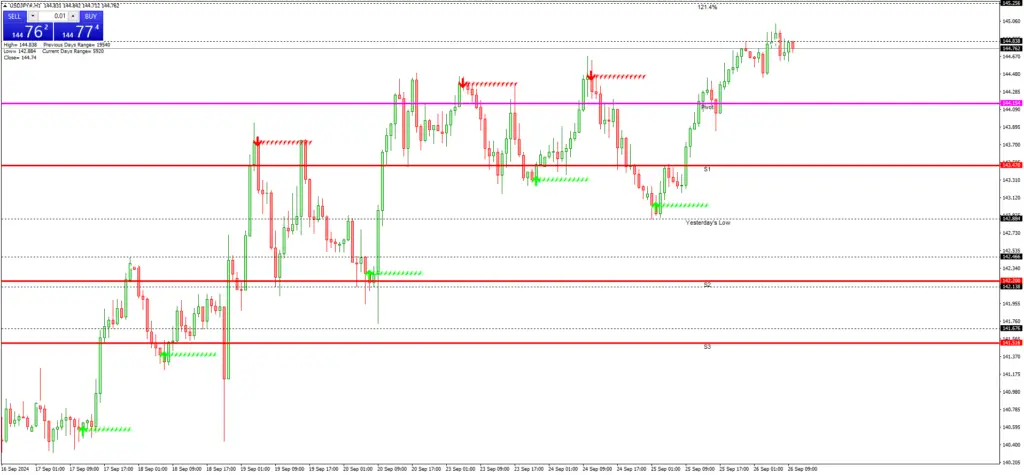

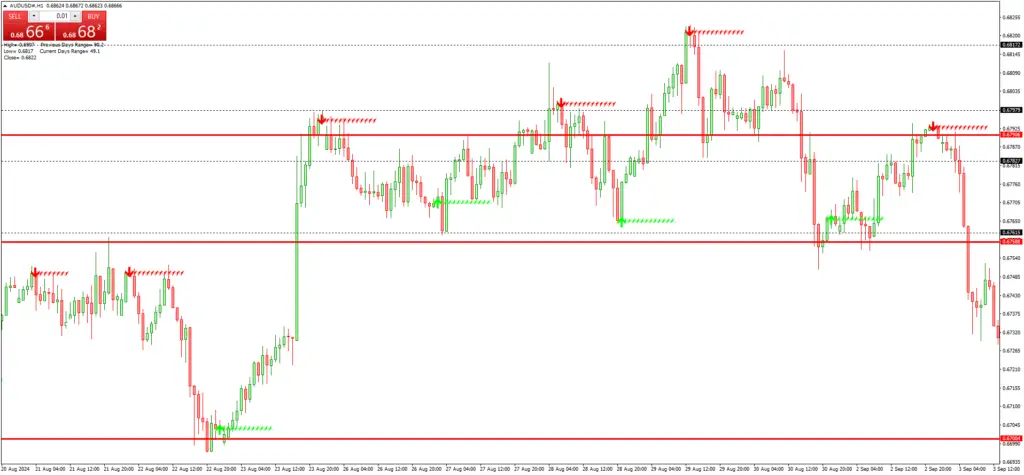

Pivot points are a widely employed technical analysis tool utilized by traders to identify potential support and resistance levels in the market.

These levels are calculated based on the previous day’s high, low, and closing prices, providing traders with valuable insights into the overall trend and potential reversal points in the market.

Contents

Day traders and short-term traders, in particular, find pivot points useful for capitalizing on short-term price movements.

The calculation of pivot points involves using the high, low, and closing prices from the previous trading session.

The pivot point is determined by averaging these three prices. Subsequently, traders can calculate support and resistance levels based on the pivot point.

The first level of support and resistance is calculated by subtracting and adding the previous day’s high and low from the pivot point, respectively.

Additional support and resistance levels can be calculated using various formulas, such as Fibonacci retracement levels. Traders employ pivot points to identify potential turning points in the market.

When the price is trading above the pivot point, it is considered a bullish signal, and when it is trading below the pivot point, it is considered bearish.

Traders can utilize pivot points to determine potential entry and exit points for their trades, as well as to set stop-loss and take-profit levels.

A thorough understanding of pivot points is essential for traders seeking to incorporate this strategy into their trading approach.

