Entry point and exit point are crucial indicators in trading. These technical indicators help traders make informed decisions by identifying optimal moments to enter or exit a trade.

The entry point and exit point is an MT5 indicator that clearly calculated and display signals of new entry point and also provide a targeted exit point, on any currency pair chart, the indicator works very great.

Contents

By understanding the significance of these indicators, traders can improve their chances of maximizing profits and minimizing losses.

Timing is everything. Identifying the right entry point can determine whether a trade will be profitable or not.

Similarly, knowing when to exit a trade can lock in gains or limit potential losses. The entry point and exit point indicator really make the difference!

Technical indicators such as resistance levels provide valuable insights into market trends and price movements, aiding traders in pinpointing favorable entry and exit points.

Importance of Entry Point and Exit Point in Trading

Having a clear and accurate entry point is crucial for traders to maximize their profit potential, that is why the entry point and exit point indicator comes in play.

When traders enter a trade at the right moment, they increase their chances of making profitable trades.

A well-timed entry point allows traders to buy stocks or other assets at a favorable price.

Ensuring that they are not buying at the top of an uptrend or selling short at the bottom of a downtrend.

Exit points manage risk and protect capital

Exit points play an equally important role in trading by managing risk and protecting capital.

Knowing when to exit a trade can prevent significant losses and preserve the trader’s investment.

By setting predetermined exit points based on technical indicators or other strategies, traders can limit their losses if a trade goes against them.

This helps them maintain discipline and avoid emotional decision-making. The entry point and exit point indicator will help with that.

Effective entry and exit points impact overall trading success

The effectiveness of both entry and exit points has a direct impact on overall trading success.

Traders who consistently identify accurate entry points increase their profitability over time.

On the other hand, having well-defined exit points ensures that losses are kept under control, preventing substantial drawdowns in the trader’s account.

Examples of successful traders emphasizing these points

Numerous successful traders have emphasized the importance of entry and exit points in their trading strategies.

For instance, Warren Buffett, one of the most renowned investors in history.

Emphasizes the significance of buying stocks at attractive prices (entry point) while also knowing when to sell (exit point).

His focus on these key aspects has contributed significantly to his long-term investment success.

Another example is Jesse Livermore, considered one of the greatest stock market speculators.

Livermore stressed the importance of waiting patiently for ideal entry points before initiating trades.

He believed that entering positions too early or too late could lead to unnecessary risks or missed opportunities.

The Features of Entry Point and Exit Point Indicator

Entry point and exit point indicators are essential tools for traders to identify the best times to enter or exit a trade.

These indicators come in different types, each with its own set of features that can help traders make informed decisions.

Let’s explore the key features of entry point and exit point indicators.

Different Types of Indicators Used for Identifying Entry and Exit Points

Traders have access to a variety of indicators that can assist them in identifying entry and exit points.

Some common types include trend-following indicators, oscillators, and volume-based indicators.

Trend-following indicators track the direction of a market trend, helping traders determine when to enter or exit a trade based on the momentum.

Oscillators, on the other hand, identify overbought or oversold conditions in the market, indicating potential reversal points.

Volume-based indicators analyze trading volume to gauge market strength and confirm price movements.

Common Features Found in Reliable Indicator Tools

Reliable entry point and exit point indicator tools often share common features that enhance their effectiveness. These features include:

- Flagging patterns: Indicators may flag certain patterns such as triangles or head-and-shoulders formations that indicate potential entry or exit points.

- Look-back periods: Indicators consider historical data within specific time frames to provide insights into past price movements.

- Customizable settings: Traders can adjust indicator parameters according to their trading strategies and preferences.

- Visual representation: Indicators typically display information through charts or graphs, making it easier for traders to interpret signals.

How Indicators Provide Real-Time Data for Making Informed Trading Decisions

One of the significant advantages of using entry point and exit point indicators is their ability to provide real-time data.

These indicators continuously analyze price movements, volume, and other factors relevant to trading decisions.

By receiving up-to-date information, traders can make timely decisions based on current market conditions.

This real-time data helps traders stay on top of market trends and capitalize on profitable opportunities.

Benefits of Customizable Settings in Entry Point and Exit Point Indicators

Customizable settings in entry point and exit point indicators offer traders flexibility and adaptability to their trading strategies.

