The legacy of Gann Indicator is a technical analysis tool renowned for its ability to identify potential price movements and trends in financial markets.

Developed by the esteemed trader and analyst W.D. Gann, this indicator is rooted in the principles of geometry, astrology, and ancient mathematics.

Contents

Its primary function is to provide traders and investors with valuable insights into market trends and potential price reversals, thereby enabling them to make informed investment decisions.

Triangle patterns are a common phenomenon in financial markets, frequently employed by traders to forecast future price movements.

These patterns emerge when the price of an asset consolidates within a narrowing range, resulting in a triangular shape on the price chart.

There are three primary types of triangle patterns: symmetrical triangles, ascending triangles, and descending triangles.

Each of these patterns possesses distinct characteristics, offering valuable information about potential price movements.

Forex T-shirt Just for You!

Solid colors: 100% Cotton; Heather Grey: 90% Cotton, 10% Polyester; Dark Heather and Heather Blue: 50% Cotton, 50% Polyester; OR Dark Heather, Heather Blue and All Other Heathers: 65% Polyester, 35% Cotton; Girls’ Heathers: 60% Cotton, 40% Polyester

Solid colors: 100% Cotton; Heather Grey: 90% Cotton, 10% Polyester; Dark Heather and Heather Blue: 50% Cotton, 50% Polyester; OR Dark Heather, Heather Blue and All Other Heathers: 65% Polyester, 35% Cotton; Girls’ Heathers: 60% Cotton, 40% Polyester

Solid colors: 100% Cotton; Heather Grey: 90% Cotton, 10% Polyester; Dark Heather and Heather Blue: 50% Cotton, 50% Polyester; OR Dark Heather, Heather Blue and All Other Heathers: 65% Polyester, 35% Cotton; Girls’ Heathers: 60% Cotton, 40% Polyester

Solid colors: 100% Cotton; Heather Grey: 90% Cotton, 10% Polyester; Dark Heather and Heather Blue: 50% Cotton, 50% Polyester; OR Dark Heather, Heather Blue and All Other Heathers: 65% Polyester, 35% Cotton; Girls’ Heathers: 60% Cotton, 40% Polyester

Solid colors: 100% Cotton; Heather Grey: 90% Cotton, 10% Polyester; Dark Heather and Heather Blue: 50% Cotton, 50% Polyester; OR Dark Heather, Heather Blue and All Other Heathers: 65% Polyester, 35% Cotton; Girls’ Heathers: 60% Cotton, 40% Polyester

Solid colors: 100% Cotton; Heather Grey: 90% Cotton, 10% Polyester; All Other Heathers: 50% Cotton, 50% Polyester

Solid colors: 100% Cotton; Heather Grey: 90% Cotton, 10% Polyester; All Other Heathers: 50% Cotton, 50% Polyester

Understanding the Legacy of Gann Indicator

Identifying Key Market Trends

The Gann Indicator is particularly effective in identifying support and resistance levels, as well as potential trend reversals.

The indicator works by analyzing both price and time, allowing traders to identify potential areas of market movement.

This information enables traders to make more informed decisions when it comes to their trading activities.

By understanding where the market may be headed, traders can better position themselves to take advantage of potential opportunities and mitigate risks.

This analysis helps traders to stay ahead of market trends and make more strategic trading decisions.

The Power of Geometric Patterns

One of the key concepts behind the Gann Indicator is the use of angles and geometric shapes to identify potential price movements.

Gann’s belief in the use of angles and geometric patterns to predict future price movements led him to develop various tools and techniques for traders to identify these patterns.

He believed that by understanding these patterns, traders could gain an edge in the market and make more informed trading decisions.

Gann’s work has had a lasting impact on technical analysis and continues to be studied and utilized by traders and analysts in the financial markets.

A Proven Approach to Market Analysis

The Gann Indicator is based on these principles and is designed to help traders identify potential price reversals and trend changes.

The Gann Indicator is a powerful tool that can provide traders with valuable insights into market dynamics.

By incorporating this indicator into their analysis, traders can develop a more comprehensive understanding of market trends and potential price movements.

This can enable them to make more informed and accurate predictions about future price changes, ultimately helping them to make more successful trading decisions.

Overall, the Gann Indicator can be a valuable asset for traders looking to enhance their market analysis and improve their trading strategies.

How to Detect Triangle Patterns Using Gann Indicator

The Gann Indicator can be a valuable tool for detecting triangle patterns in the financial markets. By using the principles of geometry and mathematics, this indicator can help traders identify potential triangle patterns before they fully develop.

One of the key features of the Gann Indicator is its ability to identify potential support and resistance levels, which can be particularly useful when trying to detect triangle patterns.

To detect triangle patterns using the Gann Indicator, traders can look for specific price movements and chart patterns that indicate the formation of a triangle.

