Top 10 most volatile currency pair, in this article we are going to see the most volatile currency pair in the forex industry today, many traders never know of volatile currency and how to probably trade them, we are going to go through each of the volatile pairs in this article!

Do you know that some currencies have higher volatility than others? Yes, they do! Trading forex does not only depend on you knowing the basics only, like what is forex, how to enter and exit a trade, how to set take profit and stop loss and so much more!

You have to know much about currency pairs and how or when to trade them, well some traders never take this and put it into consideration! But to be honest with you all of this mention above really matters

What are the most volatile currency pair?

To trade effectively you need to know the most volatile currency pair and how to probably trade them step by step, in this part of the article we are going to see the most volatile pairs, what you may be thinking now is do my favorite pair is part of the volatile pair?

Well to be honest it maid be and it maid not be, my favorite pair cannot be yours! And the probability of it being among the volatile currency pair is 50 – 50 yes you heard me right! But let still dive deeper into this!

Well, the question is if your favorite currency pair happen to be in the most volatile currency pair set will you still trade it?

The answer to this is yes because is still a tradeable currency pair, just that you need to know when and how to trade them, let see the list of the most volatile currency pair below.

Volatile Currency Pair

| TOP 10 MOST VOLATILE CURRENCY PAIR IN FOREX | |

| MAJORS | EMERGING MARKET |

| AUDJPY | USDZAR |

| NZDJPY | USDKRW |

| AUDUSD | USDBRL |

| CADJPY | USDTRY |

| GBPAUD | USDHUF |

The table above shows us very clearly all the most volatile currency markets in the forex market, you maid be wondering saying how can one probably trade them anyway, ok!!!!! That is not a problem we at joebenz.com got you cover.

