Accurate triangle detection is crucial for successful trading. Traders need to be able to identify triangle patterns as they can be used to make informed trading decisions.

The non-repaint triangle detector indicator is an innovative tool designed to provide high precision in detecting various types of triangles in the market.

Contents

By utilizing this triangle scanner, traders can identify and capitalize on triangle formations, patterns, and breakouts.

This triangle indicator can significantly improve trading performance, leading to higher profitability and accuracy.

Key Takeaways

- Accurate triangle detection is crucial for successful trading.

- The Non-Repaint Triangle Detector provides high precision in detecting various types of triangles in the market.

- By utilizing this triangle scanner, traders can identify and capitalize on triangle formations, patterns, and breakouts.

- The Non-Repaint Triangle Detector can significantly improve trading performance, leading to higher profitability and accuracy.

- Successful traders should incorporate the Non-Repaint Triangle Detector into their trading strategies.

Achieve High Precision with Non-Repaint Triangle Detection

The Non-Repaint Triangle Detector is an innovative tool designed to provide traders with high precision in detecting different types of triangles in the market.

Traders can rely on this indicator to identify triangular patterns accurately, making profitable trades easier to achieve.

Triangles are a popular trading pattern due to their accuracy in predicting price movements.

Having a reliable triangle detector like the Non-Repaint Triangle Detector is crucial in achieving profitable trading.

The tool is designed to distinguish between valid and invalid triangles, ensuring traders get accurate readings every time.

The Non-Repaint Triangle Detector scans the market for triangular formations and provides a clear signal once the pattern is identified.

It is designed with user-friendly features, making it accessible to both new and experienced traders.

Recommended forex beginners books

How the Non-Repaint Triangle Detector Works

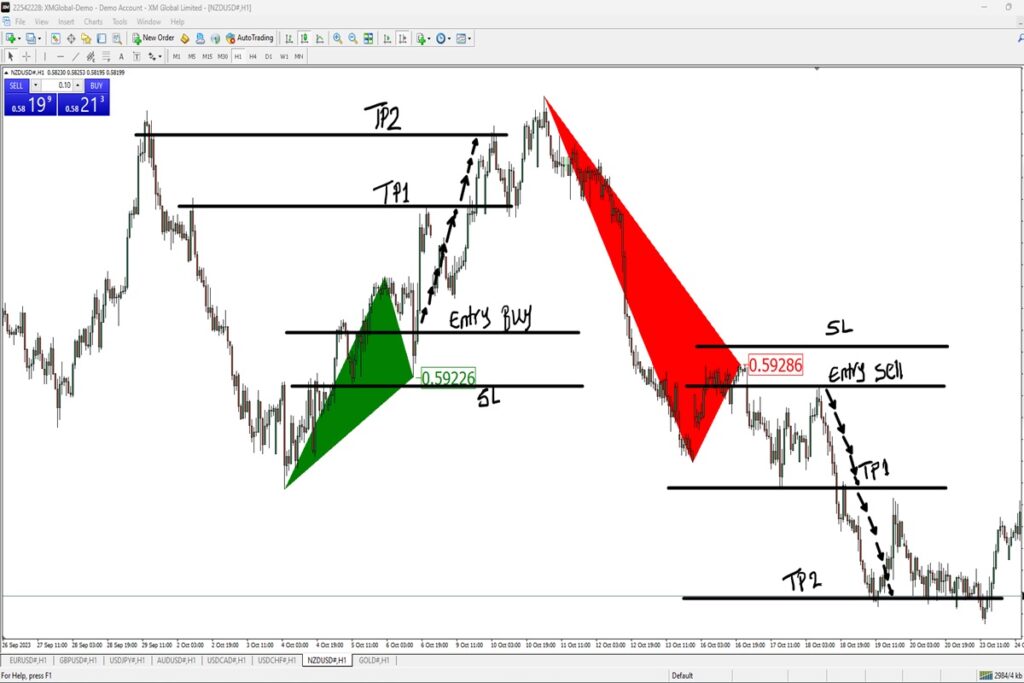

The Non-Repaint Triangle Detector works by analyzing price movements and identifying triangular patterns based on specific criteria such as trendlines and price points.

