If you’re looking to enhance your trading strategies and make more informed trading decisions, it’s essential to understand the power of forex wedge patterns.

Unlock the secret world of trading with Forex Wedge Patterns. Discover how these intriguing patterns can help you predict market movements and maximize your profits in the dynamic forex arena.

Contents

In this comprehensive guide, we will explore these patterns and how they can help you unlock profits in the foreign exchange market.

Forex wedge patterns are essential to consider, as these technical chart patterns can signal a temporary pause in the overall trend, often leading to significant price breakouts or reversals.

Top pick

Forex For Beginners: What you need to know

Editor’s choice

Forex Trading: A Beginner’s Guide

To a new trader, the forex market can be overwhelming because there are all kinds of concepts to absorb like pip value, leverage, lot size……

Best value

The Black Book of Forex Trading

The knowledge and information contained in The Black Book Of Forex Trading was learned by me after several years of losing…

Key Takeaways

- Forex wedge patterns can help you unlock profits in the foreign exchange market.

- By mastering forex chart patterns and technical analysis, you can make informed trading decisions.

- Wedge patterns signal a temporary pause in the overall trend, leading to significant price breakouts or reversals.

- Identifying these patterns can serve as entry or exit signals, increasing the probability of successful trades.

- Combining technical indicators or candlestick patterns with wedge patterns can maximize your profits when trading forex.

What are Forex Wedge Patterns?

When it comes to trading forex, technical analysis is essential to identifying profitable opportunities. One chart pattern that traders often use is the forex wedge pattern.