Traders can adjust parameters such as look-back periods, smoothing factors, or sensitivity levels based on their preferences and market conditions.

This customization allows traders to fine-tune the indicators to suit their individual trading styles, increasing the accuracy of identifying entry and exit points.

Mastering Entry Point and Exit Point Indicator

To become proficient in using indicator tools effectively, there are several steps you can take.

First and foremost, it is crucial to backtest your strategies using historical data for validation.

This involves analyzing past market movements and applying your chosen indicators to see how they would have performed.

By backtesting, you can gain insights into the accuracy and reliability of your chosen indicators.

It helps you understand their strengths and weaknesses, allowing you to fine-tune your trading strategies accordingly.

Backtesting also provides an opportunity to identify any potential pitfalls or limitations of the indicators before implementing them in real-time trading.

Another useful approach is to utilize demo accounts provided by many trading platforms.

These accounts allow you to practice implementing indicator signals without risking real money.

By doing so, you can gain hands-on experience in interpreting and acting upon these signals in a simulated trading environment.

Continuous learning is essential in mastering entry point and exit point indicators.

Stay updated with market trends, patterns, and behaviors through various resources such as books, online courses, webinars.

Or even joining trading communities where experienced traders share their knowledge.

Studying market trends enables you to identify recurring patterns that may indicate potential entry or exit points.

For example, if a specific indicator consistently triggers buy signals when certain conditions are met during an uptrend, it may suggest an opportune moment to enter a trade.

Understanding market behaviors is equally important since different market conditions may require different approaches.

During volatile periods, for instance, indicators that work well in trending markets might not be as effective due to increased price fluctuations.

By studying market behaviors over time, you can adapt your strategies accordingly.

The Concept of Entry Point and Exit Point Indicator

To successfully navigate the world of trading, it’s crucial to grasp the concept of entry points.

An entry point refers to the optimal time for a trader to enter a trade, aiming to maximize potential profits.

Identifying entry points involves analyzing various factors such as price patterns, trendlines, and market indicators.

Traders often rely on technical analysis tools like pennant patterns and trendlines.

Pennant patterns are formed when there is a brief consolidation in price after a strong upward or downward move.

Traders look for breakouts from these patterns as potential entry points.

Trendlines, on the other hand, help identify the direction in which prices are moving and can provide valuable insights into when to enter a trade.

Exploring the Concept Behind Determining Optimal Exit Points

While identifying entry points is essential, knowing when to exit a trade is equally vital for successful trading.

Determining entry point and exit point involves considering factors such as profit targets, stop-loss levels, and market conditions.

Profit targets refer to predetermined levels at which traders aim to close their positions and secure profits.

These targets are typically based on technical analysis indicators or support/resistance levels.

Stop-loss levels act as safeguards by automatically closing trades if prices move against expectations beyond a certain threshold.

Relationship Between Price Action Analysis, Technical Indicators, and Signal Generation

Price action analysis plays a significant role in determining both entry and exit points.

By studying historical price movements without relying solely on indicators or oscillators, traders can gain insights into market sentiment and make informed decisions.

Technical indicators complement price action analysis by providing additional information about trends, momentum, volatility, and other important aspects of market behavior.

These indicators generate signals that help traders identify potential opportunities or confirm their analysis.

Role Played by Market Volatility When Considering Both Entry & Exit Points

Market volatility, the degree of price fluctuation, is a crucial factor to consider when determining both entry and exit points.

Higher levels of volatility can present greater profit opportunities but also carry higher risks.

Traders must carefully assess market conditions and adjust their strategies accordingly.

In highly volatile markets, traders may opt for wider stop-loss levels to account for potential price swings.

Conversely, in less volatile markets, tighter stop-loss levels may be appropriate to protect against smaller fluctuations.

Techniques for Identifying Entry Point and Exit Point

To make informed trading decisions, it’s crucial to identify the right entry and exit points.

Here are some popular techniques that traders use to determine these points:

Trend Following, Breakouts, or Reversals

Traders often rely on trend following strategies to identify entry points.

They analyze price movements over a specific period and look for trends that indicate the direction of the market.

