Is forex trade real? Forex or FX trade is one of the most reliable, accurate and rewarding investments in the world today. However, forex investment can be very difficult for new traders to start due to the fact that it has high risks.

In order to overcome the challenge posed by forex investment, Forex trading is made simpler and easier with a Forex trading software. Forex trade is the promising and lucrative form of investing that can make you a significant amount of money in a short period of time.

So why not try trading forex and start making some real money right away? Forex, FX or Forex trading is the exchange of one currency for another at present market prices.

The terms foreign exchange and forex are used predominantly in the global foreign exchange market. In other words, it is a worldwide decentralized, over-the-counter (OTC) marketplace for the trading of currencies. There are several forex brokers that manage online trading accounts.

The forex market is the largest, most liquid market in the world. There are over $5 trillion worth of currencies traded every day. Anywhere in the world you might buy or sell a currency, chances are someone else is going to trade it with you.

Forex trade is a huge industry. The volume of currency traded per day is in the hundreds of trillions. That’s a huge scale, and many investors are attracted by forex trading as it can offer potentially really high returns if you know how to do it. But, is forex trade real?

If you’re thinking of getting into this market, you’re probably asking yourself if forex trading is for real and if it’s possible to make money with it. If you are, I have good news for you because I am going to answer these exact questions below so you can get an idea of what this market is all about.

The forex market is the largest, most liquid market in the world. Over $5 trillion is traded every day. Whether you’re a seasoned trader or just looking to get started, the question of whether forex trading is real or not tends to come up.

Key to note

- Is forex trade real?

- What is forex trade?

- Objective of a forex trade

- How can I start forex trading?

- What makes forex trading very risky?

- Should I rely on the use of tools like bots?

- Avoid Unregulated forex brokers

Is forex trade real?

Forex trade is real and can be very profitable. It is a market where you can trade currencies, commodities and stocks. The forex market is the largest and most liquid investment vehicle in the world. It is open 24 hours a day, 5 days a week and trades over $4 trillion daily.

The forex market allows you to take advantage of fluctuations in the price of currencies from one country to another. For example, if the US dollar rises against the Japanese yen then it will become more expensive for Japanese businesses to import goods from America making them less competitive in global markets.

There are also many different types of forex brokers available today with varying levels of experience and expertise. You should always research your broker before signing up with them so that you know exactly what type of service they provide and how they operate their business.

A good broker will help you understand how trading works and how to get started with your first trades so that you don’t lose any money while learning how to trade successfully on your own.

The forex market is a global network of banks and institutions that buy and sell foreign currencies for their clients. These banks include big commercial banks like Citibank, JP Morgan Chase and HSBC, as well as smaller regional banks such as BNP Paribas, DBS Bank and Standard Chartered Bank.

They all use computers to match buyers and sellers of different currencies at the best price possible. In addition to trading currencies directly with another bank or institution, you can also deal with a brokerage firm that matches buyers and sellers through its own accounts in various banks around the world.”

Forex is a real market, and it is the largest financial market in the world. It is reported that more than $5 trillion dollars are traded on the Forex market each day. So, yes, Forex trading is real and it can be profitable.

The question of whether or not Forex is real comes up because there are so many scams out there trying to steal your money. If you search Google for “Forex scam”, you’ll see hundreds of results of companies promising to teach you how to make money trading forex but never delivering on their promise.

So what’s the difference between a scammer and a genuine broker? A scammer will promise to teach you how to trade or offer guaranteed profits if you sign up with them first, whereas a genuine broker will simply offer their services without making any promises about how much money you’ll make or how easy it will be for you.

What is forex trade?

Forex trade, or foreign exchange trading, is the buying and selling of different currencies. The exchange rates between currencies are constantly changing, so traders can buy a currency when it’s cheap and sell when it’s expensive.

Traders use forex markets to speculate on the future value of currencies, with no obligation to purchase in the future. They can also be used for hedging against risk if you’re exporting or importing goods into a country with a different currency.

Trading currencies can be done through spot and forward contracts or swaps. Forex traders use technical analysis and fundamental analysis to help them determine when to buy and sell currencies with the goal of making a profit on the fluctuations in exchange rates.

Forex trading involves buying one currency or commodity in order to sell it later at a higher price. In short, it is trading currencies for profit.

The foreign exchange market trades over $5 trillion worth of currency per day. It’s not just large institutions that take part in forex trading; individual investors trade as well.