The tool provides traders with alerts when a triangle pattern has been identified, allowing them to make informed trading decisions.

The Non-Repaint Triangle Detector can identify different types of triangles, including ascending, descending, and symmetrical triangles.

Traders can use this information to anticipate market trends and capitalize on profitable opportunities.

| Types of Triangles Detected by the Non-Repaint Triangle Detector | Definition |

|---|---|

| Ascending Triangle | A bullish pattern characterized by a flat upper trendline and a rising lower trendline. |

| Descending Triangle | A bearish pattern characterized by a flat lower trendline and a declining upper trendline. |

| Symmetrical Triangle | A neutral pattern characterized by two converging trendlines of equal slope. |

The Non-Repaint Triangle Detector also has a non-repaint feature, which means that once a triangle pattern is identified, it will not disappear or re-paint.

Traders can rely on the accuracy of the signal and make informed trading decisions accordingly.

In conclusion, the Non-Repaint Triangle Detector is an essential tool for traders looking to achieve profitable trading.

Its high precision in detecting different types of triangles in the market makes it a reliable indicator for traders of all levels.

Whether used as a standalone tool or as part of a trading strategy, the Non-Repaint Triangle Detector can help traders achieve success.

Exploit Triangle Breakouts for Profitable Trading

Triangle breakouts are a popular trading strategy that can generate significant profits for traders.

A breakout occurs when the price of an asset moves beyond a defined price range, often caused by a fundamental or technical event.

Traders can use the Non-Repaint Triangle Detector to identify and capitalize on triangle breakouts.

Triangle Breakout Trading

Many traders employ triangle breakout trading strategies to generate profits. This technique involves identifying a triangle formation and waiting for a breakout to occur.

The breakout is typically followed by a significant price movement in the direction of the breakout, which can generate substantial profits for traders.

The Non-Repaint Triangle Detector can be used to identify triangle breakouts and gauge their potential profitability.

By identifying breakouts early, traders can take advantage of the price movement and maximize their profits.

Most advance forex books for beginners

Triangle Double and Triple

The Non-Repaint Triangle Detector is also useful for identifying triangle double and triple formations.

These patterns occur when two or three triangles appear in succession, indicating an increase in volatility and potential price movement.

Traders can use these formations to make informed trading decisions and maximize their profits.

When using the Non-Repaint Triangle Detector to identify triangle double and triple formations.

Traders should consider the duration of each triangle formation, the volume of trades, and any other relevant market conditions.

By carefully analyzing these factors, traders can make profitable trading decisions.

Table: An example of a triangle breakout trading system using the Non-Repaint Triangle Detector

| Date | Asset | Triangle Formation | Breakout | Profit/Loss |

|---|---|---|---|---|

| January 5, 2021 | EUR/USD | Ascending Triangle | Breakout above $1.23 | +5% |

| February 20, 2021 | GBP/USD | Descending Triangle | Breakout below $1.39 | +3% |

| March 15, 2021 | AAPL | Symmetrical Triangle | Breakout above $125 | +8% |

Traders can generate significant profits by utilizing triangle breakouts, double and triple formations.

The Non-Repaint Triangle Detector is an effective tool that can be used to identify these patterns and make informed trading decisions.

By carefully analyzing market conditions and properly utilizing the Non-Repaint Triangle Detector, traders can maximize their profits.

Enhance Trading Strategies with Triangle Formations

Traders are always looking for ways to develop high-performing trading strategies, and incorporating triangle formations is a powerful tactic that can be utilized.

Valid triangle formations are significant indicators of price movements.

And by identifying them, traders can make informed decisions about market entry and exit points.

The Non-Repaint Triangle Detector is an excellent tool to aid traders in identifying and analyzing triangle formations.

The indicator is designed to provide high precision in detecting various types of triangles in the market, including ascending, descending, and symmetrical triangles.

Valid Triangle Formation

A valid triangle formation is a type of technical analysis pattern that can indicate a potential price movement in the market.