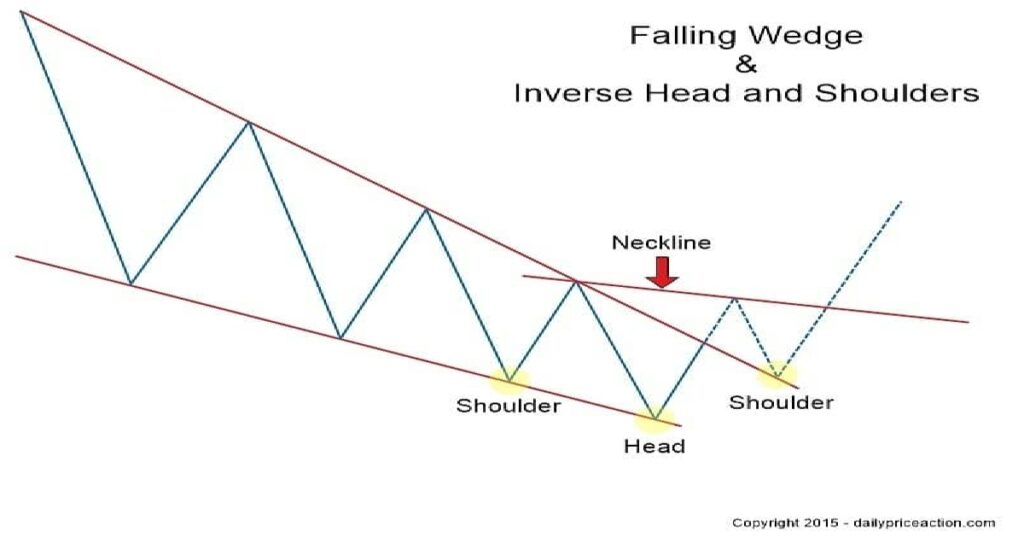

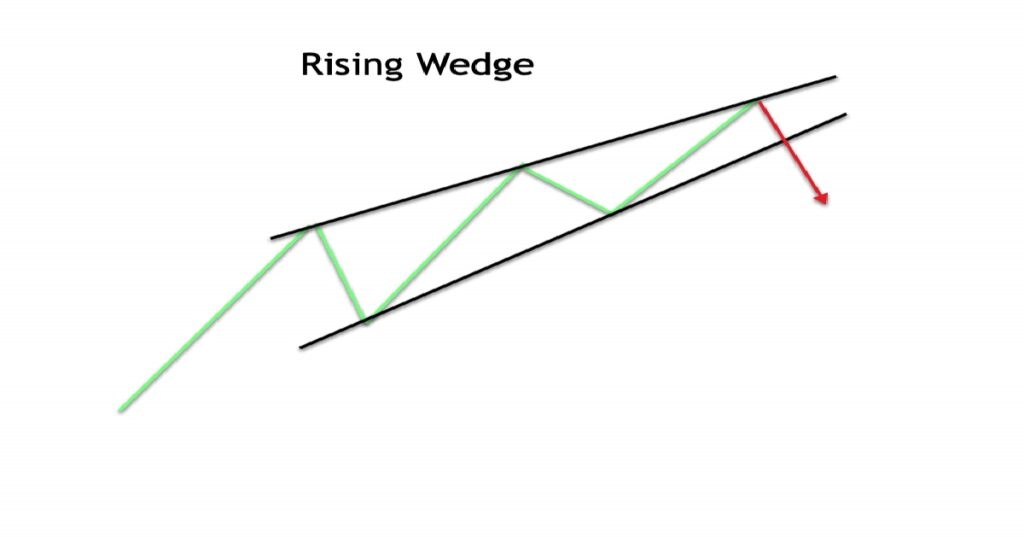

A wedge pattern occurs when the price of a currency pair consolidates within converging trend lines, forming a triangular shape.

This pattern can be either ascending, descending, or symmetrical, depending on the direction of the trend lines.

Wedge patterns indicate a temporary pause in the overall trend, often leading to significant price breakouts or reversals.

For this reason, traders look for these patterns as potential entry or exit signals.

By identifying and trading these patterns, you can capitalize on potential profit opportunities.

Wedge pattern trading forex involves studying historical price data to identify these patterns.

Using technical analysis, traders attempt to predict future price movements based on the formation of these patterns.

Forex breakout patterns, which occur when the price breaks above or below the wedge’s trend lines.

Can signal a strong shift in market sentiment and often lead to substantial price movements.

Therefore, traders may use wedge patterns as part of their forex trading strategies to help them make more informed decisions.

Understanding Forex Chart Analysis

Forex chart analysis is a crucial component of successful trading.

By studying historical price data, you can identify forex chart patterns that reveal potential market trends and opportunities.

These patterns can be categorized as forex price patterns, forex trend patterns, or forex chart patterns, such as the wedge pattern.

Forex price patterns are formed by the interaction of buyers and sellers in the market.

Examples of these patterns include double tops and bottoms, head and shoulders, and triangles.

Forex trend patterns, on the other hand, represent the overall direction of the market and can be identified using trend lines.

Forex chart patterns, such as the wedge pattern, are formed by the price action of a currency pair.

They indicate a temporary pause in the overall trend and can signal potential breakouts or reversals.

Wedge patterns can also be used in conjunction with other technical analysis tools, such as oscillators or moving averages, to confirm trading decisions.

To become proficient in forex chart analysis, it is important to regularly practice identifying patterns and trends.

By doing so, you can increase your ability to spot potential trading opportunities and enhance your overall trading strategy.

The Power of Forex Wedge Patterns

Forex wedge patterns can unlock significant profits if identified correctly.

These patterns are great for traders as they can serve as entry or exit signals, helping you time your trades effectively.

When combined with other technical analysis tools, such as moving averages or oscillators.

Wedge patterns can provide confirmation and increase the probability of successful trades. It’s important to note that forex wedge patterns should not be used in isolation.

Instead, they should be combined with other technical analysis tools and strategies to provide a more comprehensive view of the market.

The Benefits of Technical Analysis

Technical analysis is an essential component of successful forex trading, and forex wedge patterns are just one aspect of it.

With technical analysis, you can better understand market trends, identify key trading levels, and make more informed trading decisions.

Technical analysis is also useful for determining potential profit targets and stop-loss levels.

By closely monitoring these levels, you can manage risk and maximize profits.