Forex trade is a global market, which means that you can trade currencies 24 hours a day, 7 days a week, and 365 days a year. There are no holidays or weekends when it comes to forex trading.

The forex market consists of more than 100 countries who are connected to each other through the use of a single currency the U.S. dollar.

While there are many different ways to trade currencies, it’s important to note that most traders use leverage to multiply their profits (or losses). Leverage allows you to control larger positions with smaller amounts of capital at risk, so that you can make larger trades without having to spend all of your money upfront.

For example, if you wanted to buy $10,000 worth of EUR/USD, you could do so by using only $1,000 as margin (the rest would be borrowed from your broker). If the EUR/USD goes up 1%, then you would make 10% on your $1,000 investment (and lose 10% if it went down 1%).

Objective of a forex trade

A forex trader’s objective is to make money by buying and selling currencies. For example, if the USD/JPY is trading at 123.00, a trader can buy one USD for 123.00 JPY and then sell one USD for 124.00 JPY.

This would generate a profit of $1 per USD traded, or $100 in this example. The trader would then have to decide whether or not to close out the position at that time, or keep it open until he/she reached a predetermined profit level.

Size of position

The size of a position is determined by taking into account the amount of money you have available and your level of risk tolerance (i.e., how much money you can afford to lose).

A larger position will allow you to make more money in the event that the price moves in your favor, but it also increases your risk exposure should the price move against you (and vice versa).

Risk management

Risk management involves controlling risk exposure by limiting loss potential with stop losses, trailing stops and other protective measures including margin requirements and leverage ratios.

The objective of a forex trade is to make a profit. There are many ways to do this but the most common method is to buy a currency pair and sell it at a higher price. To make money, you need to know that you will be able to sell the currency at a higher price than what you paid for it.

If you don’t have enough knowledge about the market and its dynamics, then it’s better not to take such risks and trade with small amounts of money. The risk is high in this business so it’s better to start small until you gain enough experience and knowledge about how the market works.

Many people who invest in the forex market do so with the goal of making money. This is perfectly fine, but it makes sense to set realistic expectations and understand the risks associated with trading currencies.

If you’re looking to profit from currency trading, there are two main ways to do so:

Trend following (also called momentum trading) is a strategy that involves buying assets when prices are rising or selling them when they’re falling. The goal is to ride a trend until it reverses direction and then sell before prices fall back down again.

Currency pairs can be traded using leverage (borrowing money to increase your exposure), which allows you to make bigger profits if things go your way but also exposes you to greater losses if they don’t.

How can I start forex trading?

The next step is to open an account with a forex broker. You’ll need to provide the broker with your name, address, date of birth and other personal information. The broker will check your credit score and identity before allowing you to open an account.

Once you’ve opened an account, you’ll need to deposit money into it. Brokers accept payments in a variety of currencies, including US dollars, British pounds and euros.

Once your account is funded, you’re ready to start trading currencies. Forex trading is a global marketplace that allows you to trade currencies.

The main thing to know is that it’s not physical currency, but rather the price of one currency in relation to another. For example, if you wanted to buy €100 worth of US dollars, you would pay €100 for 1 US dollar and sell your €100 for the price of 1 US dollar.

How does forex work?

To understand how forex works, let’s look at an example. Say you have $1,000 and want to buy 1 Euro for $1.20. You would buy 1 Euro for $1,200 (your $1,000 + $200) and sell it back for $1,200 (your $1,000 + $200).

Now say you want to sell your Euro back for $1.20 again this time you’d sell it for $1,200 (your $1,000 + 200) and buy it back for $1.20 (your $1,200 -$200). In this way you can use leverage to make money because you don’t need to own any foreign currency before trading it on an open market.

The first step in forex trading is to find a broker. A broker is a company that will give you a platform to trade on, and they charge you for the service. There are many different types of brokers out there, and some will suit your needs better than others.

You’ll need a broker that offers a variety of different currencies and instruments with low leverage, so that you can begin trading without too much risk. You can use our Forex Broker comparison tool to find the best brokers in your country or region.

What makes forex trading very risky?

The financial market is a very risky place. There are many factors that can make the market volatile, and this is also true of currency exchange rates. In fact, there are times when the forex market is more volatile than ever before.

In this article, we will look at some of the reasons why forex trading is so risky.

1) Currency Exchange Rates Can Move Very Quickly

The main reason why foreign exchange trading is so risky is because currencies can change their value very quickly. This means that you could be making money one minute and losing it the next. If you do not keep track of how these changes occur, you could end up losing a lot of money very quickly.