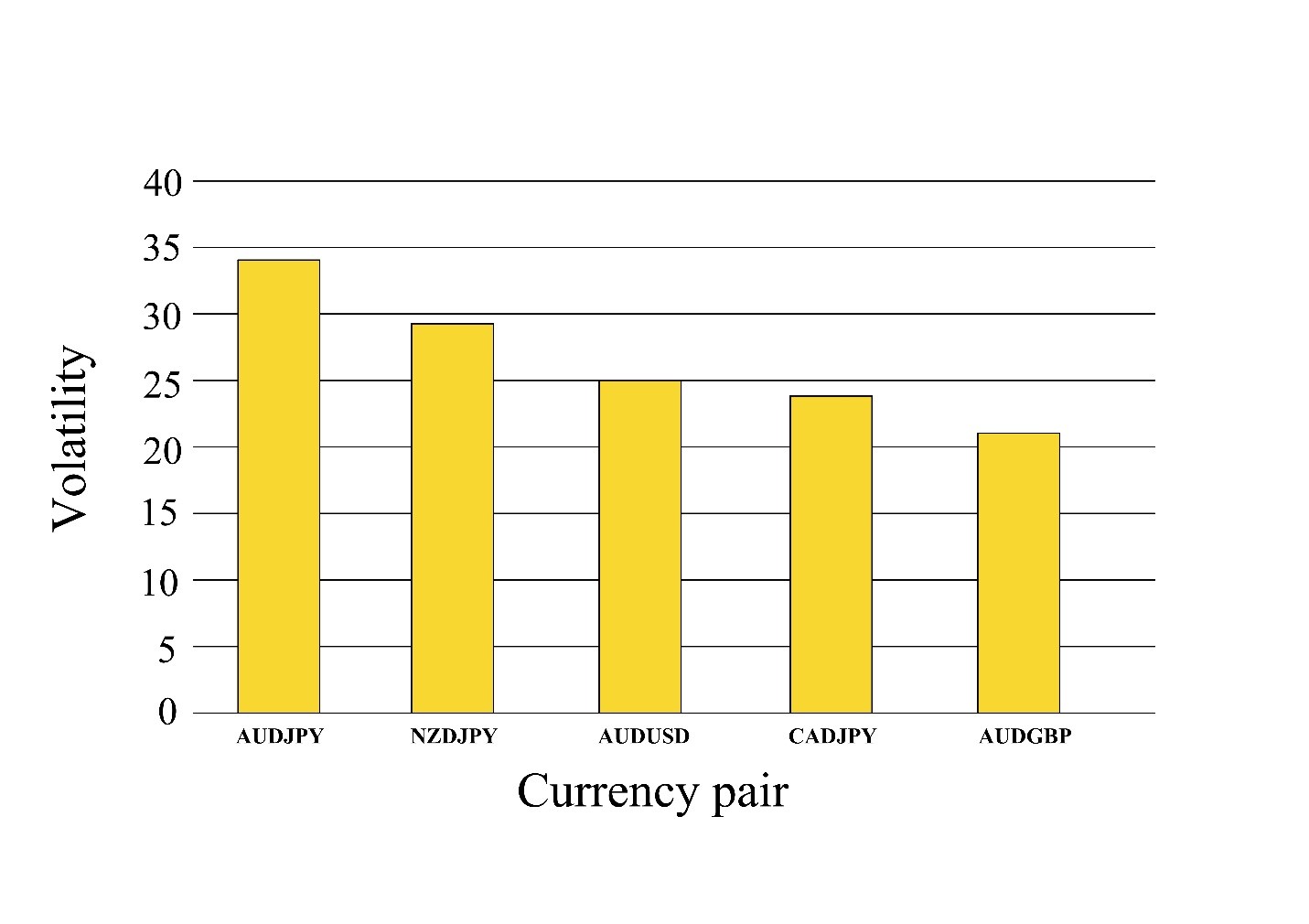

Well the majors have 5 most volatile and also the emerging market has 5 most volatile, those currencies above can be very volatile, be honest, and trading them one need to be very careful, among the majors let us still look at the most volatile, see the picture graph below.

Want to Make Money Trading? Try This!

Read more article: Foreign Exchange Market Today

If you take a proper look we see clearly that the AUDJPY Australian dollar against the Japanese yen is the most volatile, that is to say, the level of volatility is higher among the majors!

And its level can reach up to 34 volatility the picture graph clearly shows that next in the list is the NZDJPY New Zealand dollar against the Japanese yen, yes this currency pair can be volatile.

To be honest, and it happens to be the second in the list, the level of volatility can reach up to 28 volatility, the NZDJPY is of course volatile!

Well, the level of their volatility is not really a problem at all, the third on the list is the AUDUSD Australian dollar against the United State dollar.

This currency pair is also volatile and is among one of the most favorite currency pairs traded by so many traders! I also trade this currency pair myself!

And it’s one of my favorites! The volatility level of the AUDUSD is 25 volatility, the fourth on this list is the CADJPY Canadian dollar against the Japanese yen, yes the CADJPY is also volatile and traded by many traders.

Well its level of volatility is up to 24 volatility, the fifth and the last on the list is the AUDGBP Australian dollar against great British pounds sterling.

Many traders trade this currency pair and it happens to be most traders favorite due to its nature, the level of it volatility is up to 21 volatility, this simple picture graph as shown us

Read more article: Foreign Exchange Market Definition

what we all need to know about the majors most volatile currency pair. Now let us check at the emerging market’s most volatile currency pair.

what we all need to know about the majors most volatile currency pair. Now let us check at the emerging market’s most volatile currency pair.