It is formed by connecting two or more price points with trend lines to create a triangle shape. The trend lines must converge at a specific price point.

And the pattern must have a series of higher lows and lower highs, indicating that the buyers and sellers are in a period of indecision.

When the triangle pattern breaks out of the trend lines, it indicates a potential direction for the price movement.

A breakout above the trend line suggests a bullish market, while a break below the trend line indicates a bearish market.

The right books you need before you start forex!

Triangle Formation Prices

The Non-Repaint Triangle Detector identifies valid triangle formations by analyzing price movements and providing precise entry and exit points.

The indicator also provides invaluable information, such as the highest and lowest prices within the triangle formation.

Making it easier for traders to set stop loss and take profit levels.

The following table illustrates an example of a valid triangle formation and how the Non-Repaint Triangle Detector can provide valuable information on price movements:

| Date | Open Price | High Price | Low Price | Close Price | Triangle High | Triangle Low |

|---|---|---|---|---|---|---|

| 01/01/2022 | 100 | 110 | 90 | 105 | 110 | 90 |

| 02/01/2022 | 105 | 112 | 100 | 105 | 112 | 100 |

| 03/01/2022 | 105 | 115 | 95 | 100 | 115 | 95 |

| 04/01/2022 | 100 | 110 | 95 | 98 | 110 | 95 |

| 05/01/2022 | 98 | 115 | 98 | 100 | 115 | 98 |

| 06/01/2022 | 100 | 115 | 100 | 105 | 115 | 100 |

In the above example, the Non-Repaint Triangle Detector has identified a valid descending triangle formation.

The indicator has provided the highest and lowest prices within the formation, as well as the precise entry and exit points.

Traders can use this information to create a profitable trading strategy that takes advantage of the triangle formation.

Incorporating valid triangle formations into trading strategies can be a highly effective way to maximize profitability.

The Non-Repaint Triangle Detector is an advanced tool that accurately identifies and analyzes triangle formations, making it an essential addition to any trader’s toolkit.

Uncover Trading Signals with Triangle Patterns

Triangle patterns are a crucial aspect of technical analysis in trading. These patterns typically exhibit a series of lower highs and higher lows.

Forming a symmetrical shape that can provide valuable insights into market trends and potential price movements.

By identifying these patterns early on, traders can make informed decisions that can lead to profitable trades.

One of the primary benefits of using Non-Repaint Triangle Detector is its ability to accurately identify and analyze different types of triangle patterns.

This tool’s advanced algorithm can detect patterns such as ascending, descending, and symmetrical triangles, among others.

Using this tool, traders can easily spot triangle patterns and incorporate them as trading signals into their overall strategy.

Pattern triangle trading involves utilizing the shapes formed by the triangle patterns to predict the direction of price movements.

In a symmetrical triangle, for example, traders can predict an upcoming bullish or bearish trend based on the direction of the breakout.

If the price breaks out above the triangle’s upper resistance line, it is usually a bullish signal, while a breakout below the lower support line indicates a bearish trend.

One popular type of triangle pattern is a pattern descending triangle. This pattern usually forms after an extended uptrend and signals a potential reversal in the trend.

With the help of Non-Repaint Triangle Detector, traders can easily identify this pattern and use it as a signal to sell or short their positions.

Overall, incorporating pattern triangle trading using the Non-Repaint Triangle Detector can significantly enhance a trader’s overall success.

By taking advantage of the tool’s accurate and timely detection of triangle patterns, traders can make informed decisions that can lead to profitable trades.

Optimize Trading Performance with Advanced Triangle Strategies

Traders looking to enhance their trading strategies can utilize the Non-Repaint Triangle Detector to identify advanced triangle formations and optimize performance.

Symmetrical Triangle Triple Strategy

The symmetrical triangle triple strategy involves identifying three consecutive symmetrical triangles in the market.

This pattern typically indicates a strong breakout to the upside or downside, offering traders the opportunity to capitalize on significant price movements.

Using the Non-Repaint Triangle Detector, traders can accurately detect and analyze symmetrical triangle formations.

Making it easier to identify triple patterns and anticipate potential price movements.

