In the world of forex trading, indicators play a crucial role in helping traders make informed decisions. The forex indicator buy sell signals is a game changer.

Forex indicators are mathematical calculations based on historical price, volume, or open interest information, which help in predicting future price movements.

They are essential tools for traders looking to capitalize on market trends and identify potential trading opportunities.

Contents

Understanding Forex Indicator Buy Sell Signals

Forex Indicator Buy Sell Signals are alerts or markers generated by forex indicators that suggest optimal points to buy or sell a currency pair.

These signals help traders make timely decisions, thus enhancing their potential for profit while minimizing risk.

By understanding and utilizing these signals, traders can maximize their returns and improve their trading strategies.

Watch my video!

Types of Forex Indicators

Forex indicators are broadly classified into two categories: leading indicators and lagging indicators.

Each type offers unique insights into market conditions and helps traders make different types of trading decisions.

Leading Indicators

Leading indicators are designed to predict future price movements before they occur. They provide traders with a glimpse into possible price action, allowing them to take positions early. Common examples of leading indicators include:

- Relative Strength Index (RSI)

- Stochastic Oscillator

- Commodity Channel Index (CCI)

These indicators are particularly useful for traders looking to capitalize on early signals of price reversals or trends.

Lagging Indicators

Lagging indicators, on the other hand, focus on historical price data, confirming trends after they’ve been established.

These indicators are typically used to identify longer-term trends and are less prone to false signals. Examples of lagging indicators include:

- Moving Averages

- MACD (Moving Average Convergence Divergence)

- Bollinger Bands

While lagging indicators may provide signals later than leading indicators, they help ensure that the signals are reliable and confirmed by existing market trends.

How Forex Indicators Generate Buy Sell Signals

Forex indicators generate buy sell signals by analyzing historical price data and applying specific mathematical formulas to identify patterns and trends.

Here’s a step-by-step breakdown of how these signals are typically generated:

- Data Collection: Indicators collect historical price data, including open, high, low, and close prices, along with volume data.

- Calculation: The collected data is processed using predetermined mathematical formulas to generate indicator values.

- Signal Generation: When certain criteria or thresholds are met, the indicator generates buy or sell signals. For example, when the RSI crosses above the 30 level, it might generate a buy signal, indicating oversold conditions.

These signals can be visualized on trading charts, making it easier for traders to interpret and act upon them.

Popular Forex Indicators for Buy Sell Signals

There are several popular forex indicators known for generating reliable buy sell signals. Let’s explore some of these indicators in detail:

Moving Averages

Moving averages smooth out price data to form a trend-following indicator. They help traders identify the direction of the trend and potential reversal points.

Moving averages can be classified into Simple Moving Averages (SMA) and Exponential Moving Averages (EMA).

- SMA: An average of the closing prices over a specified period.

- EMA: Places more weight on recent prices, making it more responsive to new information.

A common strategy involves the crossover of short-term and long-term moving averages. When the short-term moving average crosses above the long-term moving average, a buy signal is generated, and vice versa.

Relative Strength Index (RSI)

The RSI measures the speed and change of price movements on a scale of 0 to 100. It is used to identify overbought or oversold conditions in the market.

- RSI above 70: Indicates overbought conditions, potentially generating a sell signal.

- RSI below 30: Indicates oversold conditions, potentially generating a buy signal.

MACD (Moving Average Convergence Divergence)

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. It consists of three components:

- MACD Line: The difference between the 12-day and 26-day EMA.

- Signal Line: The 9-day EMA of the MACD line.

- Histogram: The difference between the MACD line and the signal line.

When the MACD line crosses above the Signal line, a buy signal is generated. Conversely, a sell signal is generated when the MACD line crosses below the Signal line.

Bollinger Bands

Bollinger Bands consist of a middle band (SMA) and two outer bands (standard deviations above and below the middle band).

They measure market volatility and provide buy and sell signals based on price action relative to the bands.

- Price touches the upper band: Indicates overbought conditions and generates a sell signal.

- Price touches the lower band: Indicates oversold conditions and generates a buy signal.

Incorporating Forex Indicator Buy Sell Signals in Your Trading Strategy

Incorporating Forex Indicator Buy Sell Signals into your trading strategy can significantly enhance your decision-making process. Here are some tips for effective integration:

- Combine Multiple Indicators: Relying on a single indicator can lead to false signals. Combining multiple indicators can provide confirmation and increase the reliability of signals.

- Set Clear Criteria: Define clear entry and exit criteria based on the generated signals. This helps minimize emotional decision-making.

- Backtest Your Strategy: Before going live, backtest your trading strategy on historical data to assess its performance and make necessary adjustments.

- Risk Management: Always incorporate risk management techniques, such as stop-loss and take-profit levels, to protect your capital.

Advantages and Disadvantages of Using Forex Indicator Buy Sell Signals

Advantages

- Informed Decision-Making: Forex Indicator Buy Sell Signals provide traders with essential information to make informed decisions.

- Increased Accuracy: Combining multiple indicators can increase the accuracy of trading signals.

- Timely Alerts: Indicators can provide timely alerts, allowing traders to capitalize on market opportunities swiftly.

Disadvantages

- False Signals: Relying solely on indicators can sometimes produce false signals.

- Lag in Signals: Some indicators, especially lagging ones, may generate signals late.

- Over-Reliance: Over-relying on indicators without understanding market fundamentals can be detrimental.

Common Mistakes to Avoid with Forex Indicator Buy Sell Signals

- Ignoring Market Fundamentals: Indicators should complement, not replace, an understanding of market fundamentals.