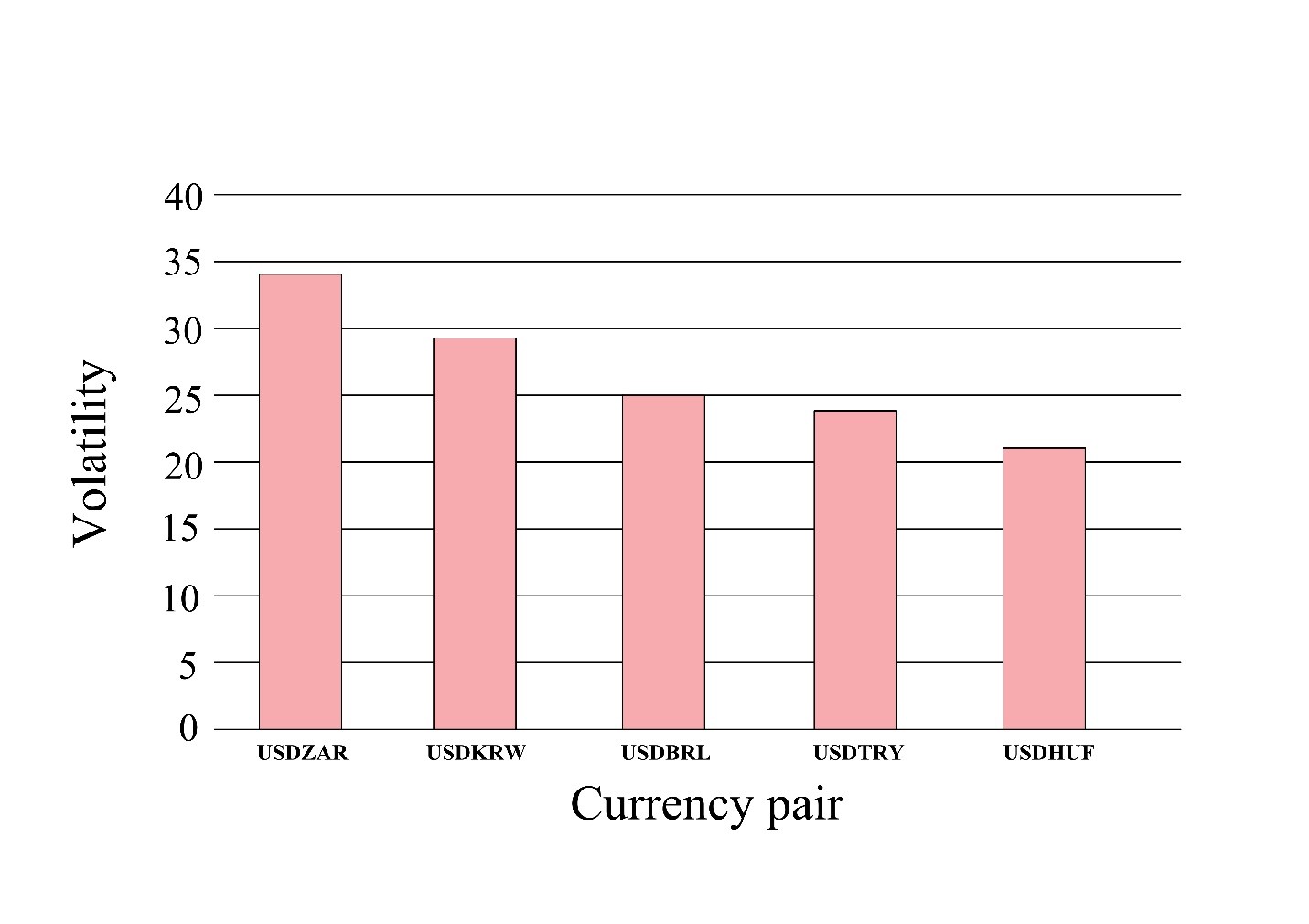

If you look at the picture graph very clear you will see that the USDZAR that is United States dollar against the South African rand is the most volatile pair among the emerging market.

And making it one of the most volatile pair in it set! The volatility level of this currency pair is high!

We are looking at the 34 volatility level of this currency! To be honest this currency is very much tradable even though the volatility is high, the next on the list from the emerging market is the USDKRW United states dollar against the South Korean won.

Yes this currency is considered to be high volatile it is of course, and it level of volatility is also high, giving us 28 volatility high, and it can be tradable as well.

Just that if you are trading high volatile pair you need to be careful, the next we on our list is the USDBRL is the United states dollar against the Brazilian real is the third on the list and consider to be volatile currency pair from the emerging market.

Still this currency pair is tradable and there is no limit to what you can make with it, and it have 25 volatility level, the next on our list is the USDTRY is the United states dollar against the Turkish lira.

This currency is also volatile with 23 volatility level nevertheless still tradable, the last on the list is the USDHUF Is the Hungarian forint this currency is also volatile and is the last in the list with 21 volatility level.

Want to Make Money Trading? Try This!

Read more article: Learn Forex Trading Step by Step

Forex pairs that move the most pips

All nations have responded to the pandemic’s problems in various ways, and the consequences of these actions will be felt for a long time in their economic indices. The biggest concern among traders right now is which currency pairings are best to trade in 2022.