Effective Trading Strategies

When trading forex wedge patterns, there are several strategies that you can use to increase your chances of success.

One common approach is to wait for a breakout above or below the pattern’s trend lines before entering a trade.

This breakout can signal a strong shift in market sentiment, often leading to substantial price movements.

Another strategy involves placing trades near the apex of the wedge, anticipating a potential breakout.

Additionally, traders may use other technical indicators or candlestick patterns to confirm their trading decisions.

The Importance of Technical Analysis Tools

Technical analysis tools, such as moving averages and oscillators, can be used in conjunction with forex wedge patterns to provide confirmation and increase the probability of successful trades.

For example, a moving average can help confirm a breakout or validate the strength of a trend. Similarly, oscillators, such as the Relative Strength Index (RSI) or the Stochastic Oscillator.

Can help identify oversold or overbought conditions, indicating potential reversals or continuations.

By incorporating technical analysis tools into your trading strategy, you can better identify forex wedge patterns and maximize your profits.

Trading Strategies for Forex Wedge Patterns

When it comes to trading forex wedge patterns, there are a variety of strategies that traders can use to maximize their profit potential.

Strategy 1: Trading Breakouts

One common approach is to wait for a breakout above or below the trend lines of the wedge pattern before entering a trade.

This breakout can signal a strong shift in market sentiment and often leads to substantial price movements.

To use this strategy, you will need to identify the support and resistance levels of the wedge pattern and wait for the price to break past one of those levels.

Strategy 2: Trading the Apex

Another strategy involves placing trades near the apex of the wedge, anticipating a potential breakout.

This approach can be risky since it’s not always clear which direction the price will move.

However, if the price does break out in the desired direction, traders can benefit from a large price movement.

Strategy 3: Combining Technical Indicators

Traders can also use other technical indicators, such as moving averages or oscillators, to confirm their trading decisions.

For example, if a trader identifies a bullish wedge pattern and sees that the price is above the 200-day moving average, they may view this as a bullish signal and enter a long position.

Strategy 4: Candlestick Patterns

Candlestick patterns can also be helpful when trading forex wedge patterns.

For example, a trader may look for bullish engulfing patterns to confirm a bullish wedge pattern or bearish harami candlestick patterns to confirm a bearish wedge pattern.

Regardless of the strategy you choose, it’s important to keep in mind that forex wedge patterns should be used in conjunction with other technical analysis tools.

By doing so, you can increase your probability of making profitable trades.

Tips for Successful Trading with Forex Wedge Patterns

To successfully trade forex wedge patterns, follow these tips:

- Identify breakout points: Forex wedge patterns often lead to significant price breakouts. Identify breakout points based on technical indicators or price action to enter or exit trades.

- Use other technical indicators: forex wedge patterns are powerful indicators, but they should not be used alone. Incorporate other technical analysis tools, such as moving averages or oscillators, to support your trading decisions.

- Be patient:wait for the right signals before entering or exiting a trade. Do not act impulsively or based on emotions, which can lead to costly mistakes.

- Practice risk management:Use stop-loss orders to minimize potential losses. Do not put all your capital at risk in a single trade.

- Continuously learn:Keep up with the markets, read relevant news articles, and educate yourself on new forex strategies. Stay curious and open to new ideas.

By following these tips and keeping up with developments in forex technical analysis.

You can maximize your potential profits and minimize potential losses when trading forex wedge patterns.

Conclusion

Forex wedge patterns offer traders a valuable tool for identifying potential trend reversals or continuations in the forex market.

By incorporating these patterns into your trading strategies, you can elevate your trading game and unlock profits.

Remember that chart analysis is an essential aspect of trading, and mastering it can help you identify valuable trading opportunities.