- Overloading with Indicators: Using too many indicators can lead to analysis paralysis and conflicting signals.

- Not Adjusting for Different Market Conditions: Different market conditions require adjustments in indicator settings and interpretations.

Tools and Platforms for Forex Indicator Buy Sell Signals

Several tools and platforms offer robust features for using Forex Indicator Buy Sell Signals. Some popular ones include:

- MetaTrader 4/5 (MT4/5): Offers a comprehensive suite of indicators and charting tools.

- TradingView: Provides advanced charting features and a large community for sharing strategies.

- NinjaTrader: Known for its powerful analytics and automated trading capabilities.

Conclusion

Understanding and utilizing Forex Indicator Buy Sell Signals can provide a significant edge in the highly competitive forex market.

By incorporating a combination of leading and lagging indicators, setting clear criteria, and practicing sound risk management, traders can navigate the market with greater confidence and precision.

While these signals offer valuable insights, it is crucial to maintain a balanced approach, integrating technical analysis with a thorough understanding of market fundamentals.

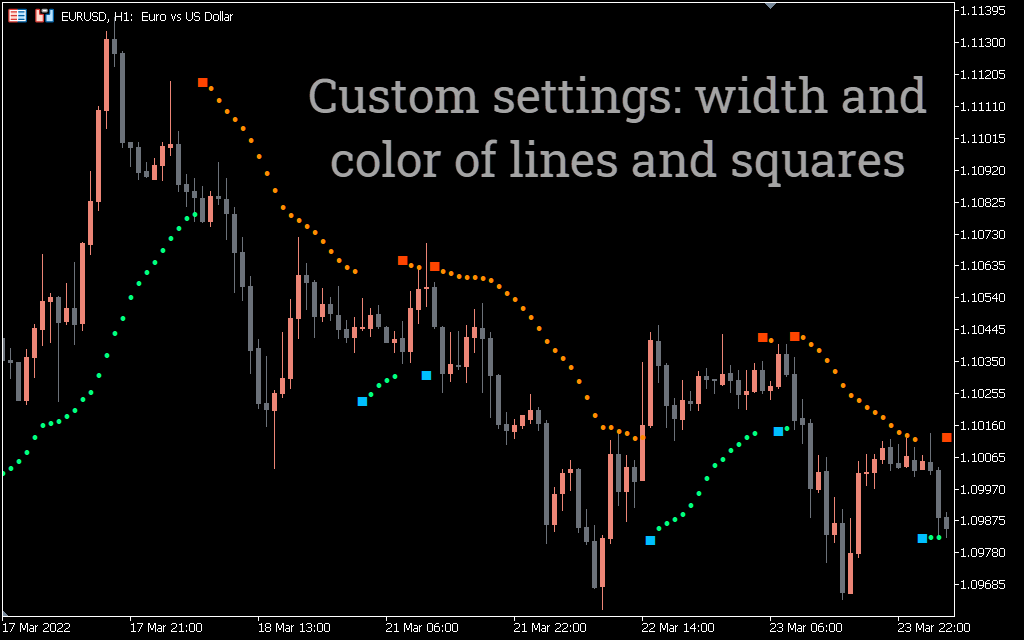

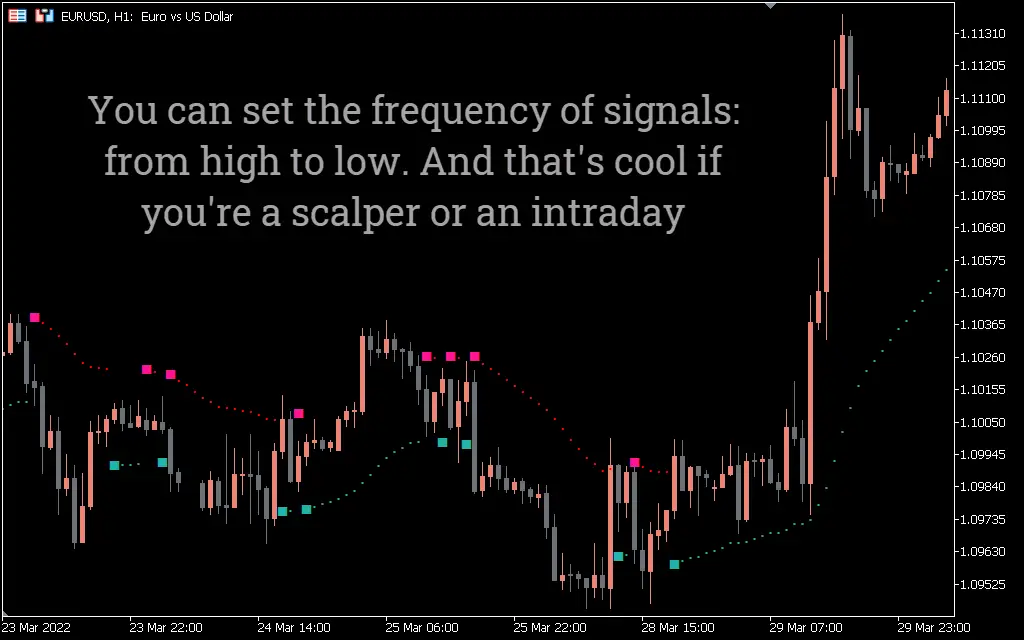

Download Forex Buy Sell Signal MT5 It’s Free!

After downloading and installing, use the demo account to familiarize yourself with the system before starting live trading.

Leave a Reply