different time frames and gain a more comprehensive view of the market trend.

Lastly, traders should always use proper risk management techniques, such as setting stop-loss orders and managing position sizes, to protect their capital when trading with trend lines.

In conclusion, trading with trend lines is an advanced forex strategy that can provide valuable insights into market trends and potential trading opportunities.

By understanding how to identify and draw trend lines, confirm market trends, implement trading strategies, use advanced techniques, manage risk and set targets.

And follow tips for successful trading, traders can improve their performance in the forex market and increase their profitability.

Trend lines are a powerful tool for forex traders and mastering their use can lead to greater success in the dynamic world of currency trading.

Conclusion

Understanding how to trade trend lines can significantly enhance your trading strategy and improve your decision-making process.

Trend lines, when used effectively, serve as a powerful tool to identify potential entry and exit points, gauge market sentiment, and manage risk.

To recap, trading trend lines involves several key steps:

1. Identifying the Trend: Recognize whether the market is in an uptrend, downtrend, or sideways movement. This foundational step sets the stage for drawing accurate trend lines.

2. Drawing Trend Lines: Use at least two significant price points to draw a trend line. For an uptrend, connect the lows; for a downtrend, connect the highs. Ensure that the line touches as many points as possible without being forced.

3. Validating Trend Lines: Confirm the validity of your trend line by checking if it aligns with historical price movements and if it has been tested multiple times without being breached.

4. Trading Strategies: Utilize trend lines to formulate trading strategies such as breakout trades, bounce trades, and combining them with other technical indicators for more robust analysis.

5. Risk Management: Always incorporate risk management techniques like stop-loss orders and position sizing to protect your capital against unexpected market movements.

By mastering how to trade trend lines, traders can gain a clearer perspective on market trends and make more informed trading decisions.

This skill not only helps in identifying profitable opportunities but also in avoiding potential pitfalls that come with volatile market conditions.

Remember, while trend lines are a valuable component of technical analysis, they should not be used in isolation. Combining them with other analytical tools and maintaining a disciplined approach will yield the best results.

In conclusion, learning how to trade trend lines is an essential skill for any serious trader. It requires practice, patience, and continuous learning to perfect this technique.

As you refine your ability to draw and interpret trend lines accurately, you will find yourself better equipped to navigate the complexities of financial markets and achieve consistent trading success.

Happy trading!

Leave a Reply