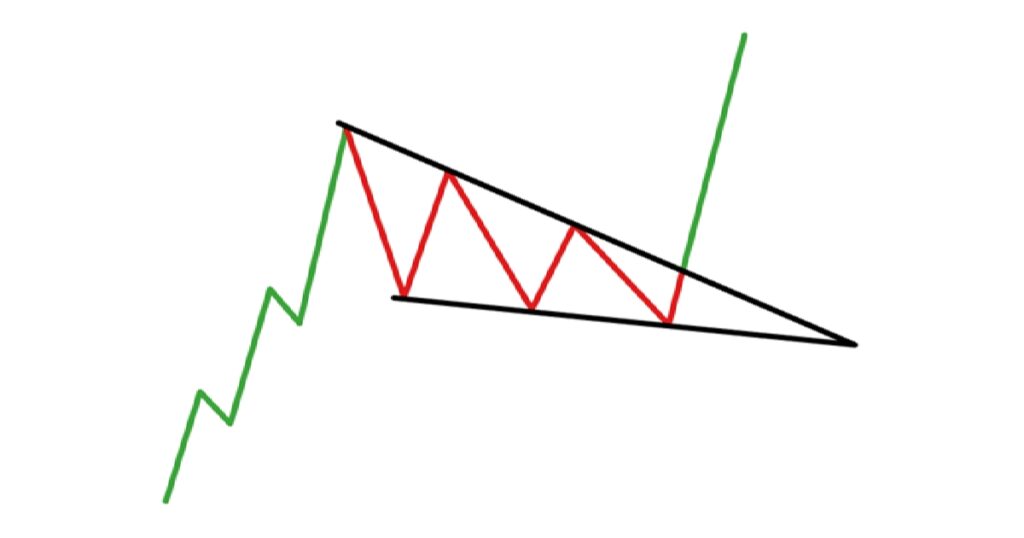

The Triangle Pattern Forex

The triangle pattern forex is a prevalent wedge pattern that can signal important market movements.

When identified correctly, this pattern can lead to significant profits.

Remember to consider other technical indicators and candlestick patterns when trading forex wedge patterns.

Continuously Improve Your Forex Chart Analysis

Successful trading requires continuous learning and improvement. Keep honing your forex chart analysis skills and stay up to date on the latest market trends.

Use multiple strategies and indicators to increase your chances of profitable trades. Practice proper risk management to minimize losses and maximize profits.

By following these tips and incorporating forex wedge patterns into your trading strategies. You can unlock profits and make informed decisions in the forex market.

Keep practicing and refining your skills – with dedication and a sound understanding of forex wedge patterns. You can elevate your trading to new heights.

FAQ

1. What are Forex wedge patterns?

Forex wedge patterns are technical chart patterns that occur when the price of a currency pair consolidates within converging trend lines, forming a triangular shape. These patterns can be either ascending, descending, or symmetrical, depending on the direction of the trend lines.

2. How can Forex wedge patterns help me unlock profits?

Forex wedge patterns indicate a temporary pause in the overall trend, often leading to significant price breakouts or reversals. By identifying and trading these patterns, you can capitalize on potential profit opportunities.

3. How do I analyze Forex chart patterns?

Forex chart analysis involves studying historical price data to identify patterns and trends. Chart patterns, such as wedges, are formed by the interaction of supply and demand in the market.

4. What is the power of Forex wedge patterns?

Forex wedge patterns have the potential to unlock significant profits if identified correctly. These patterns can serve as entry or exit signals, helping traders to time their trades effectively.

5. What are some trading strategies for Forex wedge patterns?

There are various trading strategies that traders can use when trading Forex wedge patterns. One common approach is to wait for a breakout above or below the pattern’s trend lines before entering a trade.

6. What are some tips for successful trading with Forex wedge patterns?

To increase your chances of success when trading Forex wedge patterns, consider the following tips: 1. Enter at the right time. 2. Use take profits and stoploss. 3. Never avenge the market.

7. How can I make informed decisions in the Forex market?

By understanding the dynamics of Forex wedge patterns, conducting thorough chart analysis, and employing effective trading strategies, you can unlock profits and make informed decisions in the Forex market.

Leave a Reply