Indicator Triangle Breakout Strategy

The indicator triangle breakout strategy involves using the Non-Repaint Triangle Detector to identify triangle formations and utilizing breakout levels as buy or sell signals.

This strategy is particularly effective when used in conjunction with other technical analysis tools, such as moving averages or trend lines.

Traders can use the Non-Repaint Triangle Detector to accurately identify valid triangle formations and anticipate potential breakout levels, enhancing the effectiveness of this strategy.

Investing guide for beginners

Symmetrical Triangle Strategy

The symmetrical triangle strategy involves identifying and analyzing symmetrical triangle formations.

This pattern typically indicates a consolidation phase in the market, with prices moving within a narrow range before breaking out to the upside or downside.

Using the Non-Repaint Triangle Detector, traders can accurately identify and analyze symmetrical triangle formations.

Making it easier to anticipate potential directional movements and optimize trading performance.

Incorporating these advanced triangle strategies into a trading plan can significantly enhance profitability and accuracy.

The Non-Repaint Triangle Detector provides traders with the tools they need to accurately identify and analyze advanced triangular formations.

Making it an essential tool for traders looking to maximize their returns.

Improve Profitability with Triangle Price Retracements

Triangle price retracements are an effective way to improve profitability in trading.

By understanding these retracements, traders can make informed decisions and maximize gains.

The Non-Repaint Triangle Detector is an excellent tool to identify and act upon these retracements.

“A triangle retracement occurs when the price of an asset moves back to a previous level of support or resistance in a triangle formation.”

Traders can use a triangle breakout trading system to identify these retracements, using the Non-Repaint Triangle Detector to pinpoint the best entry and exit points.

The indicator can identify triangle bearish flag bearish and other reversal patterns, helping traders take advantage of these opportunities.

| Triangle Retracement Levels | Description |

|---|---|

| 50% | Halfway point between the high and low of the triangle formation |

| 61.8% | Common retracement level based on Fibonacci ratios |

| 78.6% | Another common retracement level based on Fibonacci ratios |

The chart above showcases different triangle retracement levels and their significance.

By identifying these levels, traders can make informed decisions and maximize profitability.

The Non-Repaint Triangle Detector can assist in identifying these levels, providing traders with accurate and reliable insights.

Harness the Power of Double Bottom and Wedge Symmetrical Triangles

Traders can enhance their trading strategies by utilizing double bottom and wedge symmetrical triangle patterns.

The Non-Repaint Triangle Detector can aid traders in identifying these patterns and taking advantage of potential profit opportunities.

Descending Triangle Double Bottom

A descending triangle double bottom is a bullish reversal pattern that forms after a downtrend.

This pattern is characterized by two consecutive lows, with the second bottom being marginally higher than the first.

The pattern is completed when the price breaks out above the upper resistance line.

| Bullish Reversal Pattern | Double Bottom | Descending Triangle Double Bottom |

|---|---|---|

| Description | Two consecutive lows with roughly equal heights | Two consecutive lows with the second bottom being slightly higher, forming a descending triangle pattern |

| Signal | Price will rise after the second bottom | Price will rise after breaking out above the upper resistance line |

The Non-Repaint Triangle Detector can help traders identify a descending triangle double bottom and anticipate a potential bullish reversal.

By using this tool, traders can determine the accuracy of this pattern and make informed decisions on when to enter or exit trades.

Rising Wedge Symmetrical Triangle

A rising wedge symmetrical triangle is a bearish continuation pattern that forms after an uptrend.

The pattern is characterized by the convergence of two trendlines that form a symmetrical triangle.

The price breaks out below the lower support line to signify a continuation of the downtrend.

| Bearish Continuation Pattern | Rising Wedge Symmetrical Triangle |

|---|---|

| Description | Convergence of two trendlines that form a symmetrical triangle |

| Signal | Price will continue to fall after breaking out below the lower support line |

The Non-Repaint Triangle Detector can assist traders in identifying a rising wedge symmetrical triangle and anticipating a potential bearish continuation.

By using this tool, traders can determine the accuracy of this pattern and make informed decisions on when to enter or exit trades.