2) Volatility Is Extremely High In Some Markets

One of the reasons why forex trading can be so risky is because some markets are extremely volatile. This means that there is a lot of movement in currency prices over short periods of time and there may not be much time for you to react if you want to make any money out of this opportunity (or avoid losing money).

The most volatile markets include those that have political instability or where there are wars taking place (such as in Syria).

The main reason why forex is so risky is because of its high leverage. If you have a margin account, you can borrow money from your broker to make bigger trades.

For example, if you want to buy $1 million worth of EUR/USD but only have $100,000 in your account, your broker will lend you the $900,000 balance (assuming they allow margin). This means that if the price goes up 1% on your position, you can make a profit of $90,000.

However, if the price goes down by 1%, then you lose $100,000! The problem with this type of leverage is that it makes small changes in price have a large effect on your account balance.

A small change in price would be 0.1% for example this means that every time the market goes up by 0.1%, your account will gain 10 pips (points). So if EUR/USD goes up by 0.1%, then it will go from 1.1233 to 1.1243 (or 12 pips).

Should I rely on the use of tools like bots?

I personally don’t rely on the use of tools like bots, but there are some people who do. I see bots as a way for people to make money by automating tasks that they could do manually.

If you’re going to rely on a bot to do your work for you, then it’s important to understand how they work. You need to know how they’re programmed and what their capabilities are.

I think it is important to know the difference between using a tool and relying on it. The problem with relying on tools like bots is that they are not always available when you need them.

If you have a bot set up to perform a task for you, there may be times when the system is down or over capacity. You will be unable to get your work done because of this. You should use tools as tools and not rely on them because they can fail at any time.

I would suggest that instead of relying on tools, you should focus on learning how to do things manually first. Once you have mastered those skills, then you can use tools like bots to save time and effort later on down the road.

Avoid Unregulated forex brokers

Unregulated forex brokers have been around for a long time, but they have not always been transparent. In fact, some of them have been outright frauds, taking advantage of traders who have no idea what they are getting into.

The problem with unregulated brokers is that they don’t have to follow any rules or regulations. There are also no governing bodies that oversee their activities, so if something goes wrong, there is no one to call on for help.

Unregulated brokers often claim to be regulated when they’re not, which is why it’s important to do your research before signing up with any broker. Here are some signs that you’re dealing with an unregulated broker:

They don’t accept U.S. traders If you live in the U.S., chances are good that you’ll be dealing with a legitimate broker who has complied with all U.S.-specific laws and regulations.

If you see that a broker bans U.S. traders from joining its platform or doesn’t accept U.S.-based bank transfers, it’s probably not a good idea to deal with them because they’re likely breaking the law by doing so (and may not even be located in the United States).

More on this! Forex broker is a company that allows you to trade currencies. There are many types of forex brokers, but not all of them are equally reliable.

Before you sign up with a forex broker, it’s important to check the reputation of your chosen provider. You can find information about brokers at Forex Peace Army and Forex Forum. You should also check if they are licensed by CySEC or another regulatory body in your country.

Unregulated forex brokers may not have adequate financial resources and therefore can’t provide their clients with sufficient protection, if something goes wrong. They are also likely to be less trustworthy since they don’t have any legal obligations towards their clients.

Bottom line

Forex trade is real, meaning that you can make profit through Forex. There are so many ways to make money in Forex trade, but it requires dedication, passion, and a lot of patience.

And yes, one of the basic requirements would be to have a sound strategy because this will greatly influence your decision-making as well as your results. It does not matter if you are a beginner or an experienced trader, you must take time and look into the market before making any transactions.