By entering a trade in line with the prevailing trend, traders hope to ride the momentum and maximize their profits.

Another approach is using breakouts as an entry point indicator.

Traders monitor key levels of support or resistance and wait for a breakout above or below these levels.

A breakout suggests a potential shift in market sentiment, providing an opportunity to enter a trade.

On the other hand, reversals can also serve as entry points. But with entry point and exit point indicator is way too easy.

Traders look for signs that a trend is about to change direction.

This could include technical indicators like divergences or candlestick patterns that indicate a potential reversal.

Analyzing Support & Resistance Levels

Support and resistance levels play a crucial role in determining potential turning points in the market.

Support represents a level where buying pressure is expected to outweigh selling pressure, causing prices to bounce back up.

Resistance, on the other hand, is where selling pressure is expected to overpower buying pressure, leading prices to reverse downward.

By analyzing these levels using various tools such as horizontal lines or moving averages.

Traders can identify potential entry or exit points based on how price reacts at these levels. With the latest entry point and exit point indicator is automated

For instance, if price bounces off support multiple times without breaking below it, it may signal an opportunity to enter a long position.

Evaluating Volume Patterns

Volume analysis can provide valuable insights into market behavior and help confirm or diverge from other technical signals.

When volume increases significantly during price movements, it indicates strong participation from buyers or sellers.

Traders often look for confirmation signals where increasing volume aligns with a breakout or a trend reversal.

This suggests that the price movement is supported by significant buying or selling pressure, increasing the probability of a successful trade.

Conversely, divergences between price and volume can also indicate potential reversals.

For example, if prices are rising but volume is decreasing, it may suggest that the upward momentum is weakening, potentially signaling an exit point.

Implementing Multiple Time Frame Analysis

To enhance accuracy in identifying entry and exit points, traders often employ multiple time frame analysis.

This involves analyzing price movements across different time frames, such as daily, hourly, or even minute charts.

By examining longer-term trends on higher time frames and using shorter time frames for precise entry and exit timing, traders gain a more comprehensive view of market dynamics.

This approach helps to filter out noise and identify high-probability trading opportunities based on alignment across different time frames.

Strategies for Optimal Entry Point and Exit Point Identification

Traders have the option to choose between aggressive and conservative strategies.

Aggressive entry strategies involve entering a trade quickly, often at the first sign of a potential opportunity.

This approach can be beneficial for traders who want to capitalize on short-term price movements or take advantage of quick market fluctuations.

On the other hand, conservative entry strategies involve waiting for more confirmation before entering a trade.

This approach is suitable for traders who prefer a higher level of certainty and are willing to sacrifice some potential gains in exchange for reduced risk.

Pros:

- Aggressive entry strategies allow traders to potentially capture early price movements.

- Conservative entry strategies provide greater confidence in the validity of the trading signal.

Cons:

- Aggressive entry strategies may result in more false signals and increased risk.

- Conservative entry strategies may cause missed opportunities during fast-moving markets.

Using trailing stops or profit targets for effective exit point determination

Determining the right time to exit a trade is just as crucial as identifying an optimal entry point.

Traders employ various techniques, such as trailing stops or profit targets, to determine their exit points effectively.

A trailing stop is an order that adjusts automatically as the price moves in favor of the trader’s position.

The entry point and exit point indicator it allows traders to lock in profits while still giving room for potential further gains.

Profit targets, on the other hand, involve setting predetermined levels at which traders will exit their positions once reached.

Pros:

- Trailing stops protect profits by adjusting with favorable price movements.

- Profit targets provide clear objectives and help maintain discipline during trades.

Cons:

- Trailing stops can result in premature exits if there are sudden reversals.

- Relying solely on profit targets may lead to missed opportunities if prices continue moving favorably beyond the target level.

Combining multiple indicators to increase the probability of success

To enhance the accuracy of entry and exit point identification, traders often combine multiple indicators. With entry point and exit point indicator you have no worries!

These indicators can include moving averages, oscillators, trend lines, and volume analysis.

By using a combination of indicators, traders aim to increase the probability of success by confirming signals from different perspectives.

Pros:

- Combining multiple indicators reduces reliance on a single indicator’s accuracy.

- Different indicators provide complementary information for more robust decision-making.