1. EURUSD

While other currencies have had a difficult year, the EUR/USD has had an exciting year. There were a few significant ups and downs:

For starters, the USD surged during the outset of the COVID-19 epidemic as individuals sought safe havens.

The Federal Reserve then unveiled its stimulus measures, depreciating the dollar and raising questions about the dollar’s future as the world’s reserve currency.

2. USDCAD

In 2021, the USD/CAD has a good probability of becoming one of the most volatile currency combinations. The rise in oil prices to $60 per barrel, which has bolstered the CAD, is the cause for this.

However, if the economy does not recover, the picture may change: a new virus mutation, for example, might alter energy prices, causing consumers to choose the safer US dollar.

3. GBP/EUR

Due to Brexit and the virus, the British pound had a difficult year in 2020. The currency is currently leveling out because the United Kingdom is running a vaccination program more effectively than its Eurozone counterparts.

The Bank of England maintained its benchmark interest rate at 0.1 percent and said that no more stimulus measures will be implemented. The British economy may soon open up to European nations, causing the GBP to appreciate.

4. USD/CHF

The Swiss Franc is regarded as a safe haven asset. The USD/CHF combination is often a relatively solid and predictable pair to trade… But that, too, has altered in 2020.

During a worldwide epidemic, investors would pour money into the steady economy, which, along with the Dollar Index’s continued downward trend, leads to deflation, negative interest rates, and Swiss National Bank involvement.

USD/CHF has dropped 11.8 percent in the last year, from 0.98 to 0.89, and is expected to stay between 0.88 and 1.02 in 2021. This makes this combination a good option for scalpers.

5. The AUD/USD

The AUD/USD pair ranked first among the top ten pairings with the largest daily range in 2020. The Australian dollar soared 42.5 percent to 0.77 following a robust rise.

The figures that are more likely to be observed in the cryptocurrency market than in the traditional currency market. This occurred as a result of two factors:

- Anti-coronavirus measures were successfully implemented in Australia;

- Due to China’s demand for Australian exports, the economy has grown (iron and copper).

What does the Australian dollar have in store for 2021? It is contingent on the country’s ties with China and the US.

The problem is that US President Joe Biden intends to pursue a path of opposing China’s rising economic might by reviving the Trans-Pacific Partnership (TPP), of which Australia was formerly a part.

China is unlikely to appreciate it, and the nation is transitioning to a post-industrial economy, which means fewer people will buy Australian products.

For beginners, the most common forex pairs are:

Because the US dollar (USD) is the most widely traded currency in the world, it is used as the base or quotation currency in most major forex pairings.

These are viewed as important crosses when paired with other currencies from some of the world’s largest economies, such as China, Japan, and the United Kingdom.

Major currency pairs are especially appealing to traders since they represent the world’s most successful and stable nations.

And traders may benefit from their minimal spreads, which correctly reflect market value. The most often traded currencies among novices are major forex pairs.

Read more article: Things to know about Forex market

Read more articles

Least volatile forex pairs

You must comprehend volatility if you are serious about generating money in the Forex market. Volatility is a term used to describe how prices move over time.

Typically in relation to how quickly a market value changes in the realm of foreign currency. Consider the “standard deviation of returns” as an example.

Choosing whether you want to trade less volatile or more volatile pairs on a regular basis is a critical component of Forex investment success.

CHF pairings, such as EURCHF, AUDCHF, and USDCHF, are the least volatile forex currency pairs. This is owing to the Swiss franc’s status as a safe haven currency.

It’s risk-adjusted, which means it’s protected against market fluctuations. This results in very minimal volatility, making trading the CHF pairings extremely difficult.

What are the least volatile forex pairs?

Today’s least volatile Forex currency pairings could not be the least volatile Forex currency pairs next year (or even next week).

Though, during the past decade or so, there has been some actual constancy in the Forex market.

The USD/CHF, EUR/CHF, USD/EUR, AUD/CHF, and EUR/CAD currency pairings, as a general rule, are the least volatile on the market at any particular moment.

These are some of the world’s most important currencies (particularly when it comes to the US dollar (USD) and the euro (EUR), and their prices don’t vary much from year to year.

Sure, there’s always a little bit of movement (inflation, economic conditions, market factors, etc. all have an impact on these major currencies).