Solid colors: 100% Cotton; Heather Grey: 90% Cotton, 10% Polyester; Dark Heather and Heather Blue: 50% Cotton, 50% Polyester; OR Dark Heather, Heather Blue and All Other Heathers: 65% Polyester, 35% Cotton; Girls’ Heathers: 60% Cotton, 40% Polyester

Solid colors: 100% Cotton; Heather Grey: 90% Cotton, 10% Polyester; Dark Heather and Heather Blue: 50% Cotton, 50% Polyester; OR Dark Heather, Heather Blue and All Other Heathers: 65% Polyester, 35% Cotton; Girls’ Heathers: 60% Cotton, 40% Polyester

Solid colors: 100% Cotton; Heather Grey: 90% Cotton, 10% Polyester; Dark Heather and Heather Blue: 50% Cotton, 50% Polyester; OR Dark Heather, Heather Blue and All Other Heathers: 65% Polyester, 35% Cotton; Girls’ Heathers: 60% Cotton, 40% Polyester

Solid colors: 100% Cotton; Heather Grey: 90% Cotton, 10% Polyester; Dark Heather and Heather Blue: 50% Cotton, 50% Polyester; OR Dark Heather, Heather Blue and All Other Heathers: 65% Polyester, 35% Cotton; Girls’ Heathers: 60% Cotton, 40% Polyester

Identifying Key Support and Resistance Levels

Understanding Support and Resistance Levels

Support levels are areas where the price tends to find buying interest, while resistance levels are areas where the price tends to find selling interest.

By identifying these key levels, traders can gain a better understanding of the overall market sentiment and potential price movements.

Applying Pivot Points to Trading Decisions

For instance, if the price is approaching a resistance level calculated from the pivot point, traders may consider taking a short position or closing out long positions.

Conversely, if the price is approaching a support level, traders may consider taking a long position or closing out short positions.

Managing Risk and Maximizing Profits

Identifying key support and resistance levels can also help traders set their stop loss and take profit levels.

By understanding where potential turning points in the market may occur, traders can better manage their risk and maximize their potential profits.

Overall, utilizing pivot points to identify key support and resistance levels is an essential aspect of implementing a successful pivot trading strategy.

Utilizing Pivot Points for Entry and Exit Signals

Pivot points can be used to generate entry and exit signals for trades based on potential support and resistance levels.

When the price approaches a support level calculated from the pivot point, it may present a buying opportunity for traders. Conversely, when the price approaches a resistance level, it may present a selling opportunity.

By using pivot points to generate these signals, traders can capitalize on short-term price movements in the market.

In addition to using pivot points for entry signals, traders can also use them to generate exit signals for their trades.

For example, if a trader enters a long position when the price is approaching a support level, they may consider exiting the trade when the price approaches a resistance level.

This allows traders to capture potential profits while minimizing their risk in the market. Overall, utilizing pivot points for entry and exit signals can help traders capitalize on short-term price movements in the market.

By understanding how to use pivot points to generate these signals, traders can improve their overall trading performance and increase their chances of success in the market.

Incorporating Pivot Points with Other Technical Indicators

While pivot points can be powerful on their own, they can also be used in conjunction with other technical indicators to further enhance their effectiveness.

For example, traders may use moving averages or oscillators alongside pivot points to confirm potential entry and exit signals.

By incorporating multiple technical indicators, traders can increase their confidence in their trading decisions and improve their overall success rate.

One common technique for incorporating pivot points with other technical indicators is to use them in conjunction with trend lines.

Trend lines can help traders identify potential areas of support and resistance in the market, which can complement the levels calculated from pivot points.

By using both pivot points and trend lines together, traders can gain a more comprehensive understanding of potential price movements in the market.

Incorporating pivot points with other technical indicators can also help traders filter out false signals and improve their overall trading accuracy.

By using multiple indicators to confirm potential entry and exit signals, traders can reduce their risk of entering trades based on false signals generated by individual indicators.

Overall, incorporating pivot points with other technical indicators can help traders make more informed trading decisions and improve their overall trading performance.

Managing Risk and Setting Stop Loss Levels

One of the key aspects of implementing a successful pivot trading strategy is managing risk and setting appropriate stop loss levels for trades.

Pivot points can be used to help traders determine where to place their stop loss levels based on potential support and resistance levels in the market.

By using pivot points to identify these key levels, traders can better manage their risk and protect their capital in the market.