Cons:

- Overcomplicating the use of multiple indicators may lead to confusion and indecision.

- Conflicting signals from different indicators can sometimes create uncertainty.

Implementing risk management techniques to protect against losses

In addition to identifying entry and exit points, it is crucial for traders to implement effective risk management techniques while using the entry point and exit point indicator.

This involves setting stop-loss orders at predetermined levels to limit potential losses if a trade goes against expectations.

Risk management also includes determining an appropriate position size based on account size and risk tolerance.

Pros:

- Risk management techniques help protect against significant losses during unfavorable market conditions.

- Proper position sizing ensures trades are proportionate to account size and risk appetite.

Cons:

- Setting stop-loss orders too close may result in premature exits before a trade has a chance to develop.

- Inadequate position sizing can lead to excessive exposure and potential account depletion.

Trading Success Through Accurate Entry and Exit Points

One of the keys to successful trading is identifying the right entry and exit points. And that is what the entry point and exit point indicator can do for you.

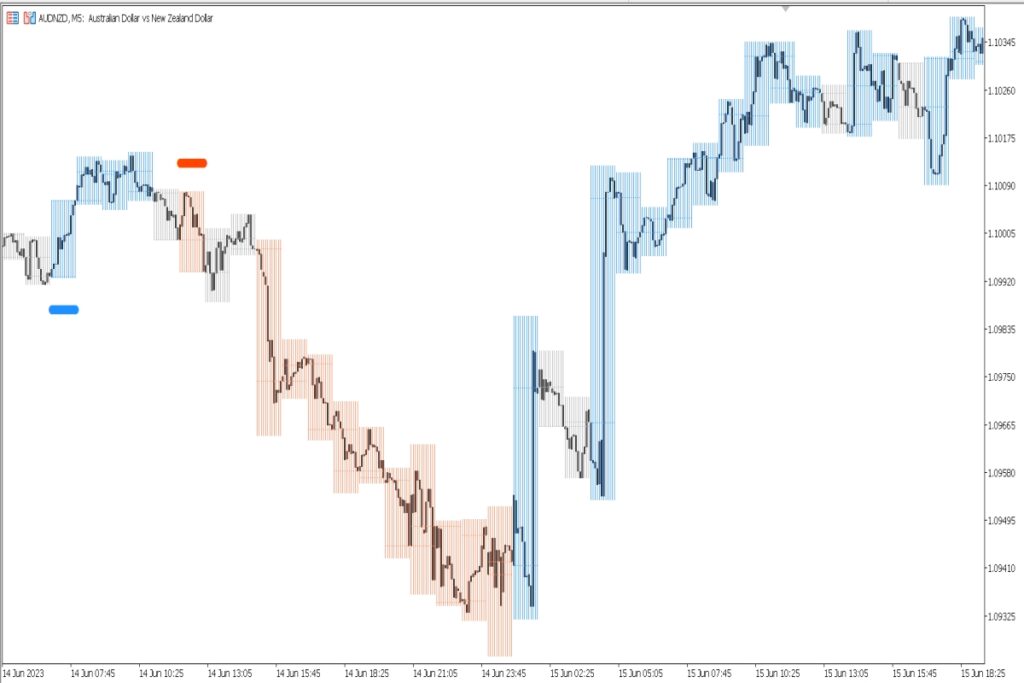

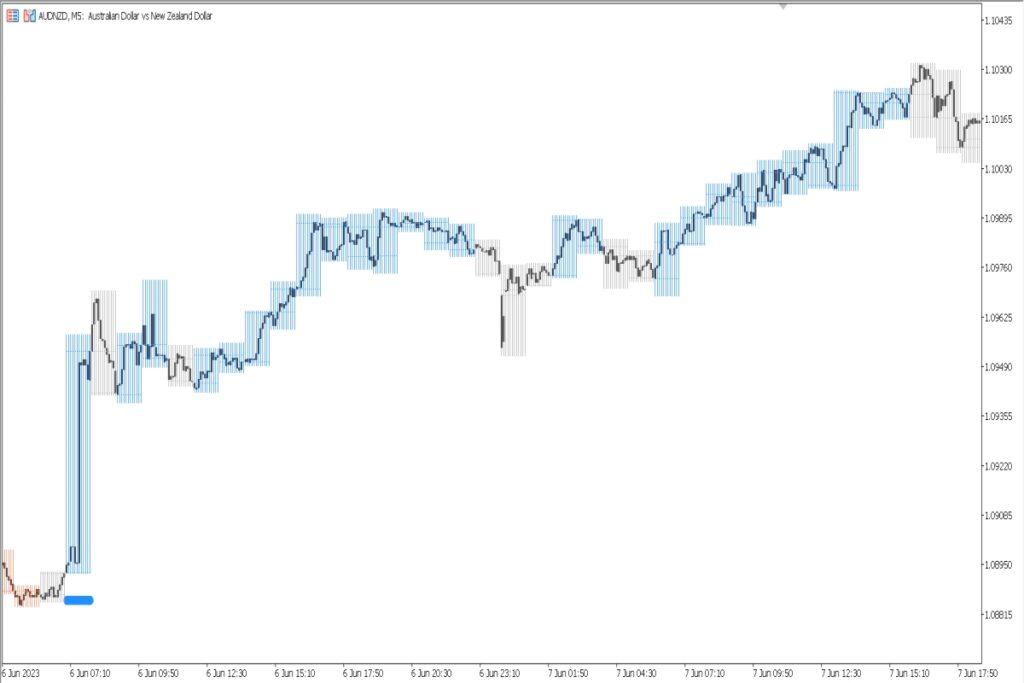

Let’s take a look at some examples of trades that were executed based on accurate entry and exit strategies.

In forex trading, a trader might have noticed a strong uptrend forming in the market.

They would have used technical analysis tools such as trendlines, support and resistance levels, or moving averages to determine the optimal entry point.

Once they identified this point, they would have placed a trade order to buy at that specific price.

The trader would have set profit orders or stop-loss orders based on their risk tolerance.

If the market moved in their favor and reached their profit target, they would have closed the trade for a profit.

On the other hand, if the market moved against them and hit their stop-loss level, they would have exited the trade to limit their losses.

Consistent Profits through Disciplined Execution

Consistency in profits is achieved through disciplined execution of entry and exit strategies. With this entry point and exit point indicator you have it right!

Traders who follow predetermined trading plans tend to fare better than those who make impulsive decisions based on emotions or short-term market moves.

