Traders live and breathe by indicators. Whether it’s identifying trends, spotting reversals, or refining entry points, technical tools play an indispensable role in decision-making. Among these, moving averages stand as the backbone of countless trading strategies.

Contents

However, not all moving averages are created equal. Enter the Super Smooth Average (SSA)—a refined, ultra-responsive moving average designed to filter out noise while maintaining the integrity of market trends.

What is the Super Smooth Average?

At its core, the Super Smooth Average is a moving average that applies advanced smoothing techniques to create a fluid, noise-free representation of price action. Unlike traditional moving averages, which can be susceptible to lag or excessive choppiness, SSA strikes a delicate balance—delivering both smoothness and timely responsiveness.

Traditional moving averages, such as the Simple Moving Average (SMA) or Exponential Moving Average (EMA), either suffer from sluggishness or overreact to price fluctuations. SSA eliminates these weaknesses by utilizing refined filtering methods, ensuring traders receive clearer signals without unnecessary whipsaws.

The Mathematics Behind SSA

SSA is not just another moving average—it is a sophisticated construct grounded in mathematical precision. Unlike the EMA, which assigns exponentially decreasing weights to past data, SSA employs a multi-stage smoothing process that progressively refines price data over multiple iterations.

This methodology reduces lag without sacrificing sensitivity. The technique can be likened to a rolling wave, where price fluctuations are absorbed and processed in layers, rather than in a single pass. By leveraging recursive filtering and weighted averaging, SSA maintains a dynamic equilibrium, adapting to market shifts with remarkable accuracy.

Why Traders Prefer SSA Over Other Averages

The popularity of SSA stems from its ability to mitigate lag while retaining precision—a feat few indicators achieve. Here’s why it outshines traditional moving averages:

- Smoother Trend Detection – The SSA eliminates unnecessary price noise, making it easier to recognize genuine trends.

- Reduced Whipsaw Effects – Many moving averages generate premature signals due to erratic price movements. SSA minimizes false breakouts.

- Enhanced Market Responsiveness – Unlike SMAs, which often react sluggishly, SSA adapts quickly to price shifts while maintaining stability.

For traders seeking clarity amidst volatility, SSA provides an elegant solution that streamlines market analysis.

Applying SSA in Trading Strategies

Incorporating SSA into a trading strategy requires a deep understanding of its behavior. Here are some of the best ways to utilize it:

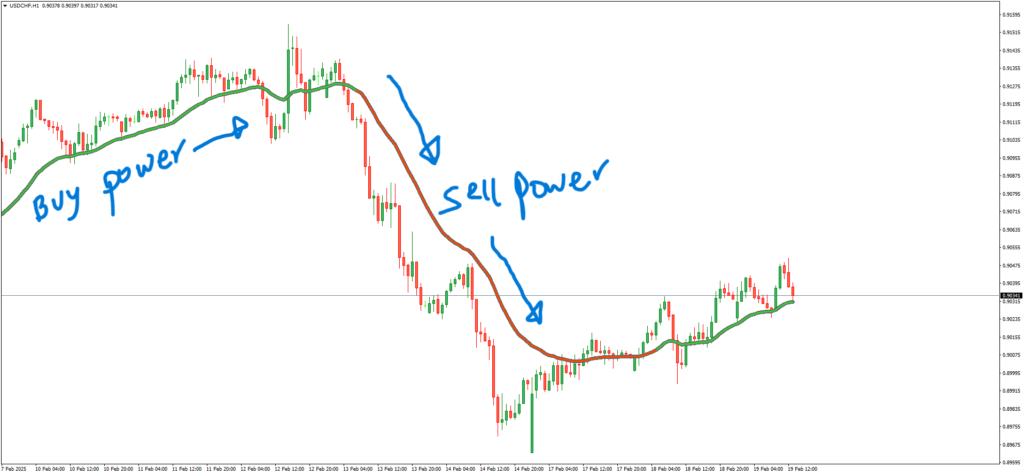

- Trend Identification – SSA serves as a robust trend-following indicator. When the price stays above SSA, the market is bullish; when it drops below, bearish momentum takes over.

- Dynamic Support and Resistance – Due to its smooth nature, SSA can act as a dynamic support/resistance level, helping traders define ideal entry and exit points.

- Confluence with Other Indicators – Pairing SSA with momentum indicators such as the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) enhances confirmation of trade setups.

For optimal results, traders should experiment with different smoothing periods to tailor SSA to their trading style.

Common Pitfalls and How to Avoid Them

Despite its advantages, misusing SSA can lead to misinterpretations and suboptimal trading decisions. Here are key pitfalls to watch out for:

- Over-Smoothing – Excessive smoothing parameters can cause SSA to react too slowly, leading to delayed entries and exits.

- Ignoring Market Context – SSA should not be used in isolation. Combining it with volume analysis and price action patterns ensures more accurate trade decisions.

- Inflexible Parameter Selection – Different market conditions require adjustments to the SSA period. A one-size-fits-all approach can lead to ineffective analysis.

By understanding these nuances, traders can harness SSA’s power without falling into common traps.

Conclusion

The Super Smooth Average stands as a modern refinement of traditional moving averages, offering traders a superior method for tracking price trends with greater clarity and precision. By reducing lag and filtering out noise, SSA provides an elegant, efficient, and adaptive approach to market analysis.

Incorporating SSA into your trading arsenal can enhance decision-making, improve trend detection, and ultimately lead to more consistent results. With proper tuning and a comprehensive trading plan, SSA can become a cornerstone of your technical strategy, elevating your ability to navigate the financial markets with confidence.

Leave a Reply