When setting stop loss levels using pivot points, traders typically place them just below support levels for long positions and just above resistance levels for short positions.

This allows traders to give their trades enough room to breathe while minimizing their potential losses if the market moves against them.

By using pivot points to set stop loss levels, traders can ensure that they are not risking more than they can afford to lose on any given trade.

In addition to setting stop loss levels, managing risk also involves proper position sizing and risk management techniques.

Traders should always consider their risk-to-reward ratio when entering trades based on pivot points and ensure that they are not risking more than they stand to gain on any given trade.

By effectively managing risk and setting appropriate stop loss levels, traders can improve their overall trading performance and increase their chances of success in the market.

Advanced Pivot Trading Strategies for Different Market Conditions

Adapting to Market Conditions Pivot trading strategies require traders to adapt to different market conditions to maximize their effectiveness.

In trending markets, traders can look for opportunities to enter trades based on pullbacks to support or resistance levels calculated from pivot points.

Conversely, in range-bound markets, traders can look for opportunities to enter trades near support or resistance levels, expecting the price to reverse from these key levels.

Using Multiple Time Frames Advanced pivot trading strategies also involve using multiple time frames to confirm potential entry and exit signals.

For instance, traders can use daily pivot points to identify potential support and resistance levels on a higher time frame, such as the weekly or monthly chart.

By combining multiple time frames with pivot points, traders can gain a more comprehensive understanding of potential price movements in the market.

Key Takeaways Overall, advanced pivot trading strategies involve adapting to different market conditions and using multiple time frames to confirm potential entry and exit signals.

By understanding how to apply pivot points in different market environments, traders can improve their overall trading performance and increase their chances of success in the market.

Tips for Implementing a Successful Pivot Trading Strategy

Implementing a successful pivot trading strategy requires careful planning and execution. To improve your chances of success with this strategy, consider the following tips:

1. Use multiple time frames: Consider using multiple time frames to confirm potential entry and exit signals based on pivot points.

2. Incorporate other technical indicators: Use pivot points in conjunction with other technical indicators to increase your confidence in your trading decisions.

3. Manage risk effectively: Set appropriate stop loss levels based on potential support and resistance levels calculated from pivot points.

4. Adapt to different market conditions: Adjust your pivot trading strategy based on whether the market is trending or range-bound.

5. Practice proper position sizing: Consider your risk-to-reward ratio when entering trades based on pivot points to ensure that you are not risking more than you stand to gain.

By implementing these tips into your pivot trading strategy, you can improve your overall trading performance and increase your chances of success in the market.

Pivot trading is a popular strategy used by many traders to identify potential support and resistance levels in the market.

By understanding how to calculate pivot points and use them effectively in your trading decisions, you can improve your overall trading performance and increase your chances of success in the market.

Whether you are a day trader or a short-term trader, incorporating pivot points into your trading arsenal can help you capitalize on short-term price movements and improve your overall profitability in the market.

By utilizing advanced pivot trading strategies and implementing proper risk management techniques, you can take your trading to the next level and achieve your financial goals in the market.

Conclusion

In conclusion, the Pivot Trading Strategy serves as a valuable tool for traders seeking to enhance their market analysis and decision-making processes.

By utilizing pivot points—key levels derived from previous price action—traders can identify potential support and resistance zones, which are crucial for determining entry and exit points.

This strategy is particularly beneficial in volatile markets, where price fluctuations can create both opportunities and risks.

The versatility of the Pivot Trading Strategy allows it to be applied across various asset classes, including stocks, forex, and commodities.

Traders can adapt the strategy to fit their individual trading styles, whether they prefer day trading or longer-term positions.

Moreover, combining pivot points with other technical indicators can further refine trading signals and improve overall performance.

However, like any trading strategy, the Pivot Trading Strategy is not without its limitations. It requires a solid understanding of market dynamics and should be used in conjunction with proper risk management techniques.

Traders must remain vigilant and adaptable, as market conditions can change rapidly.

Ultimately, the effectiveness of the Pivot Trading Strategy lies in its ability to provide a structured approach to trading while allowing for flexibility in execution.

As traders continue to explore various methodologies to navigate the complexities of financial markets, incorporating pivot points into their toolkit may offer a strategic advantage in achieving their trading goals.

Whether you are a novice or an experienced trader, understanding and applying this strategy could enhance your market insights and contribute to more informed trading decisions.

Leave a Reply