By sticking to a trading strategy that includes specific criteria for entering and exiting trades, traders can avoid chasing after every market movement.

This helps them stay focused on high-probability setups that align with their overall trading plan.

Following a disciplined approach also helps traders manage risk effectively. With proper risk managemnet and entry point and exit point indicator you are in control.

By setting predefined stop-loss levels, traders can control potential losses if a trade doesn’t go as expected.

Similarly, taking profits at predetermined targets prevents greed from clouding judgment and allows traders to lock in gains when appropriate.

The Psychological Impact of Following Plans

Trading can be an emotional rollercoaster, but following well-defined plans for entry and exit points can help mitigate the psychological impact.

Having a clear strategy in place reduces the need for impulsive decision-making and minimizes the influence of fear and greed.

Traders who stick to their plans are less likely to fall victim to emotional biases that can lead to poor trading choices.

Instead, they rely on objective criteria and technical analysis to guide their decisions, which helps them stay focused on long-term success rather than short-term fluctuations.

Adapting Strategies for Changing Market Conditions

While having a well-defined trading strategy is crucial, it’s also important to adapt strategies based on changing market conditions.

Markets are dynamic, and what worked yesterday may not work today. The entry point and exit point indicator will surely guide you.

Traders need to be flexible and open-minded, willing to adjust their entry and exit points as market dynamics shift.

By staying informed about current market trends, news events, and economic indicators, traders can make more informed decisions about when to enter or exit trades.

They can use technical tools like moving averages or oscillators to identify potential reversals or breakouts in price movements.

The Key to Profitable Trading – Mastering Entry and Exit Points

Mastering entry and exit points is the key to long-term profitability in trading. The entry point and exit point indicator is what you need right now.

It’s crucial to have a solid understanding of when to enter and exit a trade in order to maximize profits and minimize losses.

Let’s dive into why this skill is so important and how continuous improvement in identifying these points can lead to better results.