For example, a symmetrical triangle pattern can be identified by a series of lower highs and higher lows, while an ascending triangle pattern is characterized by a series of higher lows and a flat resistance level.

By using the Gann Indicator in conjunction with other technical analysis tools, traders can increase their chances of identifying potential triangle patterns in the market.

The Significance of Triangle Patterns in Technical Analysis

Triangle patterns are significant in technical analysis because they often signal potential price breakouts or breakdowns in the market.

When a triangle pattern forms, it indicates that the price of an asset is consolidating within a narrowing range, which can lead to a period of indecision among traders.

As the pattern develops, traders will closely monitor the price movements to see if the asset breaks out of the triangle pattern, which can lead to a significant price movement in either direction.

In technical analysis, triangle patterns are often seen as a continuation pattern, meaning that they can signal a continuation of the current trend.

However, they can also act as reversal patterns, indicating a potential change in trend direction.

By understanding the significance of triangle patterns in technical analysis, traders can use this information to make more informed trading decisions and potentially profit from future price movements.

Utilizing Gann Indicator for Timely Triangle Pattern Recognition

The Gann Indicator can be a valuable tool for timely triangle pattern recognition in the financial markets.

By using the principles of geometry and mathematics, this indicator can help traders identify potential triangle patterns before they fully develop.

This can be particularly useful for traders who want to stay ahead of potential price movements and take advantage of trading opportunities as they arise.

One of the key benefits of using the Gann Indicator for timely triangle pattern recognition is its ability to identify potential support and resistance levels.

By identifying these key levels, traders can anticipate potential price breakouts or breakdowns as the triangle pattern develops.

This can help traders make more informed trading decisions and potentially profit from future price movements in the market.

Successful Application of Gann Indicator in Triangle Pattern Detection

Identifying Triangle Patterns in Various Assets

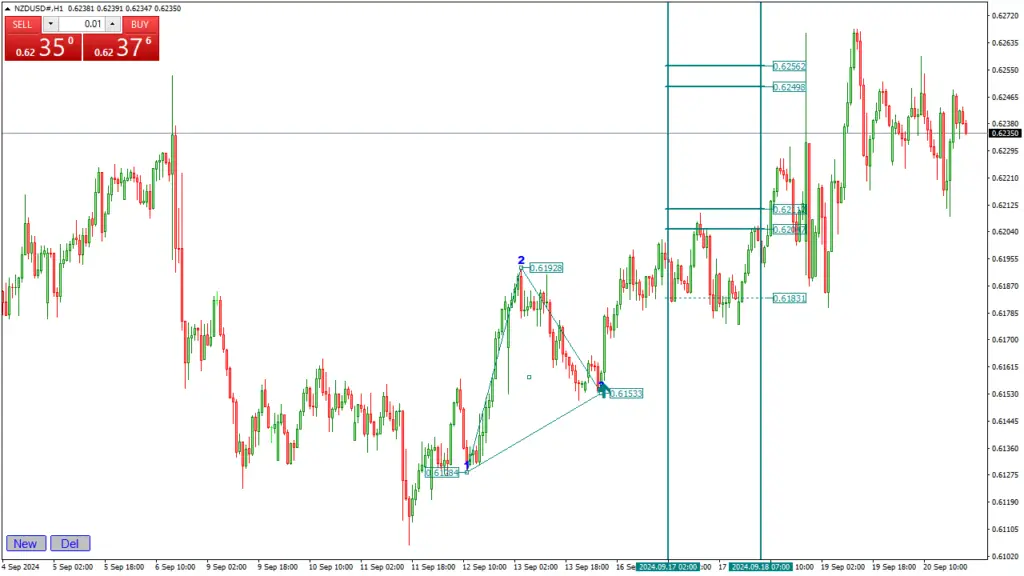

Traders have utilized the Gann Indicator to identify potential triangle patterns in a range of assets, including stocks, forex, and commodities.

Traders use the principles of geometry and mathematics to analyze charts and patterns, which helps them anticipate potential price movements in the market.

By understanding these patterns, traders can capitalize on trading opportunities as they arise, making informed decisions about when to buy or sell assets.

This analytical approach allows traders to make more strategic and calculated decisions, increasing their chances of success in the market.