However, you won’t experience the same extreme swings in value as you would in more developing economies or “lesser” currencies.

When you compare the USD/EUR currency pair to the AUD/JPY currency pair, you’ll notice a huge difference in overall volatility.

Why Should You Avoid the Forex Pairs with the Lowest Volatility?

Many rookie Forex traders want to get right into the action by trading currency pairings that they are acquainted with.

Because of their familiarity, safety, and confidence in these currencies, beginning traders often begin trading USD/EUR currency pairings.

However, it isn’t always the best approach to make money in Forex. Sure, the USD/EUR currency pair will be far more stable and reliable but that lack of volatility means there will be much less opportunities to profit handsomely from large market changes.

When trading Forex, you need that volatility. You won’t be able to produce genuine money without that type of volatility – without these currency pairings moving in respect to one another (sometimes significantly).

The USD/EUR currency pair’s stability actually works against your potential to profit in Forex! On the other hand, a high volatility pair, such as the AUD/JPY currency pair (the most volatile currency combination in 2021), offers significant potential to generate real money when traded on a daily basis.

The AUD is nearly perfectly inversely connected to the JPY in terms of value. If you trade this properly according to global economic patterns, you can make a lot more money than you could if you just traded USD/EUR pairings.

Want to Make Money Trading? Try This!

Read more article: How to use VPS for Forex Trading

Is it easier to trade low-volatility forex pairs?

Low volatility Forex pairings are simpler to trade in certain ways, but only because the chance of your transaction failing is greatly reduced.

If you’re not looking to make life-changing sums of money in Forex, some well-timed USD/EUR transactions can be the way to go.

Due of the low volatility Forex pairs’ steadiness, you won’t be risking a lot, but you also won’t have a lot of upside in these types of trades because of the lack of risk (and volatility).

Of course, keep in mind that any currency, even if just for a short period, has the potential to become volatile.

Black Swan eventsOpens in a new tab may be discovered by Forex traders who sought to “set and forget” their market positions. Their generally steady Forex pairings are subjected to a great deal of volatility.

This volatility may give possibilities to earn a lot of money in a short period of time, or it may wipe out traders who did not anticipate volatility in the blink of an eye.

It’s essential to seek for Forex correlation pairsOpens in a new tab. if you want to trade Forex in an easy way. The connection between these currencies is either favorable or negative.

The USD/EUR pair that we’ve been focusing on is a correlated pair. This effectively indicates that if the value of the US dollar falls, the euro will most likely fall to the same level. If the value of the dollar rises, the euro will follow suit at a similar pace.

These may not be the most “sexiest” Forex trades to conduct, but novices and traders with a low risk tolerance will find these correlated pairings far simpler to execute than non-correlated deals.

At the end of the day, the Forex market is brimming with abnormalities and volatility of all types (sometimes to a surprising degree).

Unlike the stock market, where you may place transactions and then forget about them for months or even years, the Forex market requires you to maintain your finger on the pulse as soon as your positions are locked in.

If you take your eye off the ball for even a short period of time (even with low volatility linked pairings), you might find yourself in a bad scenario sooner than you ever imagined!

Read more article: Tips on Forex Trading for Beginners

Final decision

Trading the high volatile pairs can be dangerous if you don’t know how to trade them, trade with caution, and make sure you take your time following or doing everything step by step.

I just hope you find this article helpful, want to get more value from me about forex on a video, strategies and indicators subscribe to my YouTube channel Joseph Benson Click Here.

And if you have any questions or comments you can drop it in the comment section below, hope I will see you next article bye-bye with much love from Joseph Benson.

Therefore, in the forex industry we are going to see many pairs and currency. If you want to trade with volatile currency then I would suggest that you look at this top 10 most volatile pair today.

The forex market is so large that fluctuations in certain currency pairs have a more noticeable impact than others.

While €/JPY and USD/CAD are major forex pairs, they’re essentially less volatile than other currency pairs, and if you’re looking to make some short-term trades.

Volatility is an important factor to consider. So what are the most volatile currency pairs today? Here’s a look at top ten most volatile currency pair:

Want to Make Money Trading? Try This!

Download Power Up Trend Indicator For Trdaers

Read more article: How to Make Profit on Forex Trading

Leave a Reply