Importance of mastering entry and exit points

Making profitable trades is the ultimate goal. And one of the most effective ways to achieve that is by mastering entry and exit points.

These points determine the optimal time to buy or sell an asset, such as stocks or cryptocurrencies.

Making accurate decisions about when to enter a trade can help you capture potential breakout opportunitie.

While knowing when to exit can secure your profits or limit your losses. The entry point and exit point indicator stand as a complete guide.

Continuous improvement for better results

To become a successful trader, continuous improvement in identifying entry and exit points is essential.

This means constantly honing your skills through practice, learning from past mistakes, analyzing market trends, and staying updated with relevant news and information.

By doing so, you can improve your ability to spot favorable trade setups and make more informed decisions.

The role of patience, discipline, and emotional control

Patience is key. Rushing into trades without proper analysis or waiting too long for the perfect setup can both be detrimental.

By exercising patience, you give yourself time to thoroughly evaluate the market conditions before entering a trade.

Discipline plays a crucial role as well. When using the entry point and exit point indicator you need to be discipline.

Following a predetermined trading plan helps maintain consistency in executing trades based on entry and exit strategies rather than impulsive decisions driven by emotions.

Emotional control is another vital aspect of mastering entry and exit points.

Fear of missing out (FOMO) or fear of losing out (FOLO) can cloud judgment and lead to poor decision-making.

Keeping emotions in check allows traders to stick to their strategies and avoid making impulsive trades based on short-term market fluctuations.

Real-life examples showcasing accurate entry and exit decisions

To illustrate the impact of accurate entry and exit decisions, let’s consider a couple of real-life examples:

- Example 1: A trader identifies a breakout in a stock’s price and enters the trade at an opportune moment. They set a profit target and an appropriate stop-loss order. When the stock reaches their profit target, they exit the trade, locking in profits. This demonstrates how identifying entry points can lead to profitable trades.

- Example 2: Another trader recognizes that a stock they are holding is experiencing a significant downward trend with no signs of recovery. They decide to exit the trade by setting a limit order to sell at a predetermined price level. By doing so, they minimize their losses instead of holding onto the stock in hopes of a rebound.

In both cases, accurate entry and exit decisions played crucial roles in achieving favorable outcomes.

Mastering entry and exit points is essential for long-term profitability in trading.

Continuous improvement, patience, discipline, and emotional control all contribute to making informed decisions about when to enter or exit trades.

Real-life examples further emphasize the importance of these skills in achieving profitable results.

Conclusion

In conclusion, understanding the concept of entry point and exit point is crucial for successful trading.

The sections completed before this conclusion have provided valuable insights into the importance of these points.

The features of indicator tools, techniques for identification, and strategies for optimal decision-making.

By mastering entry point and exit point indicators, traders can enhance their ability to make accurate predictions and maximize profits.

To become a profitable trader, it is essential to focus on mastering entry and exit points. These points serve as key indicators for making informed trading decisions based on market trends and analysis.

By applying the techniques and strategies discussed in this blog post, traders can gain a competitive edge in the market.

FAQs

1. How do I determine the best entry point for trading?

Determining the best entry point involves analyzing various factors such as market trends, technical indicators, support and resistance levels, and fundamental analysis. It is important to consider multiple sources of information before making a decision.

2. Are there specific indicators that can help identify exit points?

Yes, there are several indicators that can assist in identifying potential exit points. Some commonly used indicators include moving averages, trend lines, Fibonacci retracements/extensions, and oscillators like RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence).

3. Can entry and exit points be automated using algorithms or trading bots?

Yes, many traders utilize algorithmic trading systems or trading bots to automate their entry and exit points based on predefined rules or strategies. However, it is crucial to thoroughly test any automated system before relying solely on its performance.

4. What role does risk management play in determining entry and exit points?

Risk management plays a vital role in determining both entry and exit points. Traders need to set stop-loss orders to limit potential losses if the trade goes against them while also considering profit targets or trailing stops to secure gains.

5. How can I improve my skills in identifying entry and exit points?

Improving skills in identifying entry and exit points requires practice, continuous learning, and staying updated with market conditions. Analyzing historical data, backtesting strategies, and seeking feedback from experienced traders can also contribute to skill development.

Leave a Reply