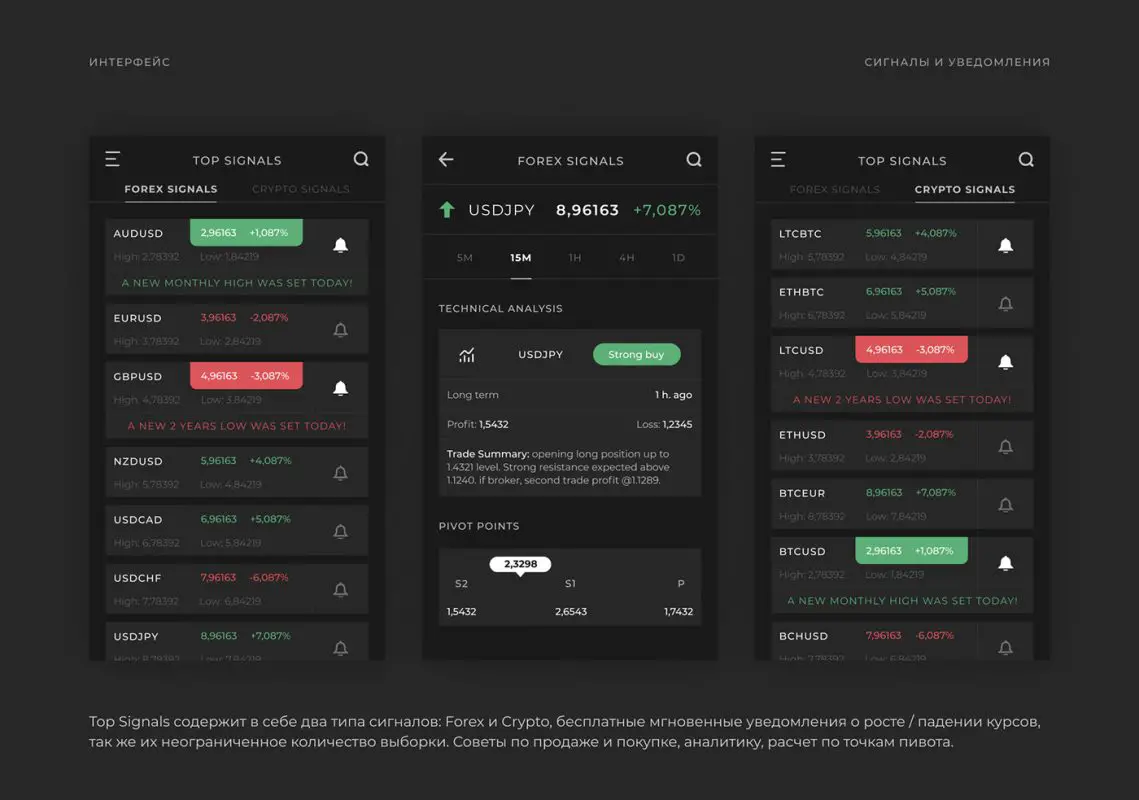

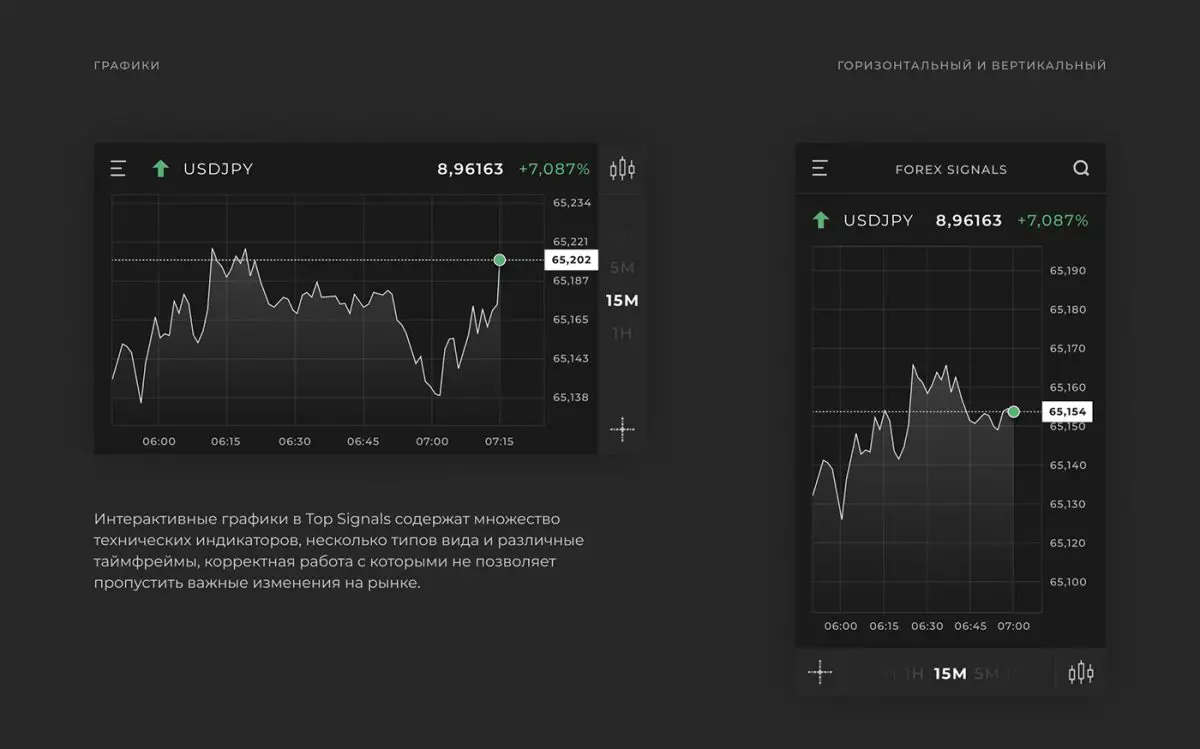

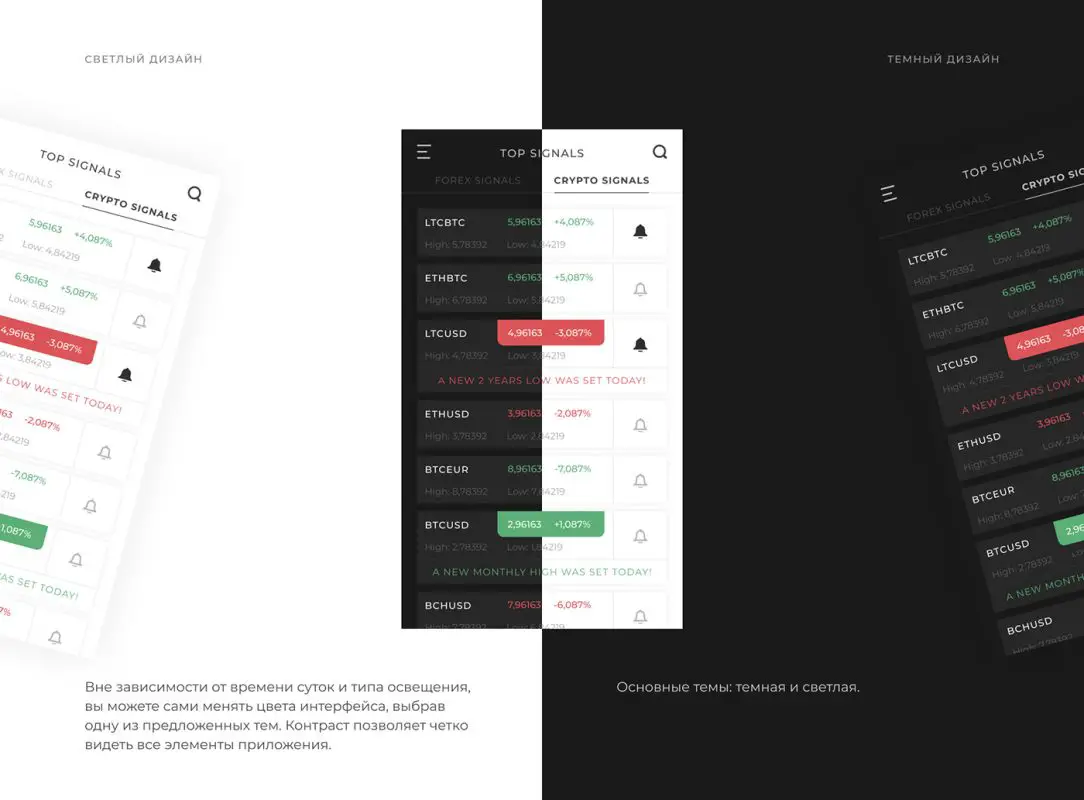

Making profitable transactions is not only about luck or guessing; there are so many forex tools out there that could give you educated guesses on what exactly the price fluctuations mean based on technical indicators and historical trends.

It’s all there; it’s just that sometimes people do not know how to read it correctly because they’re too focused with their own bias (or “gut feeling”).

If you are looking forward to simply faucet and make money, this is definitely not the right way. Forex trade is a serious business and can be potentially dangerous in case of inexperienced traders.

Forex trading is a very exciting activity. Only the wealthiest people in the world can afford to engage in this highly lucrative trade. There are hundreds of thousands of people all over the world who have been enticed into the Forex trade by the promises of getting rich quick. But before you jump in, it’s best to know what you’re getting yourself into.

Need Forex Trend Scanner? Click Here!

Leave a Reply