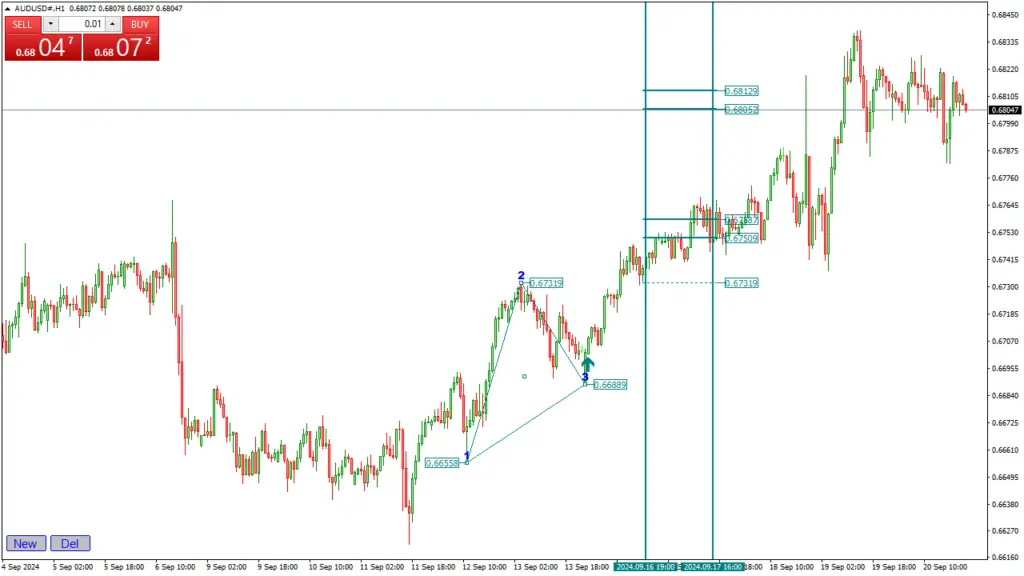

A Real-Life Example of the Gann Indicator in Action

In one notable case study, a trader employed the Gann Indicator to identify a symmetrical triangle pattern forming on a stock chart.

The trader carefully observed the fluctuations in prices and utilized the Gann Indicator to pinpoint possible support and resistance levels.

This strategic approach allowed the trader to predict an impending breakout from the triangle pattern.

By staying vigilant and analyzing market data, the trader was able to make informed decisions and potentially capitalize on the upcoming price movement.

Capitalizing on Trading Opportunities

This allowed the trader to enter a trade at an opportune time, potentially profiting from the subsequent price movement.

The Gann Indicator’s ability to detect triangle patterns has proven to be a valuable tool for traders seeking to make informed investment decisions.

By identifying these patterns, traders can anticipate potential breakouts and trend reversals, allowing them to enter and exit positions at optimal times.

This can help traders maximize their profits and minimize their losses, ultimately leading to more successful trading outcomes.

Additionally, the Gann Indicator’s ability to detect triangle patterns can provide valuable insights into market sentiment and potential price movements. Giving traders a competitive edge in the financial markets.

Overall, the Gann Indicator’s capability in detecting triangle patterns is a powerful resource for traders looking to enhance their technical analysis and decision-making processes.

Tips for Maximizing the Potential of Gann Indicator in Identifying Triangle Patterns

To maximize the potential of the Gann Indicator in identifying triangle patterns, traders can follow a few key tips.

First, it’s important to familiarize oneself with the principles of geometry and mathematics that underpin this indicator.

By understanding how angles and geometric shapes can be used to predict future price movements, traders can better utilize the Gann Indicator in their trading strategies.

Secondly, traders should consider using the Gann Indicator in conjunction with other technical analysis tools to increase their chances of identifying potential triangle patterns.

By combining this indicator with tools such as trend lines, moving averages, and volume indicators, traders can gain a more comprehensive view of market trends and potential price movements.

The Legacy of Gann Indicator is a powerful tool that can be used to detect triangle patterns in the financial markets.

Conclusion

In conclusion, the Legacy of Gann Indicator stands as a significant tool in the realm of technical analysis, offering traders and investors a unique perspective on market movements.

Rooted in the principles established by W.D. Gann, this indicator seeks to harness the power of time and price relationships to forecast potential market trends.

Its multifaceted approach incorporates various elements such as angles, time cycles, and price levels, making it a versatile addition to any trader’s toolkit.

While the Legacy of Gann Indicator has garnered a following among those who appreciate its historical context and theoretical underpinnings, it is essential to approach it with a balanced mindset.

Like any trading tool, its effectiveness can vary based on individual trading styles, market conditions, and the trader’s ability to interpret its signals accurately.

Therefore, it is advisable for users to combine the insights gained from the Legacy of Gann Indicator with other analytical methods and risk management strategies.

Ultimately, whether one views the Legacy of Gann Indicator as a groundbreaking innovation or a historical curiosity, its legacy continues to influence modern trading practices.

As markets evolve and new technologies emerge, the principles behind Gann’s work remind us of the enduring relationship between time and price in financial markets.

For those willing to invest the time in understanding its complexities, the Legacy of Gann Indicator may offer valuable insights that contribute to more informed trading decisions.

Leave a Reply