My most accurate scalping strategy – Scalping is a battlefield of precision, speed, and discipline. Unlike swing or position trading, where patience reigns supreme, scalping thrives on split-second decisions and rapid execution. A single hesitation can mean the difference between a profitable trade and a costly misstep.

Contents

Accuracy isn’t just beneficial in scalping—it’s essential. A well-calibrated approach ensures that each trade maximizes its potential while minimizing exposure to market fluctuations.

The strategy detailed here is honed through meticulous observation, leveraging key technical indicators, disciplined risk management, and an acute understanding of market structure.

Core Principles of High-Accuracy Scalping

At its core, scalping demands an intimate understanding of price movements at a granular level. The market is a dynamic entity, and each tick carries valuable information.

- Market Microstructure: Scalpers must recognize how institutional orders impact short-term price action. Order flow, liquidity zones, and bid-ask spreads dictate the feasibility of quick entries and exits.

- Liquidity and Spread Awareness: Trading highly liquid instruments ensures tighter spreads and reduces slippage, which can erode profits. Major currency pairs, such as EUR/USD and USD/JPY, often provide the best conditions for scalping.

- Risk-to-Reward Ratio: While traditional traders aim for 1:2 or 1:3 risk-reward setups, scalpers often work with a 1:1 or even a 1:0.8 ratio. Precision and high win rates compensate for the smaller profit margins per trade.

Key Technical Indicators for Precision Scalping

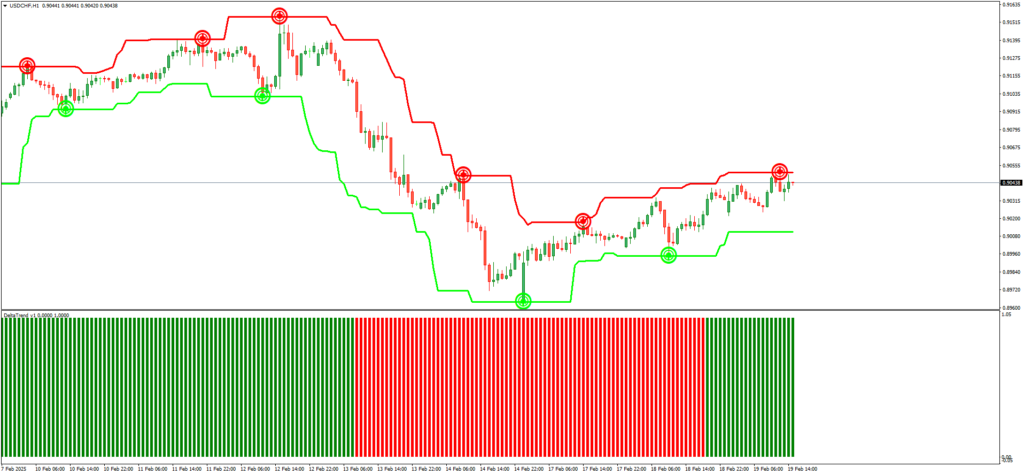

A successful scalping strategy hinges on the right combination of technical indicators. Overloading charts with excessive tools creates confusion, whereas a refined selection enhances clarity.

- Moving Averages: A combination of the 9-period and 21-period Exponential Moving Averages (EMA) provides a dynamic roadmap for trend direction. The crossover of these EMAs often signals a high-probability entry.

- Stochastic Oscillator: This momentum indicator helps confirm overbought or oversold conditions. A rapid move from below 20 to above 50 often indicates an early trend reversal, making it an excellent tool for sniper-like entries.

- Volume Analysis: Spikes in volume often precede sharp price movements. Scalpers who monitor volume alongside price action can avoid false breakouts and capitalize on real momentum shifts.

Step-by-Step Execution of the Strategy

Success in scalping comes down to flawless execution. A systematic approach ensures consistency and minimizes guesswork.

- Ideal Market Conditions: Scalping works best during high-liquidity periods, such as the London and New York sessions. Avoid trading in choppy, low-volume environments where price action lacks direction.

- Entry Signals: A valid entry occurs when the 9-EMA crosses above the 21-EMA while the stochastic oscillator rises above 50. A volume spike further confirms the trade’s viability.

- Exit Strategies: Profits should be locked in swiftly. A pre-set take-profit level of 5-10 pips is ideal, depending on volatility. A tight stop-loss—just below the most recent minor support or resistance—prevents large drawdowns.

Risk Management and Psychological Discipline

Risk control separates professional scalpers from reckless traders. The rapid pace of scalping can lead to impulsive decisions, which must be counteracted by discipline.

- Stop-Loss and Take-Profit Settings: Every trade should have a defined stop-loss to cap potential losses. A dynamic take-profit mechanism, such as trailing stops, ensures profits are maximized during extended moves.

- Emotional Control: Trading at high frequency can be stressful. A structured routine—including pre-market analysis, set trading windows, and mandatory breaks—prevents burnout and poor decision-making.

- Trade Size and Leverage: While leverage amplifies profits, it also increases risk exposure. Using excessive leverage in scalping can lead to catastrophic losses if the market moves unexpectedly.

Common Mistakes and How to Avoid Them

Even the best scalping strategies fail without proper execution. Traders must recognize and eliminate bad habits that hinder success.

- Overtrading: Entering too many trades in quick succession increases exposure to market noise. Focus on quality setups rather than sheer volume.

- Ignoring Market Conditions: Volatility fluctuates throughout the day. Scalpers who fail to adapt to changing conditions often get trapped in low-momentum environments.

- Excessive Leverage: While leverage can boost gains, it also magnifies losses. Managing position sizes based on account equity ensures sustainability.

Conclusion

Accuracy is the heartbeat of successful scalping. A refined strategy, rooted in technical precision, disciplined risk management, and a methodical approach, can yield consistent profits in the fast-paced world of intraday trading.

Mastering this scalping technique requires practice, patience, and unwavering discipline. Before risking real capital, traders should test this strategy in a simulated environment to fine-tune execution and develop confidence.

Leave a Reply