Overall, the Non-Repaint Triangle Detector is a powerful tool that can significantly enhance trading success.

By utilizing this tool in conjunction with double bottom and wedge symmetrical triangle patterns, traders can maximize profitability and accuracy in their trading strategies.

Download Non-repaint Triangle Detector Indicator

Conclusion

In conclusion, the Non-Repaint Triangle Detector is a powerful tool that can significantly enhance trading success.

By accurately detecting various types of triangles in the market, traders can achieve high precision in their analysis and make informed decisions.

The tool can be used to identify breakout opportunities, enhance trading strategies, and uncover trading signals.

Additionally, the Non-Repaint Triangle Detector can assist in more advanced triangle strategies such as the symmetrical triangle triple strategy.

nd can aid in identifying retracement levels for improved profitability. The tool can also detect double bottom and wedge symmetrical triangles for further trading potential.

Overall, traders can optimize their trading performance and achieve profitable trading by incorporating the Non-Repaint Triangle Detector into their strategies.

Its functionalities and benefits make it a valuable addition to any trader’s toolkit.

Maximizing Profits with Non-Repaint Triangle Detector

For traders seeking to maximize their profits and accuracy, the Non-Repaint Triangle Detector is a must-have tool.

Its advanced functionalities and precise detection capabilities make it an indispensable asset in trading analysis.

By incorporating the Non-Repaint Triangle Detector into their strategies, traders can achieve success in the markets with greater ease and confidence.

Downlaod Non-repaint Triangle Detector Indicator

FAQ

1. What is the Non-Repaint Triangle Detector?

The Non-Repaint Triangle Detector is an innovative tool designed to accurately detect triangle patterns in the market. It provides traders with a high precision indicator for identifying triangular formations.

2. How does the Non-Repaint Triangle Detector work?

The Non-Repaint Triangle Detector utilizes advanced algorithms to analyze market data and identify triangle patterns. It combines various technical indicators to provide accurate and reliable triangle detection.

3. Can the Non-Repaint Triangle Detector be used with any trading platform?

Yes, the Non-Repaint Triangle Detector is compatible with most popular trading platforms. It can be easily integrated into your existing trading setup for seamless implementation.

4. What types of triangles can the Non-Repaint Triangle Detector detect?

The Non-Repaint Triangle Detector can detect a wide range of triangle patterns, including symmetrical triangles, ascending triangles, and descending triangles. It can also identify double bottom and wedge symmetrical triangle formations.

5. How can traders benefit from using the Non-Repaint Triangle Detector?

By using the Non-Repaint Triangle Detector, traders can enhance their trading strategies by accurately identifying triangle formations. This can lead to improved profitability and more informed trading decisions.

6. Is the Non-Repaint Triangle Detector suitable for both beginner and experienced traders?

Yes, the Non-Repaint Triangle Detector is designed to cater to traders of all levels of experience. Its user-friendly interface makes it accessible for beginners, while its advanced features cater to the needs of experienced traders.

7. Can the Non-Repaint Triangle Detector be used in conjunction with other indicators?

Absolutely, the Non-Repaint Triangle Detector can be used in combination with other technical indicators and trading systems. It can serve as a valuable tool for confirming signals and enhancing overall trading strategies.

8. How accurate is the Non-Repaint Triangle Detector in detecting triangle patterns?

The Non-Repaint Triangle Detector is designed to provide high precision in detecting triangle patterns. However, it is important to note that no indicator can guarantee 100% accuracy, and traders should always exercise proper risk management and analysis.

9. Can the Non-Repaint Triangle Detector be customized to suit individual trading preferences?

Yes, the Non-Repaint Triangle Detector offers various customization options. Traders can adjust the sensitivity and parameters of the indicator to align with their trading style and preferences.

10. Are there any additional resources or support available for users of the Non-Repaint Triangle Detector?

Yes, users of the Non-Repaint Triangle Detector have access to comprehensive documentation, tutorials, and customer support. These resources can provide further guidance on the installation, customization, and utilization of the indicator.

Leave a Reply